Last updated on Feb 17, 2026

Get the free Limited Liability Company - LLC - ation Questionnaire template

Show details

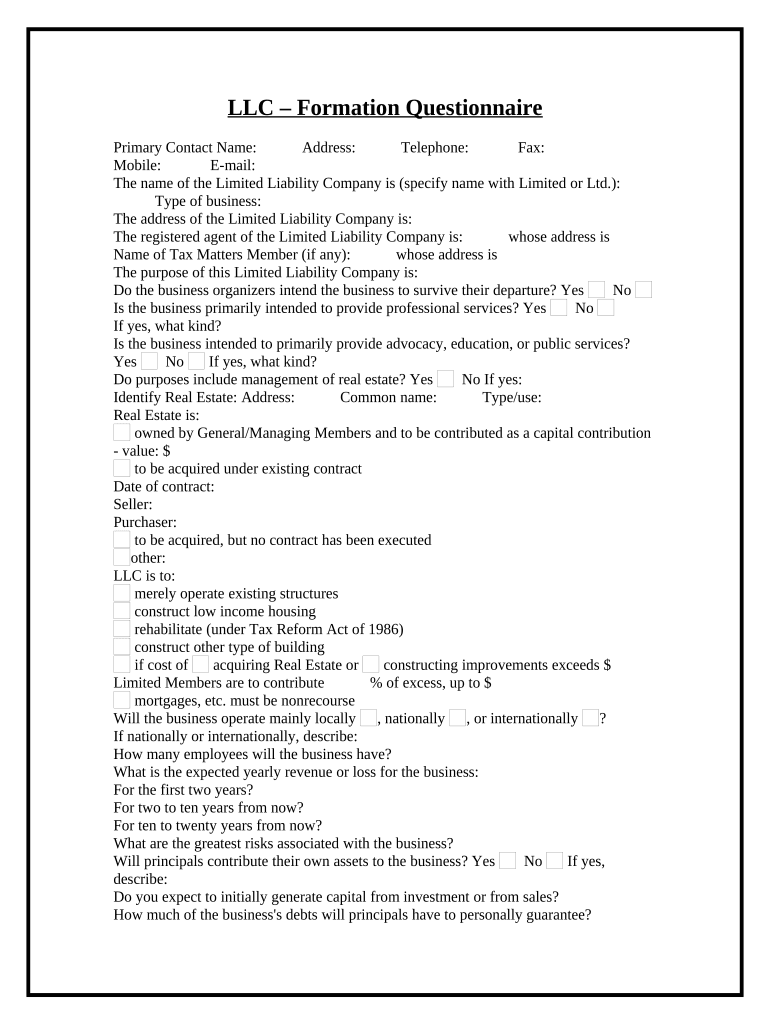

This form addresses important considerations that may effect the legal rights and obligations of the parties with the formation of a limited liability company. This questionnaire enables those seeking

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is limited liability company

A limited liability company (LLC) is a flexible business structure that combines the liability protection of a corporation with the tax benefits of a partnership.

pdfFiller scores top ratings on review platforms

It's great!

Everything works as described.

Great very easy to use

Great very easy to use

Easy and simple tool to use

Easy and simple tool to use, very efficient.

Easy to use and convenient

Easy to use and convenient

Love Love Love

Love Love Love, How I'm able to edit my documents I just wish I had more fonts to choose from. I don't know if you get more with higher plans you use but still my favorite site to use to edit all my coursework

Excellent Product

Who needs limited liability company?

Explore how professionals across industries use pdfFiller.

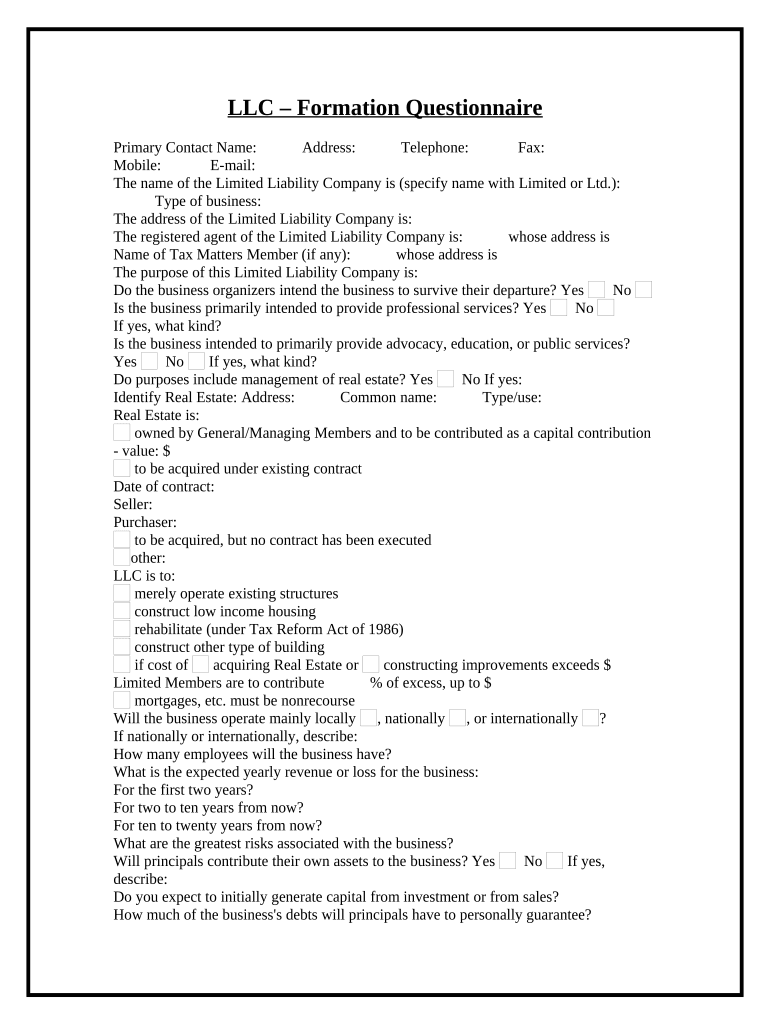

Comprehensive guide to limited liability company form on pdfFiller

When forming a limited liability company (LLC), understanding its structure and processes is crucial. This guide will walk you through filling out a limited liability company form, covering essential requirements, operational planning, and how to manage your LLC effectively.

What exactly is a limited liability company?

A Limited Liability Company (LLC) is a flexible form of enterprise that combines elements of partnership and corporation structures. This format protects its owners from personal liability for the debts of the business, ensuring that their personal assets are generally safe from business creditors.

-

An LLC serves to limit the liability of its owners while providing a partnership-style management structure.

-

Some benefits include easier tax treatments, credibility, and flexible management.

-

LLCs differ from corporations primarily in liability protection, tax structure, and management flexibility.

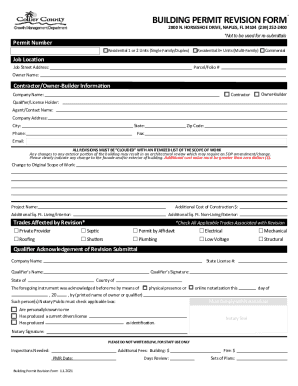

What are essential formation requirements?

-

You need to provide the primary contact person for the LLC formation.

-

A physical address is necessary to receive legal documents and notifications.

-

Your LLC name must include a designator such as 'LLC' or 'Limited Liability Company' to comply with state regulations.

-

Carefully describe your business structure to ensure it aligns with your goals and compliance requirements.

Why is a registered agent important for your ?

A registered agent acts as the point of contact for legal documents and notices. Choosing the right registered agent is crucial since this person or entity must reliably receive and forward important documents for your LLC.

-

You can appoint an individual or a company to serve as your registered agent.

-

Information on who will be handling tax obligations must be designated clearly.

-

Each member's contributions must be detailed in operating agreements to ensure clarity regarding liabilities.

What should you consider regarding business activities and purpose?

Deciding the purpose of your LLC is foundational for its operation and compliance. When defining your business activities, consider not just the current market but long-term objectives and potential areas for expansion.

-

Your LLC's purpose should align with your personal goals and existing market gaps.

-

Organizers should ensure business continuity in scenarios like member changes.

-

Define expected professional services offered and any public benefits intended.

-

If your LLC will manage real estate, ensure compliance with relevant regulations.

What are the real estate considerations for LLCs?

Managing real estate within an LLC requires adherence to specific regulations and strategic financial planning. Understanding investment structures and legal obligations can significantly impact profitability.

-

An LLC must comply with state laws regarding property management and ownership.

-

Clear documentation of member capital contributions for real estate purchases is essential.

-

Keep detailed records involving buyers, sellers, and pertinent contracts.

-

Consider the implications of non-recourse loans on personal liability and property ownership.

How to plan for operational scope and financial structure?

-

Whether local, national, or international, defining this scope helps focus marketing efforts and resources.

-

Estimate the expected workforce size to appropriately plan management strategies.

-

Create financial forecasts to anticipate revenue and potential losses accurately.

-

Recognize risks associated with business operations to develop mitigation strategies.

What are best practices for asset contributions and financial structure?

Understanding how to structure asset contributions is essential to maintain equitable ownership within your LLC. Careful planning and documentation aid in ensuring clarity for all members.

-

Clarify what assets each member will contribute upfront, which helps in avoiding future disputes.

-

Consider various methods, such as loans or investments, for raising capital to kickstart the business.

-

Develop both short-term and long-term financial forecasts to guide decision-making.

How to interact with pdfFiller tools for your formation?

pdfFiller simplifies the process of completing your limited liability company form through its user-friendly tools. As a cloud-based platform, it empowers users to edit, eSign, and manage their documents seamlessly.

-

Utilize pdfFiller’s guided questionnaire to capture all necessary information.

-

Easily edit your LLC forms and eSign documents directly from your account.

-

Share access with team members for input and finalize documents collectively.

-

Access your documents from anywhere, ensuring you can manage your LLC formation efficiently.

How to fill out the limited liability company

-

1.Visit pdfFiller and log in or create an account if you do not have one.

-

2.Select 'Create New Document' and choose the 'Limited Liability Company' template.

-

3.Fill in the required company name and ensure it adheres to your state's regulations.

-

4.Provide the names and addresses of all members or managers of the LLC.

-

5.Input the business address and contact information in the designated fields.

-

6.Choose the registered agent who will receive legal documents on behalf of the LLC.

-

7.Complete any additional sections required, depending on the state-specific LLC requirements.

-

8.Review the filled form for accuracy and compliance before submitting.

-

9.Save and download the completed document in your preferred format, or directly submit it as needed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.