Last updated on Feb 20, 2026

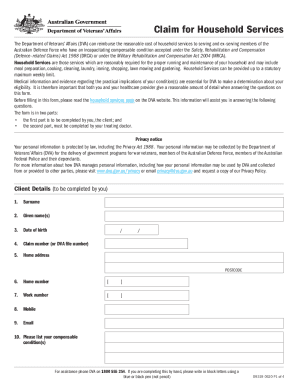

Get the free Personnel Payroll Associate Checklist template

Show details

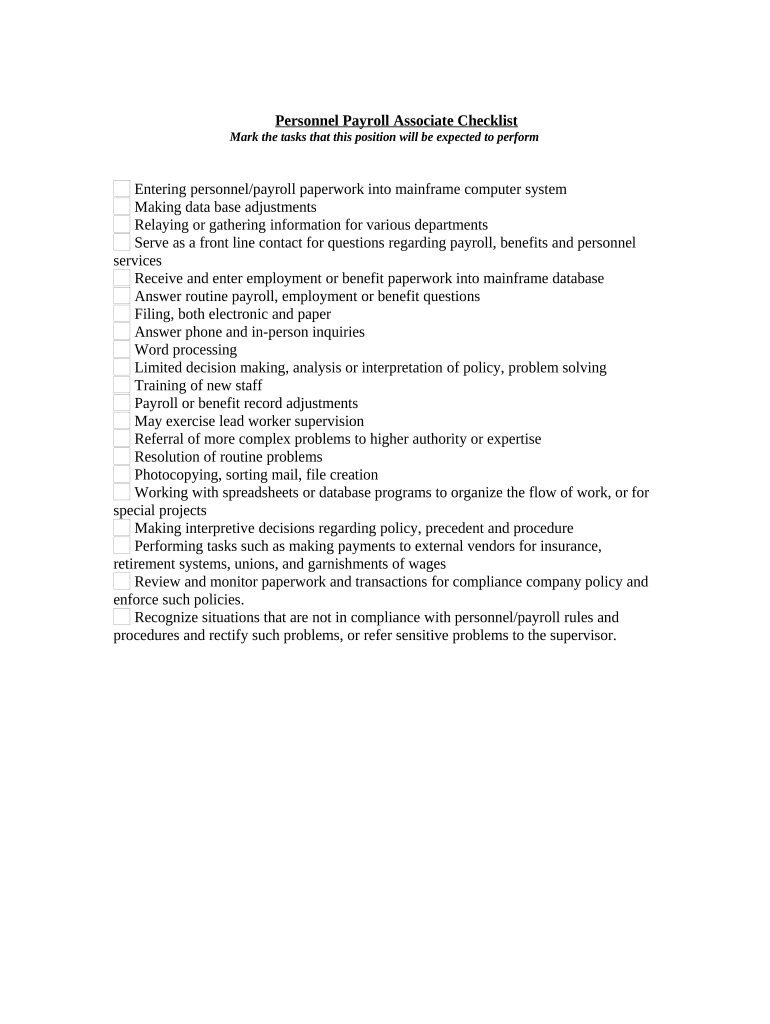

This checklist is used as a tool to highlight those duties to be performed by a payroll associate.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is personnel payroll associate checklist

A personnel payroll associate checklist is a structured document designed to ensure that payroll processes are completed accurately and efficiently.

pdfFiller scores top ratings on review platforms

great programs saves so much time cheers

simply put it, expedites the completion of online forms with a sense of professionalism.

Very helpful for a contract paralegal working from home!

Very easy to use verses other "filler" type programs I have worked with in the past. Very affordable!

filling our immigration docs that were not savable and this app totally helped me to save them and get back to the docs when I have more info. Awesome. One recommendation: I would like to be able to save to a specific file in my computer rather than have to move from the download file :-)

It came in handy when I needed something right away.

Who needs personnel payroll associate checklist?

Explore how professionals across industries use pdfFiller.

Comprehensive Personnel Payroll Associate Checklist

How does one understand the role of a Personnel Payroll Associate?

A personnel payroll associate plays a critical role in managing payroll processes and ensuring that employees are accurately compensated. Efficient payroll management is essential within organizations for maintaining employee trust and satisfaction. An effective associate must possess strong organizational skills, attention to detail, and a comprehensive understanding of payroll regulations.

-

The personnel payroll associate is responsible for processing payroll, maintaining employee records, and addressing payroll inquiries. This role ensures compliance with labor laws and company policies.

-

Effective payroll management is crucial for retaining talent. Properly managed payroll can enhance employee morale and prevent costly errors.

-

Key skills include proficiency in payroll software, knowledge of tax regulations, and strong interpersonal abilities for addressing employee concerns.

What are the essential payroll processes?

Essential payroll processes include not only the accurate entry of payroll data but also regular updates to maintain compliance. Inaccurate data can result in significant issues for employees and employers alike.

-

Inputting data into the payroll system requires accuracy to ensure that all employees are compensated correctly and on time.

-

Regular adjustments are necessary to keep personnel records current, especially with new hires, terminations, and changes in benefits.

-

Information must be communicated effectively to other departments, such as HR and finance, to ensure synergy and compliance with regulations.

What are the key checklist items for daily operations?

A daily operations checklist can help ensure that all critical tasks are consistently completed. This list serves as a guideline to maximize efficiency and maintain compliance with payroll processes.

-

Associates should be knowledgeable resources for payroll questions and benefits, guiding employees effectively.

-

Understanding the pros and cons of each filing method can determine best practices for document management.

-

Being prepared to address common inquiries fosters trust and helps employees feel supported.

How can one improve task management and organizational skills?

Strong task management and organizational skills are essential for personnel payroll associates, allowing them to handle various responsibilities efficiently. Developing these skills can directly impact the effectiveness of payroll operations.

-

Familiarity with document editing software and organizational systems enhances efficiency in managing payroll documents.

-

Associates should be equipped to make quick decisions based on established protocols to resolve issues effectively.

-

Implementing effective training processes can ensure knowledge transfer and continuity in operations.

What are the advanced payroll processing responsibilities?

Advanced responsibilities involve more complex decision-making and compliance monitoring. Associates must be vigilant to ensure all processes align with established policies and regulations.

-

Interpretation of company policies should be done carefully to ensure fairness and legal compliance in payroll processes.

-

Regular audits of payroll processes help ensure adherence to internal and external regulations, which is paramount for safeguarding the company.

-

Payroll records may require adjustments based on audits or changing regulations to maintain accuracy.

How does one handle complex payroll situations and supervisory roles?

Handling complexities in payroll requires a keen understanding of both operational procedures and compliance issues. Supervisory roles demand oversight to guide associates effectively.

-

It's critical to know when to escalate issues to ensure proper resolution, especially when they relate to compliance.

-

Supervisors set expectations and provide support for associates handling daily payroll tasks, ensuring continuity and efficiency.

-

A supervisor must be vigilant in identifying potential compliance breaches and addressing them promptly.

What tools and resources can pdfFiller provide?

pdfFiller is an excellent resource for personnel payroll associates, offering a range of functionalities to enhance document management. Users can efficiently create, edit, eSign, and collaborate on essential payroll documents from a single platform.

-

pdfFiller allows for seamless editing and management of payroll documents, ensuring accuracy and ease of access.

-

Collaboration features make it easy for teams to work together on payroll processes, maintaining compliance and efficiency.

-

Users can access pre-designed templates specific to payroll processes, streamlining operations and enhancing productivity.

What are the best practices for finalizing payroll?

Best practices for finalizing payroll include thorough checks of transactions and maintaining strict documentation protocols. Adhering to these practices ensures accuracy and regulatory compliance.

-

Ensure timely payments to insurance and retirement vendors by setting clear deadlines and monitoring compliance with company policies.

-

A final review helps catch any discrepancies before submission, preventing costly errors.

-

Proper documentation and archiving systems ensure all records are accessible and retain compliance with regulatory requirements.

How to fill out the personnel payroll associate checklist

-

1.Access the personnel payroll associate checklist on pdfFiller.

-

2.Review the checklist to understand all required sections, including employee information, pay rates, and deductions.

-

3.Begin by entering the employee's personal details such as name, ID number, and position in the designated fields.

-

4.Fill in the section regarding salary details, ensuring accuracy in figures to prevent discrepancies.

-

5.Document any applicable deductions, such as taxes or benefits, according to the latest regulations.

-

6.Check off each item as you complete it to ensure all steps are followed.

-

7.Once all information is entered, review the checklist for completeness and accuracy before final submission.

-

8.Save your work periodically to avoid any data loss.

-

9.After finalizing the checklist, either print it for physical records or submit it electronically as required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.