Last updated on Feb 17, 2026

US-412EM free printable template

Show details

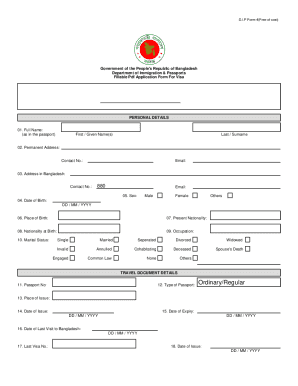

GENERAL SEPARATION NOTICE 1. Employee s Name 2. Social Security Number 3. Last Employed From to Occupation 4. Where was work performed 5. Reason for Separation Lack of Work Discharge Quit Permanent Temporary If temporary when do you expect to recall individual If other than lack of work explain the circumstances of the separation 6. Employee received Wages in Lieu of Notice Separation Pay Vacation Pay In the amount of for period from to 7. Where was work performed 5. Reason for Separation Lack...of Work Discharge Quit Permanent Temporary If temporary when do you expect to recall individual If other than lack of work explain the circumstances of the separation 6. Employee received Wages in Lieu of Notice Separation Pay Vacation Pay In the amount of for period from to 7.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is US-412EM

The US-412EM is a form used for reporting specific employment-related data to the Internal Revenue Service.

pdfFiller scores top ratings on review platforms

It has a lot more features than I expected and such good value

Seems to be a good package. A little clumsy "save as" feature.

It went fast and looked very nice when done.

Great product, just sometimes have difficulty printing it.

great service on documents helpful to operation of my company

Works as intended, very useful for filling out PDF's and editing

Who needs US-412EM?

Explore how professionals across industries use pdfFiller.

How to fill out the US-412EM form

Filling out the US-412EM form correctly is vital for ensuring that separation processes adhere to legal standards. It serves as the General Separation Notice, detailing key information about an employee's exit from a job.

What is the US-412EM form?

The US-412EM form, also known as the General Separation Notice, is a document required under employment law that informs relevant parties of an employee's separation from employment. This form is crucial for maintaining compliance with employment regulations.

Understanding the importance of the US-412EM form is essential. It not only serves as a record of the separation but also protects employers from future legal disputes related to unemployment claims.

How do prepare to fill out the form?

-

Collect the employee’s name, social security number, and employment history, which are key components of the US-412EM form.

-

Compile potential reasons for the separation such as lack of work, discharge, or voluntary quit, along with any supporting documentation.

What sections are included in the General Separation Notice?

-

Complete the employee's name and social security number, as well as their last employed dates and job title.

-

Specify the location where the employee performed their duties, and note any compliance considerations.

-

Select the appropriate reason for the separation and provide details when necessary.

-

Include any wages paid in lieu of notice or separation amounts received, as well as the compensation period.

-

Record the name and contact information for the supervising manager, as well as securing their signature and date.

What common mistakes should avoid?

-

Double-check that social security numbers and employment dates are accurate to avoid processing issues.

-

Ensure all required signatures, especially from supervisors, are included to validate the form.

How can pdfFiller assist with the US-412EM form?

pdfFiller provides an efficient platform for accessing and filling out the US-412EM form. You can easily gather documents, make necessary edits, and utilize the eSigning feature for a faster submission process.

-

Navigate to pdfFiller to find and open the US-412EM form quickly.

-

Use pdfFiller's editing tools to conveniently enter information and make any changes needed.

-

Take advantage of eSigning capabilities, allowing for quicker processing of the form.

What are the next steps after submission?

Once the US-412EM form has been submitted, it’s important to know what to expect. You should familiarize yourself with the typical processing timeline and determine if any follow-up actions are needed to confirm receipt or address additional documentation.

-

Keep an eye out for any correspondence regarding your submission status.

-

Be ready to provide further details or documentation if requested by any regulatory authorities or employment agencies.

How to fill out the US-412EM

-

1.Download the US-412EM form from the IRS or your payroll software.

-

2.Open the PDF file in pdfFiller or upload it if using a different PDF viewer.

-

3.Begin by entering your business's legal name and Employer Identification Number (EIN) in the designated fields.

-

4.Fill in the contact information for the person responsible for payroll, including name, phone number, and email.

-

5.Complete the section detailing employee wages, including gross pay and deductions for all relevant employees.

-

6.Double-check all entries for accuracy to ensure compliance with IRS requirements.

-

7.After filling in all necessary information, review the entire form for any errors or omissions.

-

8.Once confirmed, save your work and follow the instructions for submission to the IRS, either electronically or via mail.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.