Get the free pdffiller

Show details

Investment Agreement and Letter of Investment Intent between NFOX.COM and __________ (Record Holder) regarding the purchase of shares of common stock dated 00/00. 4 pages.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

very good to work

I have had success so far but, would like to learn more

muy buena experiencia facil de usar

thank you

Overall good but would like to know more about the system to maximize it's benefits

I love it. it's so satisfying when i see it!

Investment Agreement Regarding Form Form

How do you define an investment agreement?

An investment agreement is a legal document that outlines the terms and conditions between investors and a company raising funds. Its significance lies in providing clear guidelines for both parties, ensuring that rights, obligations, and expectations are laid out before any financial commitment is made. A solid investment agreement protects both the investor's interests and the issuing company's objectives.

-

An investment agreement specifies the investment made, the securities being purchased, and the commitments of both parties.

-

Common components include terms and conditions, representations, warranties, and conditions precedent to the sale.

What are the essential sections of the NFOX investment agreement?

The NFOX investment agreement contains several vital sections that clarify the terms of investment. Understanding these sections is crucial for potential investors to grasp what they are committing to, including the details surrounding the offered securities.

-

This includes information about the minimum and maximum shares available for purchase, alongside per-share pricing.

-

Investors should carefully consider the subscription agreement before signing, as it encapsulates their rights and obligations.

-

Clarification on payment options—such as checks, bank transfers, and electronic payments—ensures a smooth transaction process.

How do you fill out the investment agreement?

Filling out the investment agreement requires a methodical approach to ensure accuracy and completeness. Each section must be carefully addressed, from basic company information to specific investor details and the payment section. Adhering to compliance with applicable securities laws is essential for avoiding legal pitfalls.

-

Follow a structured guide to ensure all areas of the form are addressed thoroughly.

-

Pay special attention to sections involving company information, investor data, and payment instructions.

-

Double-check entries and ensure that all information matches documentation to meet compliance requirements.

What features does pdfFiller offer to manage your investment agreement?

pdfFiller provides a range of tools for editing and managing investment agreements effectively. These features help users customize their documents, add signatures electronically, and collaborate in real time, streamlining the overall process.

-

With various editing functionalities, users can tailor their investment agreement to suit specific needs.

-

Electronic signatures can be easily integrated, allowing for faster document processing.

-

Work in teams seamlessly by engaging with the agreement in real time.

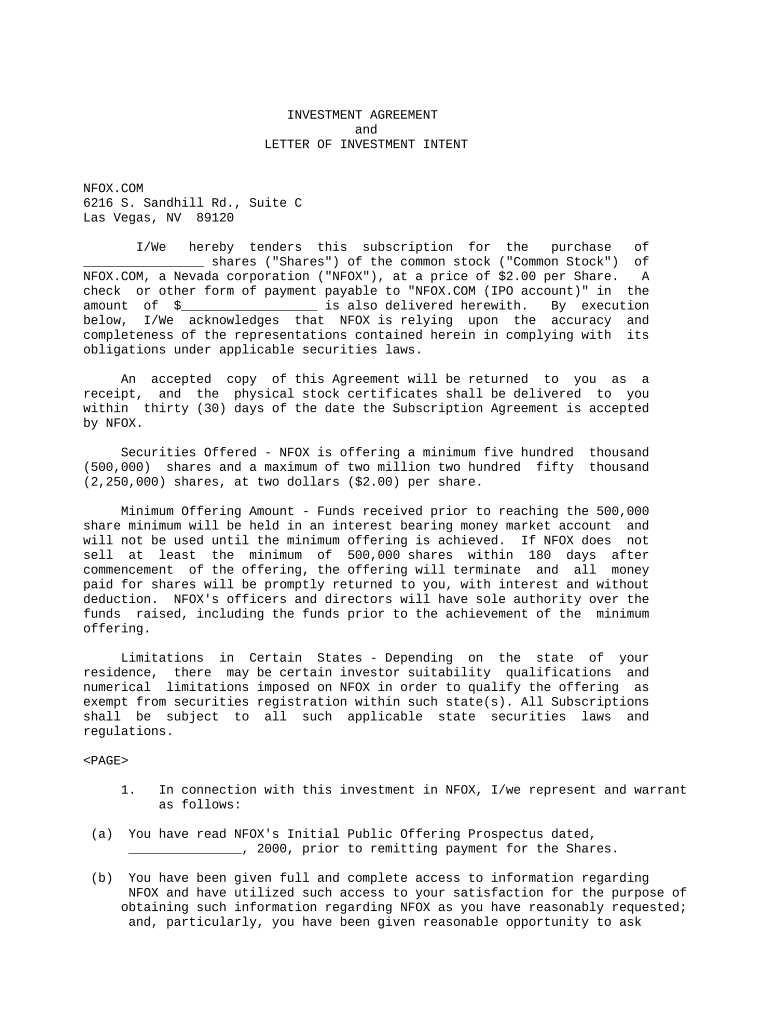

What are investor suitability qualifications?

Investor suitability qualifications vary by region and encompass specific criteria that investors must meet before participating in certain offerings. Understanding these standards, including any numerical limitations, can impact how your investment agreement is structured.

-

Different regions have unique criteria investors must satisfy, which may include income or net worth thresholds.

-

Certain states impose restrictions on the amount an individual can invest, affecting deal structures.

-

Exemptions can often simplify the investment process for individual investors by reducing regulatory requirements.

What is the return policy and minimum offering amount?

The return policy is critical in situations where the minimum offering amount is not achieved. This policy dictates how funds are managed during the offering period and outlines the timeframes for issuing stock certificates after agreement acceptance.

-

If the minimum offering isn’t met, the policy specifies the steps to return funds and any applicable timelines.

-

Details on how funds are held and managed during the offering period ensure transparency.

-

Understand the expected timelines for receiving stock certificates after acceptance of the agreement.

What common pitfalls should you avoid in investment agreements?

Many investors make avoidable mistakes when filling out investment agreements. Being aware of these pitfalls can help parties prevent mishaps that could lead to unfavorable consequences. Double-checking terms and representing accuracy can significantly reduce the risks involved.

-

Ignoring critical sections or skipping questions can lead to incomplete agreements, which could invalidate the contract.

-

Thoroughly review all terms before submission to ensure agreement fidelity.

-

Errors in representations can lead to regulatory fines and potential legal action against the parties involved.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.