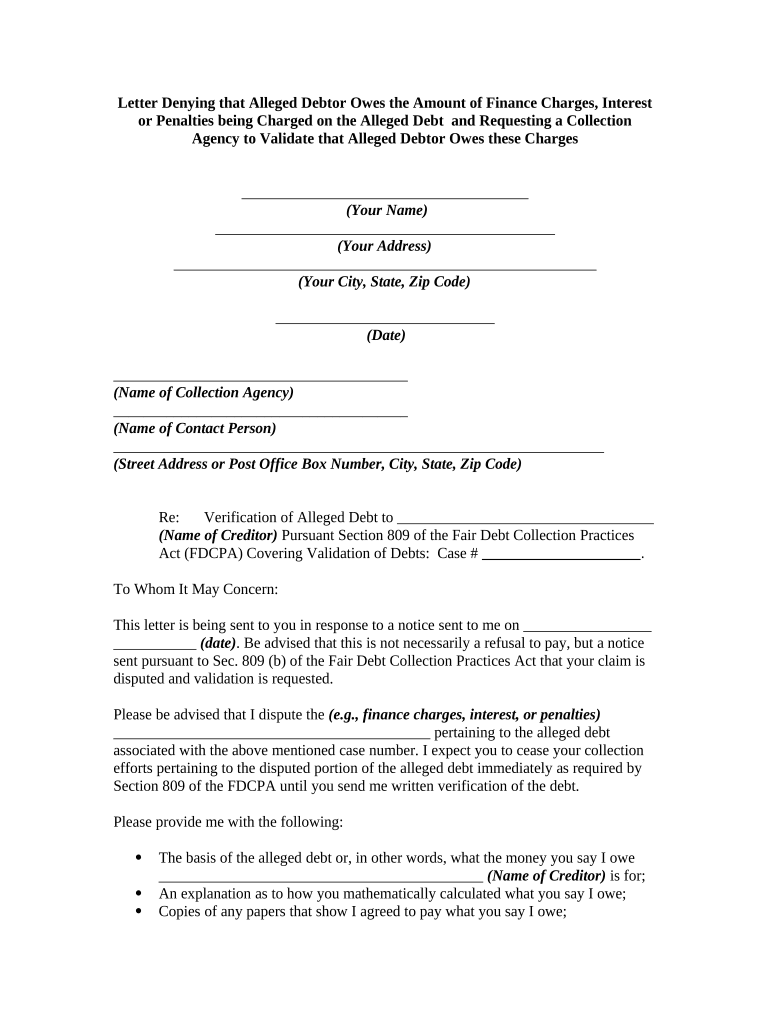

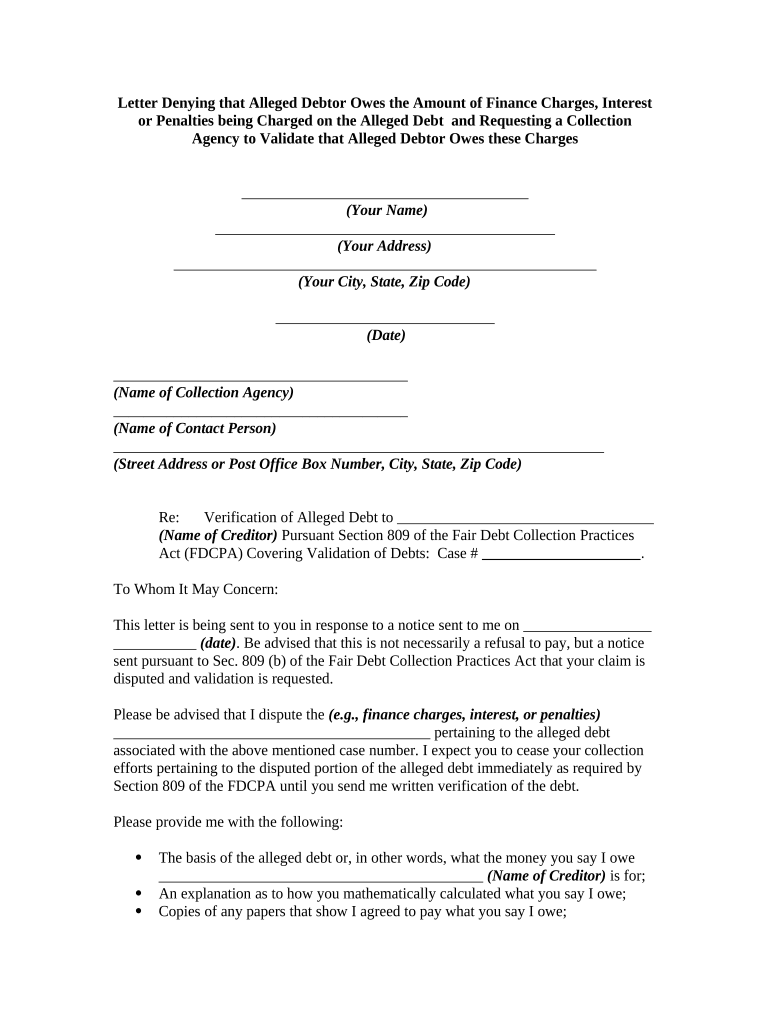

Get the free Letter Denying that Alleged Debtor Owes the Amount of Finance Charges, Interest or P...

Show details

Pursuant to 15 USC 1692g (Sec. 809 of the Federal Debt Collection Practices Act), a debtor is allowed to challenge the validity of a debt that a collection agency states you owe to the creditor they

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter denying that alleged

A letter denying that alleged is a formal response disputing the accuracy of claims made against an individual or organization.

pdfFiller scores top ratings on review platforms

What an amazing program!! It is wonderful to be able to fill in my documents without contemplating having to get a typewriter!

Fairly easy to use, only issue is occasionally locating the document I need.

Works Great for Filling in PDF Forms. Wish I could do more with it like work on documents

Good program, the FREE advertising bit misleading but over all it is good.

The search feature is easy to use, I love the option to save the form to my own computer once it has been filled out. The option to use an app is wonderful.

Thanks I have been using you and your service for years and if you ever want to run a marketing campaign to my 950,000 website members that are all real estate investors and agents please reach out to me.

Who needs letter denying that alleged?

Explore how professionals across industries use pdfFiller.

Letter denying alleged debt: A comprehensive guide

How do understand my rights under the FDCPA?

Under the Fair Debt Collection Practices Act (FDCPA), consumers are granted specific rights in dealing with debt collectors. Knowing these rights empowers you when responding to collection notices. Before making payments, it's critical to validate the debts being claimed against you.

-

Overview of the FDCPA - The FDCPA restricts the behaviors of debt collectors and protects consumers from abusive practices.

-

Rights to dispute - You have the right to contest the validity of the debt and request verification.

-

Debt validation - Always seek proof of the alleged debt before considering any payments.

What are the essential elements of a denial letter?

A well-crafted letter denying an alleged debt should include several essential elements. Firstly, clearly state your intention to dispute the validity of the debt. Use precise language to assert your rights effectively, ensuring your position is well-understood.

How do fill out key information accurately?

When preparing your letter, include essential information such as your name, address, and contact details. Format the date correctly to avoid confusion, and ensure the collection agency's details are accurate, including their name and contact person.

-

Your information - Include your full name, complete address, and phone number for clear identification.

-

Properly formatted date - This shows formality and timing in your communication.

-

Collection agency details - Outline their name, the contact person's name, and their address for direct communication.

How to assert your dispute on the debt?

In your letter, reference the specific debt in question and clearly indicate your basis for disputing it. This could be due to finance charges, interest discrepancies, or penalties that you believe were improperly assessed. It's crucial to formally request the collection agency to provide written validation of the debt as mandated by the FDCPA.

What documentation should request from the collection agency?

Request verification of the alleged debt as well as an explanation of how the amount was calculated. Additionally, demand copies of any signed agreements or judgments that affirm the validity of the charges being claimed.

-

Verification of alleged debt - Ensure that the collection agency has proper documentation supporting their claim.

-

Debt calculation explanation - Understand how the total debt amount was derived.

-

Copies of agreements - Requested documents provide evidence and help you assess the legitimacy of the claims.

What are the legal considerations in denying debt?

It's essential to understand the state laws that could influence your situation. Collectors must comply with local regulations regarding licensure, meaning they need to be authorized to operate in your state. Furthermore, familiarize yourself with the statute of limitations for debt collection, as it varies and can affect your rights.

How can pdfFiller facilitate my letter creation?

pdfFiller provides a user-friendly template to help you draft your denial letter effectively. You can benefit from advanced features, such as electronic signatures and collaborative tools, which streamline your document management process.

What are the follow-up procedures after sending the letter?

Upon sending your letter, it’s vital to keep a record of all communication with the collection agency. In case you receive a response from them, review it carefully and document it for future reference. If the agency persists with collection efforts, know your rights and consider further action.

How to fill out the letter denying that alleged

-

1.Open the PDFfiller platform and log in to your account.

-

2.Select 'Create New Document' and upload the 'Letter Denying That Alleged' template, or choose a pre-existing template from the library.

-

3.Begin by entering the recipient's information at the top of the letter, including their name and address.

-

4.Clearly state the date of the letter following the recipient's information.

-

5.In the salutation, address the recipient appropriately, using 'Dear [Name],' or 'To Whom It May Concern'.

-

6.Begin the letter with a brief introduction stating your reason for writing and your position regarding the allegations.

-

7.In the body of the letter, address each allegation specifically, providing your rebuttal and any necessary evidence or reasoning.

-

8.Conclude the letter by affirming your denial of the allegations and expressing your willingness to discuss the matter further.

-

9.Sign off with a professional closing such as 'Sincerely' or 'Best Regards', followed by your name and title.

-

10.Review the letter for clarity and completeness, and ensure that all necessary information is present.

-

11.Once finalized, save the document and download it or send it directly through PDFfiller as needed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.