Last updated on Feb 17, 2026

Get the free pdffiller

Show details

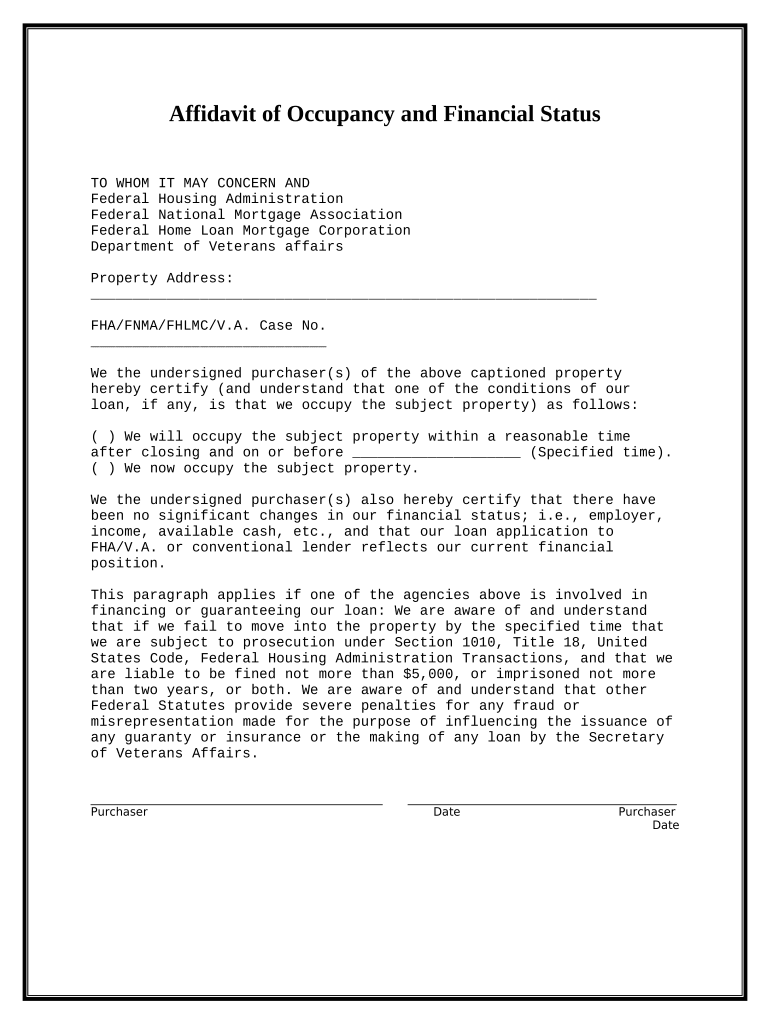

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is affidavit of occupancy and

An affidavit of occupancy is a legal document affirming that a property is occupied or has been occupied by certain individuals.

pdfFiller scores top ratings on review platforms

Great product! Does exactly what I need it to do.

Effective efficient processing of an unfamiliar form.

Super simple to use!!! Wish I had found it sooner as I now use it everyday!!!

It's very good program, but it doesn't let me use all the font sizes, e.g. 11, 13...etc.

This was a life saver and very user friendly unlike other brands that I have tried!

It's great, albeit a bit expensive. Would prefer a buy it now once option... but so easy to use and does everything you need. Wayyy better than Adobe

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to fill out an affidavit of occupancy form

What is an affidavit of occupancy?

An affidavit of occupancy is a legal document that certifies the occupancy status of a property. It plays a critical role in various loan applications, particularly for those backed by government agencies like the FHA and VA. Misrepresenting facts on this document can lead to severe consequences, including legal penalization and loss of loan eligibility.

Why is this document important?

The affidavit serves as a crucial verification tool for lenders, ensuring that borrowers are using the property as intended. This is especially important in preventing fraud and ensuring compliance with financial regulations. A solid understanding of the affidavit's significance can prevent loss of funding and facilitate smoother transactions.

What are the key components of the affidavit?

-

You must provide a complete and accurate property address along with any relevant case numbers.

-

The affidavit may require signatures and certifications from all purchasers, attesting to their intentions regarding occupancy.

Understanding these components is crucial, as each plays a significant role in validating the claim that the occupying individual(s) will utilize the property as their primary residence.

Who needs to fill out the affidavit?

-

Buyers who intend to occupy the property must fill this form.

-

Those applying under FHA, FNMA, FHLMC, and V.A. regulations frequently need this document.

-

Certain scenarios may mandate the affidavit to demonstrate the intent to occupy.

How can you successfully complete the affidavit?

Filling out the affidavit can often be streamlined by using online tools like pdfFiller. These platforms provide step-by-step instructions for completing various forms, ensuring all necessary fields are filled accurately.

-

These tools can help fill out and edit the affidavit to avoid common mistakes.

-

Being aware of potential pitfalls can help in gathering the correct documentation and information.

What are the required signatures and notarization processes?

-

Identify all individuals who must sign the affidavit to validate it.

-

Understand when and how to notarize the document, depending on your lender's requirements.

-

Notarization requirements may vary by financial institution, so it is essential to verify them.

What are the legal implications of the affidavit of occupancy?

The affidavit of occupancy is tied to specific legal frameworks, including Section 1010 of Title 18, which addresses fraud and misrepresentation. Failing to meet the requirements of this document can significantly affect loan eligibility, potentially leading to legal actions against the responsible parties.

-

Understanding these implications helps protect against fraudulent activities, both legally and financially.

-

Non-compliance could result in the denial of loan applications or even prosecution.

How can pdfFiller assist with document management?

Using pdfFiller, users can easily manage, edit, and eSign PDFs from a cloud-based platform. This not only simplifies the affidavit completion process but also allows for collaboration with others seamlessly.

-

pdfFiller’s tools facilitate straightforward editing and signing, simplifying the entire process.

-

Managing documents in the cloud means you can access them anytime, anywhere, enhancing your efficiency.

How to fill out the pdffiller template

-

1.Locate the affidavit of occupancy form on pdfFiller.

-

2.Open the document by clicking on the 'Fill' button.

-

3.Begin by entering the property owner's name in the designated field.

-

4.Next, fill in the property address, ensuring all details are accurate.

-

5.Specify the dates of occupancy, indicating when the property was occupied.

-

6.Include the names of all individuals currently residing in the property.

-

7.If required, provide additional information requested by the form, such as reasons for occupancy.

-

8.Review all entered information for accuracy to avoid any errors.

-

9.Once completed, save the document by clicking on 'Save' or 'Download'.

-

10.Finally, print the affidavit if you need a physical copy or share it directly via email if required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.