Last updated on Feb 20, 2026

Get the free Resolution of Meeting of LLC Members to Set Officer Salary template

Show details

This form is a resolution of meeting of LLC Members to set an officer salary.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is resolution of meeting of

A resolution of meeting of is a formal document that records decisions made during a meeting by the members of an organization or board.

pdfFiller scores top ratings on review platforms

easy to use

great

Very helpful to maintain neat paperwork for my Nursing job

Very helpful to maintain neat paperwork for my Nursing job

User friendly

great!

Who needs resolution of meeting of?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Resolution of Meeting of Form Form

What is a board resolution?

A board resolution is a formal document that captures decisions made by a board of directors during a meeting. This document holds significant legal implications in organizational governance, serving as a record of board decisions that impact the company’s operations, policies, and future directions.

-

A board resolution outlines specific decisions made by board members during formal meetings.

-

It ensures that all members are aware of the decisions made and the legal standing of such decisions.

-

Board resolutions are often required for compliance purposes and to demonstrate adherence to proper governance practices.

When is a board resolution necessary?

Board resolutions are often required in various scenarios such as approving significant financial transactions or organizational changes. They provide an official record of the decision-making process and are crucial for legal compliance in many jurisdictions.

-

Resolutions are needed for actions like loans, investments, or mergers.

-

Any modification in the company's bylaws or operational policies typically requires a resolution.

-

Always check local regulations before drafting, as they may dictate specific protocols or language.

How to write a board resolution?

Drafting a board resolution can be straightforward if you follow a structured approach. Emphasizing clear and concise language ensures that the document serves its purpose effectively.

-

Define the specific decision being made and the reason for it.

-

Make sure to include the company name, WHEREAS clauses, and the RESOLVED clauses clearly.

-

Designate who will sign the resolution, usually board members involved in the decision.

Key sections to include

-

State the company’s full name and the reason for the meeting.

-

Provide background information to justify the resolution.

-

Clearly outline the actions that are to be taken.

-

Include spaces for board members and their respective signatures.

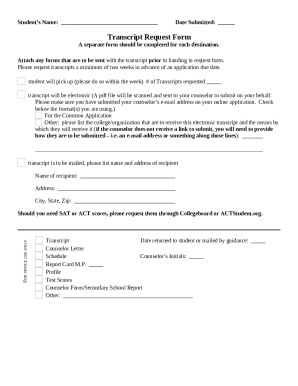

Filling out the resolution setting officer salary

When completing a resolution for setting an officer's salary, it’s essential to be precise and detailed. This ensures that all parties involved fully understand the decisions being made.

Form fields explained

-

Include the legal name of the company and any relevant identifiers.

-

Clearly articulate the position being discussed and the agreed-upon salary.

-

Define roles and responsibilities of signatory parties to avoid confusion.

Example of a completed resolution

-

Provide an example to guide users through the form-filling process.

-

Highlight mistakes such as incomplete information or ambiguous clauses that should be avoided.

Considerations for effective board resolutions

Crafting effective board resolutions entails more than just filling out forms. Attention to detail, legal considerations, and maintaining clarity are crucial aspects.

-

Avoid vague terms and ensure that the resolution is easy to understand.

-

Make sure the resolution follows relevant local regulations and organizational standards.

-

Encourage discussions among board members to secure agreement and avoid conflicts.

Exploring more with pdfFiller

pdfFiller streamlines the resolution drafting process by providing easy-to-use templates and tools for editing. The platform offers collaborative features that allow multiple users to work on the document simultaneously.

-

Integrate electronic signatures directly into your documents for efficiency.

-

Store and access your documents securely from anywhere, simplifying organization.

-

Engage with other board members in real-time, boosting productivity and communication.

How to fill out the resolution of meeting of

-

1.Open the PDF document for the resolution of meeting.

-

2.Fill in the header section with the name of the organization and the date of the meeting.

-

3.In the body, list the attendees present at the meeting.

-

4.Document the specific resolutions or decisions made, ensuring clarity and precision in wording.

-

5.Include any voting results or presentation details relevant to the resolutions.

-

6.Verify that all decisions listed are reflective of what occurred during the meeting discussions.

-

7.Assign a person responsible for overseeing the implementation of each resolution, if applicable.

-

8.Sign and date the resolution by the individuals responsible for officiating the meeting, ensuring it is printed on official letterhead if required.

-

9.Save the completed document and distribute it to the relevant stakeholders for their records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

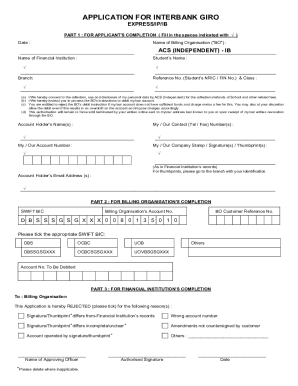

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.