Get the free Complaint regarding Insurer's Failure to Pay Claim template

Show details

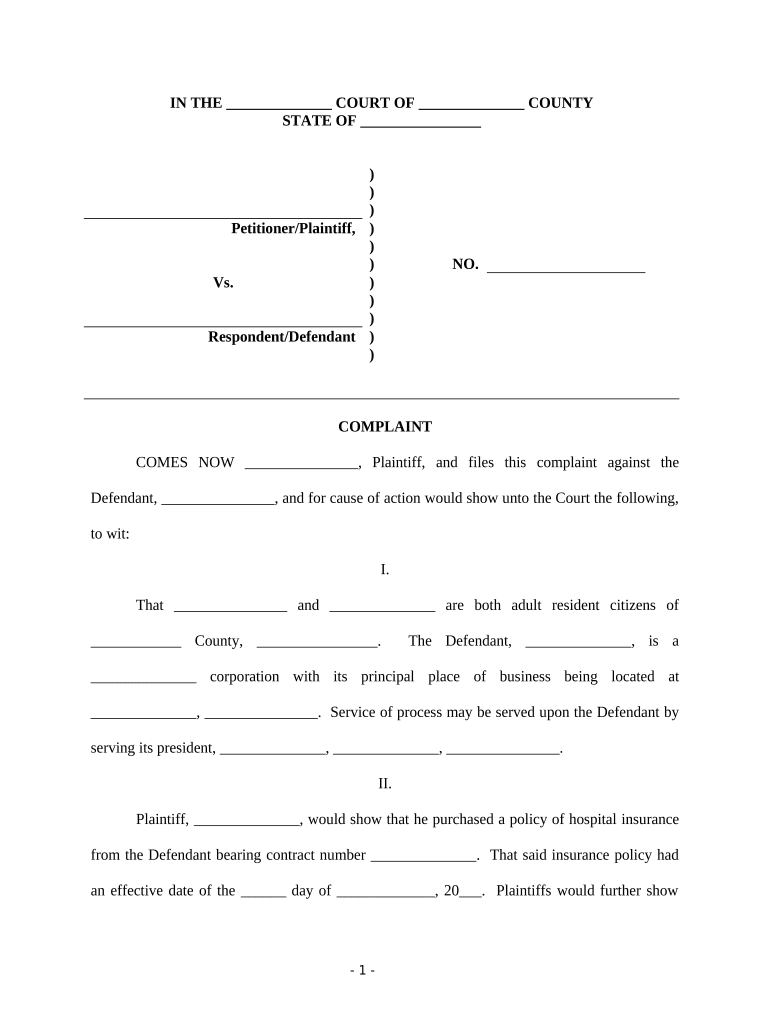

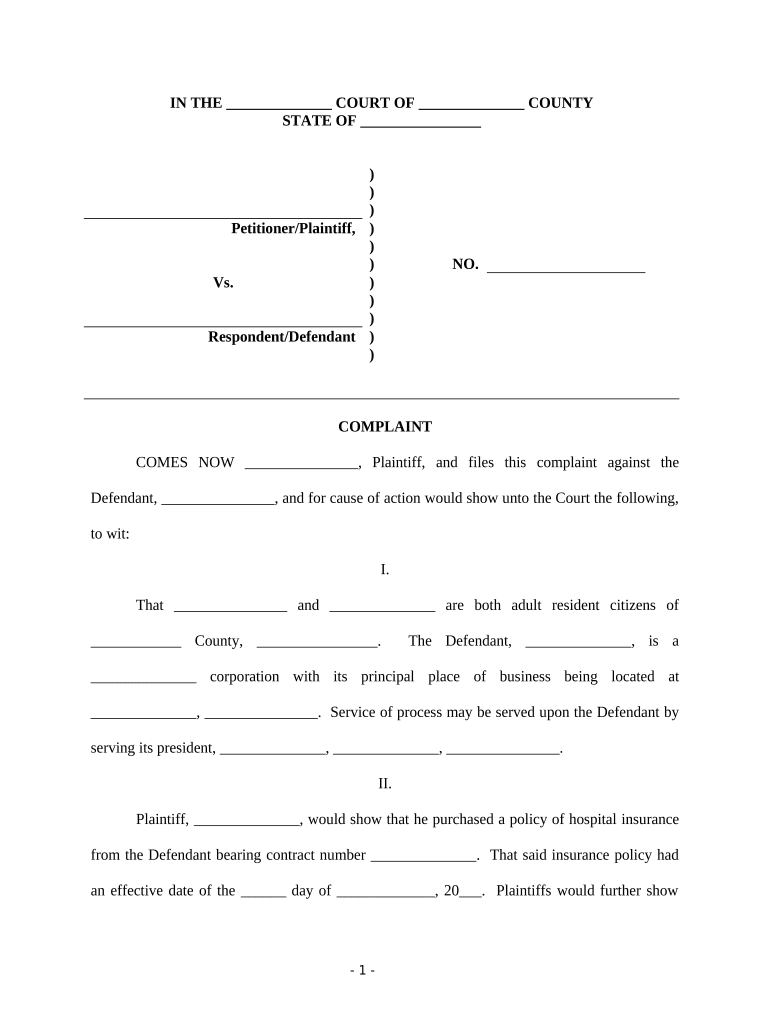

This form is a sample complaint filed against an insurer for failure to pay a claim.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

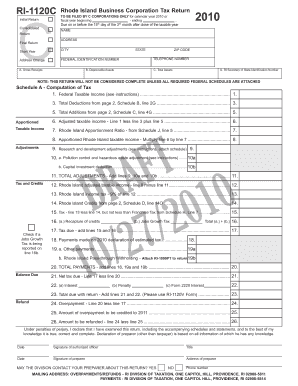

What is complaint regarding insurers failure

A complaint regarding insurers failure is a formal statement made by a policyholder that outlines grievances related to their insurance provider's inadequate performance or service.

pdfFiller scores top ratings on review platforms

Great Application. I use it to book drivers Hotel rooms where I need to fill out Credit card authorizations.

I LIKE THE WAY YOU CAN IMPORT SOME OF PDF FILES AND USE THIS PROGRAM.

Absolutely the simplest and most useful software for document creating, filling, or editing!!!

So far all I use it for is to sign documents but I would like to learn what other features at available.

not a techie, but was able to navigate the program fairly easily. love the auto fill feature and the capability to email right away and to go back and edit

Your output font on the Form could be a tad bigger. It would fit!

Who needs complaint regarding insurers failure?

Explore how professionals across industries use pdfFiller.

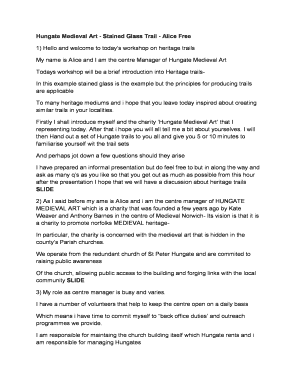

Navigating complaints regarding insurers' failures: A comprehensive guide

How can you understand your rights and the complaint process?

As a consumer, it's imperative to know your rights when dealing with insurance companies, especially when you encounter issues with claims. You have the legal right to file a complaint if your insurer fails to meet their obligations.

-

Every policy should define the rights you retain when engaging with insurers, including timelines for claims and notification requirements.

-

Complaints can be filed based on failure to fulfill policy terms, such as non-payment or unjust denial of claims.

-

Keep a detailed record of all communications with your insurer, as this documentation can strengthen your case.

What are the identified grounds for your complaint?

Understanding what constitutes insurer failure is crucial in substantiating your complaint. Insurer failure may manifest in various forms, including non-payment or denial of legitimate claims.

-

This includes failure to pay, delays in processing, or outright denial of claims that should be honored.

-

Real-world examples can provide context; for instance, when an insurer does not respond to a submitted claim within the specified timeframe.

-

You may be able to claim damages resulting from the insurers' failure, such as financial losses incurred from delays.

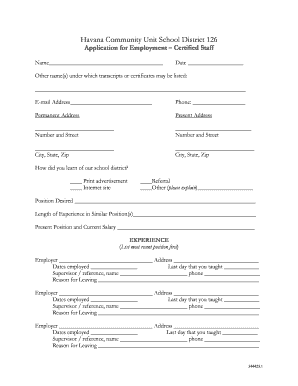

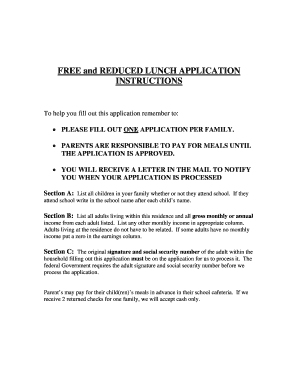

How do you fill out the complaint form step by step?

Filling out a complaint form requires attention to detail. Ensuring that you correctly input information significantly aids in your complaint's processing.

-

Include necessary information like your full name, contact information, and claim numbers.

-

Be well-versed in sections pertaining to plaintiffs, defendants, and causes of action to prevent errors.

-

When filling out your personal and medical details, double-check to avoid disclosing sensitive information inappropriately.

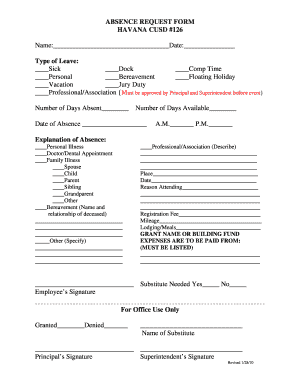

How should you submit your complaint to the insurance department?

After completing your complaint form, the next step involves submission. Understanding how to submit can ensure your complaint reaches the right entities.

-

Locate your state's insurance department contact information via their official website.

-

Submit your complaint through various means: online, by mail, or by phone as per your state's guidelines.

-

Keep a record of your submission and promptly follow up to stay updated on your complaint’s status.

What should you expect after filing your complaint?

Filing a complaint initiates a procedural review process. Being aware of what follows can prepare you for potential outcomes.

-

Be aware that processing times may vary significantly, depending on the complexity of your complaint.

-

Your complaint can lead to a variety of outcomes, including reimbursement or additional investigation by regulatory authorities.

-

If your complaint remains unresolved, explore options for escalation within the insurance regulatory framework.

How can you leverage pdfFiller for document management?

pdfFiller is an excellent tool for creating and managing your complaint form digitally. Its suite of features can simplify the process.

-

Create and edit your complaint form directly through pdfFiller’s user-friendly interface.

-

Use electronic signing features to authenticate documents securely, saving time on physical signatures.

-

Collaborate with legal experts through pdfFiller to receive accurate advice on your complaint strategy.

Where can you find resources for further assistance?

Accessing additional resources can greatly enhance your understanding of the complaint process. Numerous organizations are dedicated to helping consumers.

-

Look for links to consumer advocacy organizations that offer guidance on navigating insurance complaints.

-

Research state-specific websites that provide tailored assistance for complaining about insurers.

-

Explore interactive resources on pdfFiller that can help with document preparation and submission.

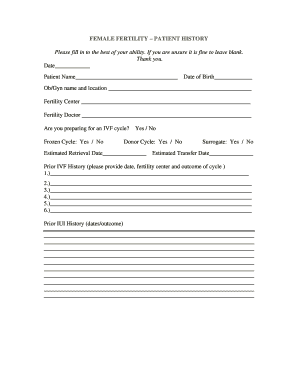

How to fill out the complaint regarding insurers failure

-

1.Begin by accessing the complaint template on pdfFiller.

-

2.Fill in your personal information, including your name, address, and contact details in the designated sections.

-

3.Provide the name of the insurance company you are filing the complaint against.

-

4.Detail the specific issue you are experiencing with the insurer—this may include denied claims, lack of communication, or dissatisfaction with service.

-

5.Include any relevant policy information, such as your policy number and the dates of the incidents.

-

6.Attach supporting documents, like claim forms, denial letters, or communications with the insurer, if possible.

-

7.Review your filled-out form for accuracy and completeness.

-

8.Submit the complaint form through pdfFiller using the submit function or download it for email.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.