Last updated on Feb 20, 2026

Get the free 497336207

Show details

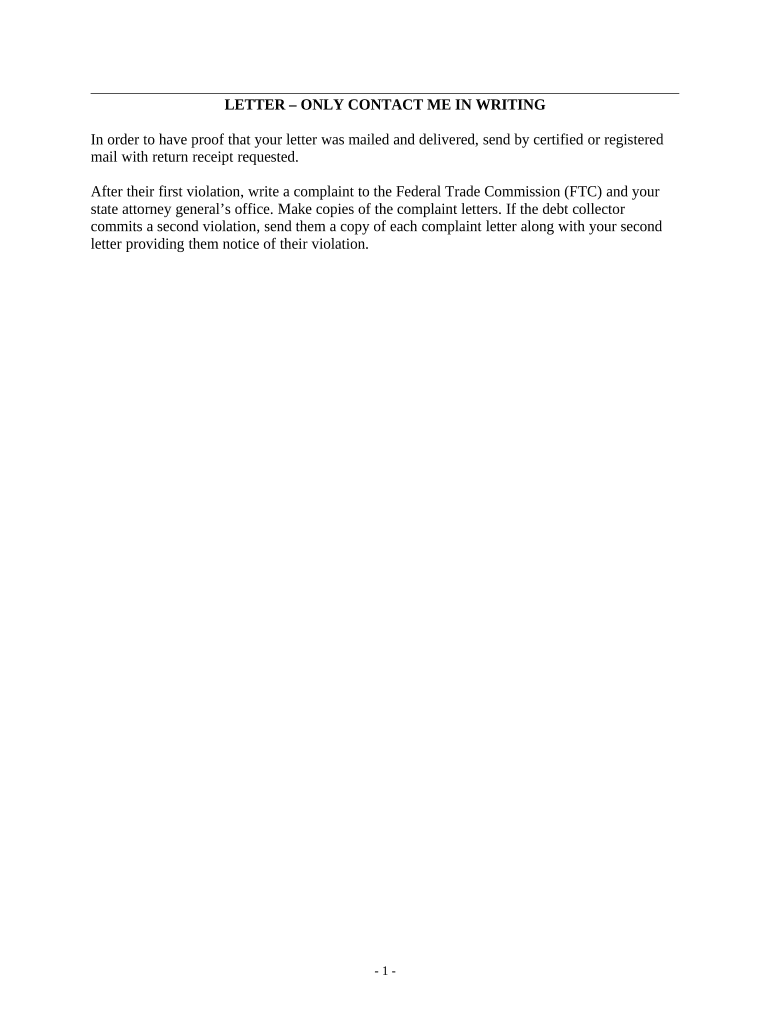

Use this form to require a debt collector to only contact you in writing.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is letter to debt collector

A letter to a debt collector is a written communication that asserts your rights under the Fair Debt Collection Practices Act, such as disputing a debt or requesting verification.

pdfFiller scores top ratings on review platforms

Could not be happier.

Could not be happier.The product is amazingly useful and intuitively simple.I'm 70!Mark L.

Needed this to fill out some documents

Needed this to fill out some documents. Worked for what I was using it for

I had no problems

Easy

Easy, Fast, and Secure way to get your info from point A to point B

awesome

awesome. def recommend

Very simple

Very simple, accurate and effective way to find the forms I needed. Great service!

Who needs 497336207 template?

Explore how professionals across industries use pdfFiller.

How to write a letter to debt collector form: A step-by-step guide

What are debt collection communications?

Debt collection communications refer to any correspondence initiated by a debt collector in an effort to collect a debt. These communications must adhere to regulations under the Fair Debt Collection Practices Act (FDCPA), which protects consumer rights during the debt recovery process.

-

Debt collection communication includes phone calls, letters, and emails aimed at persuading consumers to pay debts.

-

Consumers have rights under the FDCPA, such as the right to dispute the debt and request written verification.

-

Identifying improper communication is essential; collectors cannot use threats, false statements, or harass consumers.

Why is it important to communicate in writing?

Written correspondence is crucial when dealing with debt collectors as it establishes a clear record of all communications. This method helps protect consumers and minimizes the risk of misunderstandings that can arise from verbal exchanges.

-

Written communications provide tangible proof of what was discussed and agreed upon, serving as a formal record.

-

Using certified or registered mail guarantees proof of delivery, ensuring the debt collector cannot deny receiving your correspondence.

-

A written letter allows you to state your preferences clearly, such as requesting all further communication to be in writing.

How to structure your letter to a debt collector?

A well-structured letter can effectively communicate your position to a debt collector. Including specific personal information and referencing past communications can make your case more robust.

-

Include personal details: Your full name, address, and contact information will authenticate your letter.

-

Reference specific case numbers or identifiers related to your debt to ensure clarity.

-

Clearly state your request for all future correspondence to be conducted in writing, enhancing your protection.

What to include regarding compliance notes in your letter?

Incorporating compliance notes into your letter can serve as an important reminder to debt collectors about their obligations. Mentioning any FDCPA violations can strengthen your position.

-

Indicate any specific violations of the FDCPA you believe have occurred in your case.

-

Provide details about previous interactions or communications that may not comply with legal standards.

-

Highlight the importance of documenting all communications to hold collectors accountable.

How to file a complaint against harassment?

If you experience harassment, knowing how to file a complaint can empower you. You can report wrongdoings to the Federal Trade Commission (FTC) and local attorney general offices.

-

Outline the steps for submitting a complaint, ensuring to keep copies of all complaint letters and associated documentation.

-

Retaining copies of your letters helps track your complaints and can be valuable for future reference.

-

Follow up after filing your complaint, especially if the offending behavior persists.

What to do if communication proceeds unlawfully?

If a debt collector continues to communicate unlawfully after your attempts to halt contact, you need to take decisive action. Notifying them can pave the way for legal recourse or support.

-

Use a template to formally notify debt collectors of their legal violations.

-

If they remain unresponsive, consider exploring legal options, such as small claims court.

-

Seek out local resources for support, potentially including consumer protection agencies.

Sample letters: templates you can use

Having templates can streamline your communication with debt collectors. Properly designed letters can help convey your intent effectively.

-

Downloadable templates for common scenarios, ensuring you have the right style for your situation.

-

Examples tailored for specific debts, making it easier to customize the correspondence.

-

Focus on key phrases to enhance effectiveness, such as formally requesting written communication only.

What additional tools can help manage your debt communication?

Utilizing additional tools can improve how you manage your debt communications. Platforms like pdfFiller offer convenient features to streamline the writing and editing processes.

-

pdfFiller allows you to easily edit and create letters, providing a user-friendly interface for document management.

-

Features such as eSigning and document collaboration make it easier to have multiple parties involved.

-

Being a cloud-based solution, pdfFiller enables you to access your documents anytime, enhancing flexibility.

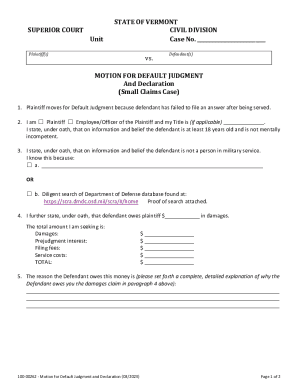

How to fill out the 497336207 template

-

1.Open the letter template in pdfFiller.

-

2.Begin by filling in your contact information at the top, including your name and address.

-

3.Next, enter the date on which you are writing the letter.

-

4.Below the date, write the debt collector's name and address accurately.

-

5.In the body of the letter, clearly state the reason for your communication, such as disputing the debt or requesting verification.

-

6.Be sure to include specifics about the debt, like reference numbers and amounts owed.

-

7.If applicable, mention your intention to cease communication until verification is provided.

-

8.Conclude the letter with a polite closing statement and sign your name.

-

9.Before submitting, review the document for accuracy and completeness.

-

10.Save the document and either print it for mailing or send it electronically if preferred.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.