Last updated on Feb 20, 2026

Get the free Auditor Agreement - Self-Employed Independent Contractor template

Show details

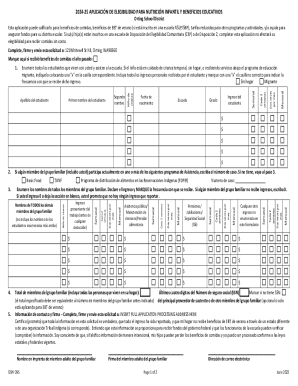

Employer contracts with an auditor on an independent contractor basis to provide auditing services as specified and agreed upon in the contract. Contract includes a confidentiality clause.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is auditor agreement - self-employed

An auditor agreement - self-employed is a contract between a self-employed auditor and a client outlining the terms and conditions of the auditing services provided.

pdfFiller scores top ratings on review platforms

fast, convenient

GOOD

Great product, but price is too steep

fanatstic

Good

the site is good

Who needs auditor agreement - self-employed?

Explore how professionals across industries use pdfFiller.

Auditor Agreement - Self-Employed Form Guide

How can you understand the independent contractor auditor agreement?

An auditor agreement is a legal document that outlines the terms of a working relationship between an auditor as an independent contractor and the client. It has specific clauses that cater to the unique requirements of freelance auditors, distinguishing it from traditional employee contracts, which provide less flexibility.

-

The agreement serves to clarify the roles of the auditor, ensuring both parties have a mutual understanding of their obligations.

-

Employee contracts typically offer benefits and long-term engagement, while independent contractor agreements emphasize project specificity and self-management.

-

Clear terms help prevent misunderstandings and disputes, making it more essential for freelancers to have well-defined agreements.

What are the key components of the auditor agreement?

A solid auditor agreement contains critical elements that safeguard the interests of both the auditor and the employer. Understanding these components ensures effective collaboration and compliance.

-

Identifying the employer and auditor establishes accountability.

-

Clearly defined roles and responsibilities prevent role confusion and outline the expected outcomes.

-

These clauses protect sensitive data, ensuring that the auditor cannot share proprietary information.

-

Specifying the engagement terms helps both parties understand the length of the contract and conditions for termination.

How do you fill out the auditor agreement?

Properly filling out the auditor agreement is crucial to ensure that all details are accurate and legally binding. Follow a systematic approach to avoid mistakes.

-

Collect all relevant documents such as identification and previous work references before beginning the process.

-

Define the duties and expectations in detail to minimize ambiguity.

-

Incorporate confidentiality clauses that specify what information must be kept private.

-

Utilize eSignature options available on platforms like pdfFiller for efficient signing and document management.

What are the best practices for drafting an auditor agreement?

Drafting an auditor agreement requires attention to detail and adherence to best practices that ensure legal compliance and clarity.

-

Avoid jargon and ensure that all parties can easily understand the terms outlined.

-

Stay updated on local regulations governing independent contractors to avoid legal pitfalls.

-

Always proofread the agreement for errors and make necessary adjustments before finalizing.

-

Take advantage of pdfFiller’s editing features to enhance the document and facilitate collaboration.

What common mistakes should you avoid in auditor agreements?

Avoiding mistakes in auditor agreements is crucial to maintaining a successful professional relationship and preventing legal issues.

-

Not clearly defining responsibilities can lead to misunderstandings and unmet expectations.

-

Lack of robust confidentiality terms may expose sensitive information to unauthorized access.

-

Ambiguous terms can cause disputes, making it harder to resolve conflicts if they arise.

-

Self-employed auditors must understand the tax responsibilities that accompany their independent status.

Why start your auditor agreement now with pdfFiller?

Engaging with pdfFiller’s tools facilitates a smooth process for creating an auditor agreement. Their features are designed for efficiency and collaboration, making it ideal for both teams and individuals.

-

pdfFiller provides various templates that help you quickly find a suitable starting point for your agreement.

-

Access to tools that simplify the document creation process ensures you can focus on the content.

-

Collaborate in real time with team members using pdfFiller’s cloud-based features.

-

New users can take advantage of free trials, allowing them to explore pdfFiller’s full capabilities before committing.

How to fill out the auditor agreement - self-employed

-

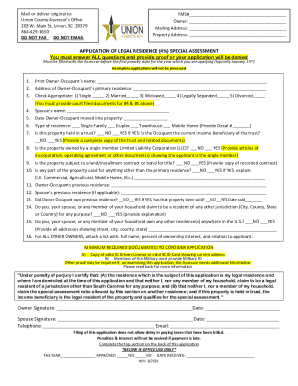

1.Open the pdfFiller website and log into your account or create a new one if you don't have an account.

-

2.Search for 'auditor agreement - self-employed' using the search bar located at the top of the page.

-

3.Select the appropriate template from the search results and click on it to open the editing interface.

-

4.Fill in the client's name and contact information in the designated fields at the top of the document.

-

5.Add your name, business name, and contact details as the self-employed auditor in the appropriate sections.

-

6.Clearly outline the scope of work to be performed, including the specific auditing services you will provide.

-

7.Specify the payment terms, including the total fee, payment schedule, and any retainer fees, if applicable.

-

8.Include a clause detailing the duration of the agreement and the conditions under which it may be terminated by either party.

-

9.Review all provided information for accuracy and completeness before saving your final document.

-

10.Once completed, save the document as a PDF or other preferred formats and send it to the client for their review and signature.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.