Get the free debt collector attorney

Show details

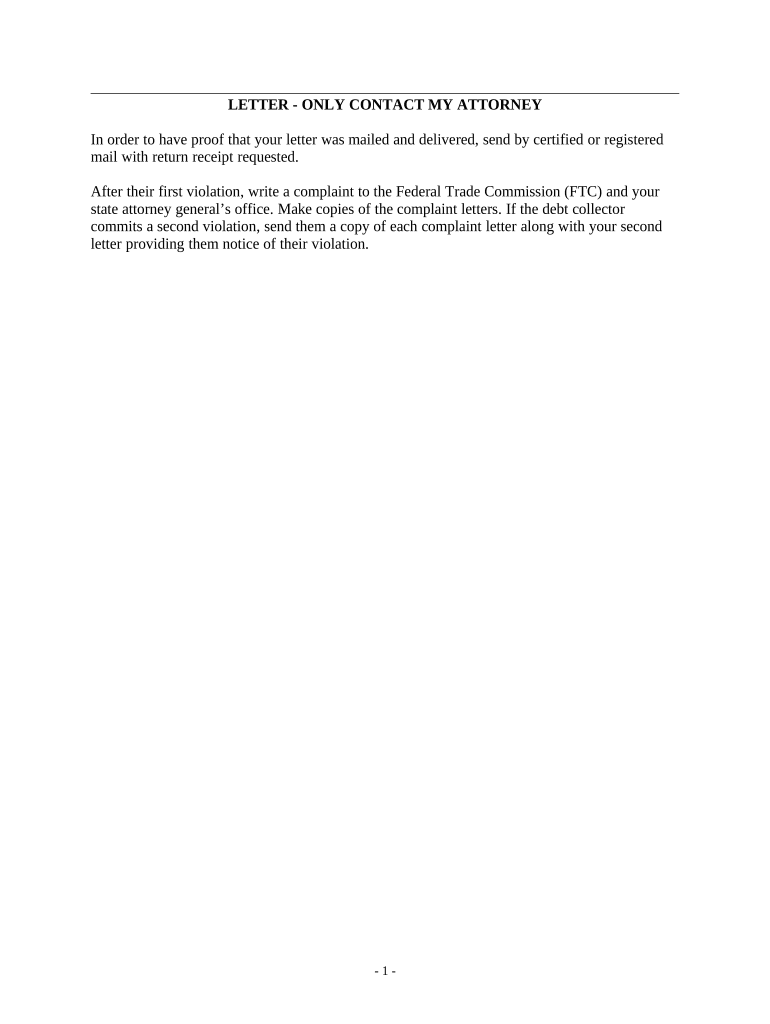

Use this form to tell a debt collector to only contact your attorney.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter to debt collector

A letter to a debt collector is a formal written communication disputing a debt or requesting verification of the debt owed.

pdfFiller scores top ratings on review platforms

The documents were easy to find & download

The documents were easy to find and with the help of ChatGPT, they were easy to fill out.

not applicable

nothing was wrong, i just needed one document

Good PDF Form Filler software

Was able to manipulate the text size to make sure everything fit into the text boxes I had to fill out. By approaching each set of box as one text, it cut down the time needed to fill out the form.

An Easier Way to File Taxes on Time

Mailing the document and the payment processing works very well. I would like a reminder to upload my extra attachments so that I don't have to try and add them later. I hope to refer to the site later like an archive for the information that I am mailing online.

Easy to use!

Easy to use!

easy to use

easy to use. simple to upload documents.

Who needs debt collector attorney template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Letter to Debt Collector Form

Learning how to properly draft a letter to debt collector form is crucial in managing your debts effectively. This guide provides you with all the information you need to understand your rights, prepare your letter, and manage responses. Using tools like pdfFiller makes it easier to create, edit, and send your letters.

What is the Fair Debt Collection Practices Act (FDCPA)?

The Fair Debt Collection Practices Act (FDCPA) is a federal law designed to protect consumers from unfair debt collection practices. This law provides specific guidelines on how debt collectors can behave when communicating with individuals about their debts.

What rights do consumers have regarding debt collection?

-

Consumers cannot be subjected to harsh, abusive treatment when debt collectors attempt to collect debts.

-

Debt collectors are required to disclose specific information regarding the debt, including the original creditor's name and amount owed.

-

Consumers have the right to limit when and how debt collectors can contact them, including the ability to request communication through an attorney.

Why is it important to send a letter to debt collectors?

Sending a letter to debt collectors is essential for formalizing communication and protecting your rights. It sets clear boundaries and creates an official record of your correspondence.

-

An official letter signals to the collector that you take the matter seriously and prefer to communicate through formal channels.

-

This letter can restrict future communications, helping you define how and when you can be contacted.

-

Maintaining a record of all communications will aid you in any future disputes or legal issues.

What key elements should be included in your letter?

Your letter should be comprehensive yet concise, including critical details that identify you and the debt. Make sure to include everything necessary for your case.

-

Include your full name, mailing address, and any other identifying details to ensure proper identification of your case.

-

Specify the debt amount and the name of the debt collector, if applicable.

-

If you are being represented, clearly state this in the letter to direct communications accordingly.

-

A clear request for future contact to be directed to your attorney reinforces your boundaries in communication.

What sample letter templates can help?

Using sample letter templates tailored to various scenarios can simplify writing a letter to debt collectors. Templates can be easily customized using platforms like pdfFiller.

-

A sample template designed to limit communication to your attorney can save time and clarify your boundaries.

-

These templates help you address any violations committed by debt collectors by outlining the specific incidents.

-

Templates on pdfFiller include fillable fields that let you personalize your letters effortlessly.

How can you use pdfFiller to edit and send your letter?

pdfFiller's platform is user-friendly, enabling you to easily access and edit your letter. Its tools are designed for seamless document management.

-

Begin by logging into pdfFiller and searching for the debt collector letter template within the template library.

-

Use interactive fields to easily input your information, ensuring accuracy and completeness.

-

Follow the platform's instructions to send your letter by certified mail, providing proof of delivery.

What should you do upon receiving a response?

After you send your letter, be prepared for any responses from debt collectors. How you manage these responses can significantly affect the outcome.

-

Use pdfFiller's document tracking feature to manage and monitor responses to your letters efficiently.

-

Know when it is necessary to escalate your case to the Federal Trade Commission (FTC) or your state attorney general for additional support.

What are best practices after communicating with debt collectors?

Keeping thorough records and maintaining ongoing communication with your attorney is vital. This will help you navigate any issues that arise.

-

Document every interaction you have with debt collectors to provide an accurate history if needed.

-

Keep your attorney informed about any new developments related to your case.

-

Create a checklist to stay organized and follow up on key points in your debt management strategy.

What common pitfalls should you avoid?

Understanding the common mistakes in dealing with debt collectors can save consumers a lot of stress and complications.

-

Avoid saying or writing anything that could be interpreted as an admission of the debt, which could strengthen the collector’s position.

-

Every communication counts; be mindful of how your words could be interpreted in a legal context.

-

Don’t hesitate to contact a professional if you feel overwhelmed or if the situation escalates.

How can pdfFiller enhance document management?

pdfFiller's innovative features provide significant advantages for ongoing document management. Leveraging these tools can improve your overall efficiency.

-

Utilize pdfFiller’s eSigning function to expedite document approval processes.

-

Use shared folders to collaborate with your team on debt management strategies, ensuring a unified approach.

-

pdfFiller allows you to securely store and access your documents, ensuring they are always at your fingertips.

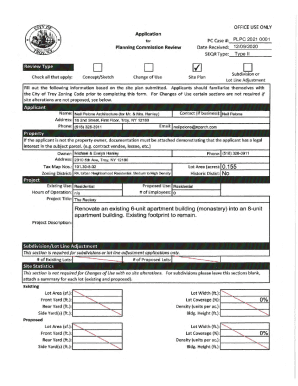

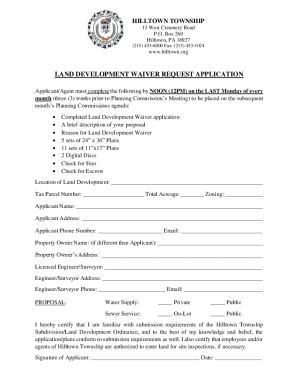

How to fill out the debt collector attorney template

-

1.Open the pdfFiller website and log in to your account.

-

2.Select the option to create a new document and choose the 'Letter to Debt Collector' template.

-

3.Fill in your personal information at the top of the letter, including your name, address, and contact information.

-

4.Enter the debt collector's name and address provided on previous communications regarding the debt.

-

5.Clearly state your dispute regarding the debt in the main body of the letter, specifying the reasons for your dispute or requesting validation.

-

6.Include any supporting information or documentation you have regarding your dispute.

-

7.Review the letter for clarity and accuracy; ensure all fields are correctly filled out.

-

8.Save the document and choose the option to either download it or send it directly to the debt collector via email or postal mail.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.