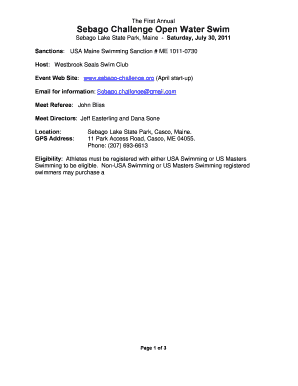

Get the free 497336411

Show details

Servicing Agreement of Ameriquest Mortgage Securities, Inc. dated 00/00. 37 pages

We are not affiliated with any brand or entity on this form

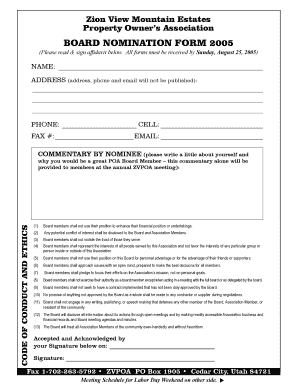

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is servicing agreement

A servicing agreement is a contract that outlines the responsibilities and obligations of a service provider and a client in relation to specific services rendered.

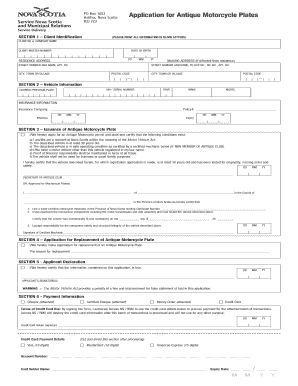

pdfFiller scores top ratings on review platforms

Lots of functionality that I needed ... much more than I expected when I found PDFfiller.

it is very cheap and you get a free trail it was great for that need it for.

Excellent software.

perfectly replies to my needs.

Reliable service. Always been very happy to use PDFfille

As a first-time user, I was very elated to be able to fill out my year-end tax forms.

i love that i can fill up a fors for the irs that are form years before

Who needs 497336411 template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Servicing Agreement Forms

TL;DR: How to fill out a servicing agreement form

To fill out a servicing agreement form, start by gathering all necessary information about the parties involved, including details about the servicer and company. Carefully complete each section, ensuring accuracy for compliance. Finally, consider integrating a digital signature for a streamlined submission.

What is a servicing agreement?

A servicing agreement is a vital contract that outlines the responsibilities and expectations between a servicer and a company, particularly in loan servicing. It plays a crucial role in ensuring the effective management of obligations related to mortgage loans. Parties involved include the servicer, who manages loan payments and collections, and the company, which owns the assets.

-

Key parties involved: Knowledge of the servicer and company roles is essential.

-

Importance: Understand how these agreements protect both parties' interests.

-

Common usages: Various industries leverage servicing agreements for managing loans effectively.

What are the key components of a servicing agreement?

Each servicing agreement comprises multiple essential clauses and sections that define the terms of engagement. A well-structured Table of Contents acts as a beneficial navigational tool for finding specific clauses quickly. Commonly included standard terms are Definitions, Representations, and Warranties, which clarify the legal obligations of the parties involved.

-

Clause breakdown: Key sections include definitions and obligations.

-

Navigational tool: A Table of Contents can simplify complex agreements.

-

Standard terms: Recognize the importance of robust definitions and warranties.

How do fill out a servicing agreement form?

Filling out a servicing agreement form requires meticulous attention to detail. Begin by entering your details and those of the other party accurately. Particular emphasis should be placed on financial figures and compliance-related fields. Utilizing tools like pdfFiller can enhance this process by offering features like digital signature integration.

-

Step-by-step compliance: Follow a structured approach to ensure accuracy.

-

Data entry importance: Ensure correctness to maintain legal integrity.

-

Digital signature benefits: Streamline the process using eSignatures.

What is the role of a servicer in mortgage loan administration?

The servicer plays a pivotal role in managing mortgage loans, including collecting payments and maintaining records. Their responsibilities extend to handling insurance expenses and ensuring timely loan payment processing. Effective servicers maintain transparent communication with borrowers to foster trust and compliance.

-

Payment management: Timely collection and management of payments are essential.

-

Record maintenance: Keep meticulous records for audit purposes.

-

Risk management: Address expenses related to insurance and real estate effectively.

What compliance considerations should be aware of?

Compliance is paramount in the realm of servicing agreements, especially as it relates to industry standards and legal requirements. Documentation mandated by the IRS must be meticulously prepared to avert potential pitfalls. Understanding these aspects can significantly enhance the durability of your agreements.

-

Legal aspects: Stay informed about compliance laws affecting servicing agreements.

-

IRS documentation: Familiarize yourself with necessary recordkeeping.

-

Common pitfalls: Recognize challenges to avoid during agreement drafting.

How do manage distribution and payment accounts?

Setting up and managing distribution and payment accounts can streamline the loan servicing process. Adopting best practices for transaction records and reporting fosters clarity and accountability. Common issues regarding account maintenance are frequently simplified through automated systems, which offers efficiency.

-

Setup process: Understand the key steps for creating accounts.

-

Record management: Keeping accurate transaction records is essential.

-

Automation benefits: Utilize technology to enhance efficiency.

What should know about default scenarios?

Identifying servicing defaults early is crucial for a favorable resolution. Understanding the role of the Indenture Trustee and available recovery options will prepare you for potential defaults. Anticipating complications can foster proactive strategies that safeguard your interests.

-

Identifying defaults: Recognize what constitutes a servicing default.

-

Trustees' role: The Indenture Trustee facilitates resolution of defaults.

-

Recovery strategies: Be prepared with contingency plans.

What is optional repurchase in servicing agreements?

Optional repurchase allows servicers and companies to manage defaulted loans strategically. Understanding this option's implications can be pivotal for financial planning. Strategizing around such provisions can alleviate long-term financial distress for all parties involved.

-

Repurchase option: Understand how defaulted loans can be repurchased.

-

Strategic alignment: Ensure that all parties agree on the implications.

How do finalize a servicing agreement?

Finalizing a servicing agreement is critical to establishing the terms agreed upon. Common closing procedures include reviewing all clauses for accuracy and ensuring any amendments are documented. Consulting with legal professionals can provide valuable insights into strengthening your agreement.

-

Closing procedures: Follow best practices to ensure nothing is overlooked.

-

Documenting amendments: Be diligent about any changes made to the agreement.

-

Legal consultation: Always involve professionals for compliance purposes.

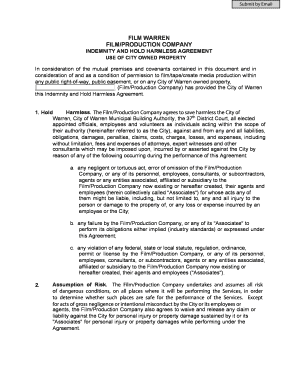

How to fill out the 497336411 template

-

1.Open the servicing agreement template on pdfFiller.

-

2.Begin by filling in your name or the name of your organization in the designated field.

-

3.Enter the name of the service provider in the corresponding section.

-

4.Specify the date of the agreement and any relevant effective dates.

-

5.List the services to be provided in detail to ensure clarity.

-

6.Include any payment terms, including amounts and due dates, in the financial section.

-

7.Add clauses for responsibilities, such as performance standards or timelines if applicable.

-

8.Fill out any areas requiring additional signatures, such as witnesses or co-signers.

-

9.Review the entire document for accuracy and completeness before finalizing.

-

10.Save your filled agreement, and consider sending it for electronic signatures if required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.