Last updated on Feb 20, 2026

Get the free Self-Employed Independent Contractor Employment Agreement - commission for new busin...

Show details

This form is a contract with an independent contractor. The employer will pay the contractor a gross commission of the net invoice amount of all new business generated by the the contractor for the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is self-employed independent contractor employment

Self-employed independent contractor employment refers to a working arrangement where an individual provides services to clients without being classified as an employee.

pdfFiller scores top ratings on review platforms

PDF filler was a great product but I don’t need it any longer. Thanks for your past service.

Like when my customer opens a PDF file I get a notification. I will recommend it to others.

Fantastic, never fails. Does exaclty what it promises and more!

Always works. Saves time and money over other apps and programs.

So useful! It's saved me several times over now.

you need to have in you are in business!!

Who needs self-employed independent contractor employment?

Explore how professionals across industries use pdfFiller.

How to fill out a self-employed independent contractor employment form

Filling out a self-employed independent contractor employment form can streamline collaboration between independents and businesses. It provides clear terms and responsibilities, helping enhance productivity.

Understanding the role of an independent contractor

An independent contractor is defined as a self-employed individual who provides services to clients under specific terms. Key characteristics include the ability to set their own hours and work independently without direct control from employers. Hiring independent contractors offers flexibility, often leading to cost savings for businesses.

-

Businesses can hire contractors as needed, avoiding the costs associated with full-time employees.

-

Contractors often bring specialized skills that are specific to particular assignments.

-

Employers have fewer legal obligations with contractors, such as benefits and payroll taxes.

The importance of an independent contractor agreement

An independent contractor agreement is crucial for defining the relationship and protecting both parties. Essential elements typically include the scope of work, payment terms, and timelines.

-

A well-structured agreement prevents misunderstandings by outlining the roles and responsibilities of each party.

-

Written agreements can provide legal recourse should disputes arise, highlighting terms relevant to compensation and deliverables.

-

Agreements can be tailored to meet the specific needs of the business and contractor, ensuring both parties agree on expectations.

Key components of the employment form

A comprehensive employment form for independent contractors includes various critical components. It facilitates transparency regarding financial arrangements and responsibilities.

-

Clearly identify all parties participating in the agreement to eliminate confusion.

-

Detail the gross commission and net invoice amounts to clarify what contractors will earn.

-

Outline what constitutes 'New Business' within the scope of the contract, ensuring both parties understand this context.

-

Specify any policies for reimbursing expenses incurred by the contractor while performing services.

Filling out the contractor employment form with pdfFiller

Using pdfFiller to complete the contractor employment form is streamlined and user-friendly. Individuals can access templates and interactive features to ensure accuracy.

-

Users can follow a simplified process to fill out forms correctly, ensuring no crucial sections are overlooked.

-

pdfFiller allows real-time editing and form management, contributing to a smoother workflow.

-

Once completed, documents can be electronically signed and easily shared with relevant parties.

Understanding financial responsibilities

Independent contractors have unique tax obligations compared to traditional employees. Awareness of these duties is fundamental for financial planning.

-

Contractors are responsible for self-employment taxes, which can be a significant financial commitment.

-

A clear understanding of commission structures helps contractors project their net income accurately.

-

Independent contractors generally do not receive benefits like health insurance or retirement plans, which must be factored into their earnings expectations.

Best practices for managing independent contractor relationships

Effective management of independent contractor relationships is essential for project success. Clear communication helps align expectations.

-

Establish regular check-ins to keep contractors updated on project developments and feedback.

-

Both parties should clarify deliverables and timelines to foster a productive working environment.

-

Conducting reviews ensures that both contractor and client goals are being met and adjusts expectations as necessary.

Navigating legal implications of independent contractor status

Understanding the legal framework surrounding independent contractors is vital. Proper classification can mitigate legal risks.

-

Misclassifying a contractor as an employee can lead to legal consequences and financial penalties.

-

Common issues include failure to comply with labor laws, which can affect liability and insurance.

-

Seek advice from legal professionals to navigate complex contractor agreements and employment law.

Resources for crafting your independent contractor agreement

Creating a solid independent contractor agreement is simpler with available resources on pdfFiller. Users can find templates tailored to various scenarios.

-

Access a variety of legally vetted templates designed specifically for independent contractor agreements.

-

Utilize customizable features that allow users to adapt documents to their unique needs.

-

pdfFiller provides user support to assist with any queries regarding document preparation and electronic signatures.

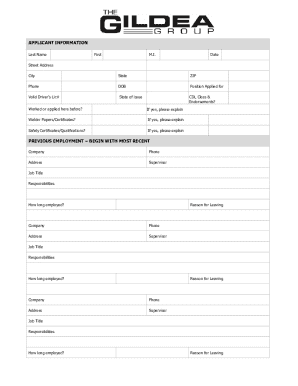

How to fill out the self-employed independent contractor employment

-

1.Start by downloading the self-employed independent contractor employment form from pdfFiller.

-

2.Open the PDF file in pdfFiller and review the layout of the form to familiarize yourself with the required fields.

-

3.Begin filling out your personal information in the designated sections, including your full name, contact details, and address.

-

4.Provide a description of the services you will be offering as an independent contractor in the appropriate section.

-

5.Indicate the agreed-upon payment terms, including the rate and payment method, ensuring clarity on deadlines.

-

6.Fill in any tax identification numbers or business licenses if required by your state or locality.

-

7.Review the completed form thoroughly for any errors or missing information.

-

8.Once satisfied, save the completed form and consider printing it for your records.

-

9.Finally, submit the form to the client, following any additional submission guidelines they may have.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.