Get the free Utah Satisfaction, Cancellation or Release of Mortgage Package template

Show details

With this Satisfaction, Cancellation or Release of Mortgage Package,you will find the forms and letters necessary for the satisfaction or release of a mortgage for the state of Utah. The described

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

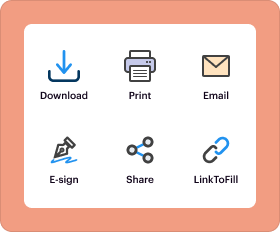

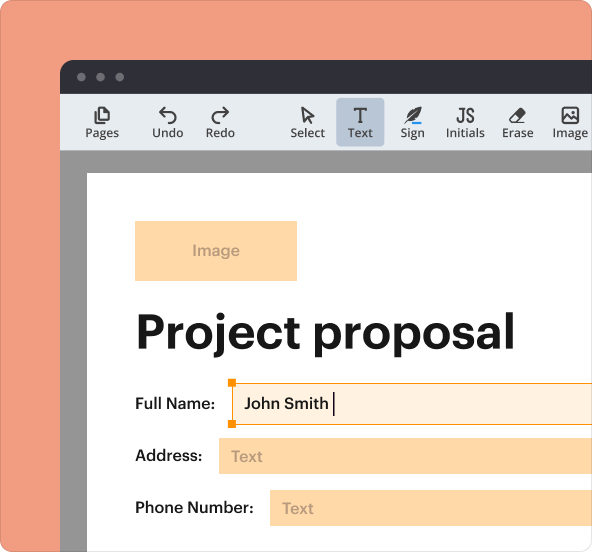

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is utah satisfaction cancellation or

The Utah Satisfaction Cancellation or is a legal document used to formally cancel a satisfaction of mortgage in Utah.

pdfFiller scores top ratings on review platforms

good, this is only my second time to use it.....so far it has been an excellent experience.

I enjoy making colorful charts to track my fitness goals.

Fantastic Website and service. The ability to fill in and email forms is a wonderful resource. Thank you.

very efficient and legible and user friendly.

so far i like it im new hopefully i get what i paid fo

Pretty handy to personalise your forms !!

Who needs utah satisfaction cancellation or?

Explore how professionals across industries use pdfFiller.

Complete Guide to Utah Satisfaction Cancellation or Form

How to fill out a Utah satisfaction cancellation form

To complete a Utah satisfaction cancellation form, start by gathering all related documents. Accurately fill out the required fields, ensuring you meet all state-specific requirements. Finally, submit the form to the appropriate authority for processing.

Understanding the acknowledgment of satisfaction in Utah

An acknowledgment of satisfaction serves to confirm that a mortgage or deed of trust has been fulfilled. This document is crucial for homeowners in Utah, as it officially cancels the lien on the property and helps maintain accurate records. Failing to submit this can lead to legal complications and ongoing obligations.

-

It indicates that a borrower's obligations under the mortgage have been met.

-

It removes the lender’s claim on the property, ensuring homeowners are free to sell or refinance without encumbrances.

-

Submission is mandatory in Utah; failure to do so may result in unresolved liens and affect property sales.

Essential forms included in the Utah satisfaction package

When navigating the Utah satisfaction process, you'll encounter several key forms, each serving a specific purpose. Understanding these forms is essential to ensure smooth processing and compliance with state regulations.

-

This document is issued by a corporate trustee to confirm the cancellation of a mortgage.

-

Similar to the corporate variant but issued by an individual, formalizing the mortgage release.

-

This form informs the borrower about the intent to cancel the mortgage.

-

It confirms the lender's official release from the mortgage obligation.

-

A personal acknowledgment that the mortgage is paid off and canceled.

-

This letter updates borrowers on their mortgage status and upcoming steps.

-

Used to formally request the recording of satisfaction in public records.

Detailed description of each form

Understanding each form’s purpose is vital for ensuring compliance and effective processing during the satisfaction cancellation.

-

This form is critical for confirming that a corporate trustee has canceled the mortgage, releasing the property's lien.

-

Used when individuals wish to confirm that their loan is satisfied and the mortgage is canceled.

-

This document serves as a preliminary notice to the borrower about the planned cancellation.

-

A necessary form for corporate lenders to formally acknowledge the mortgage has been settled.

-

Individuals must use this form to notify authorities that a loan has been paid off.

-

Keeping borrowers informed, this letter outlines the status and details of the mortgage satisfaction.

-

Essential for officially recording the mortgage satisfaction within local government records.

How to properly complete the Utah satisfaction forms

Filling out the Utah satisfaction forms can seem daunting, but following clear steps can simplify the process.

-

Begin by reviewing the form requirements, gathering necessary documentation, then methodically complete each section.

-

Ensure accurate spelling of names, the correct property address, and that all required fields are filled.

-

Make sure to include the loan number, property description, and any applicable dates; inaccuracy can delay processing.

Notary requirements and legal validation

Proper notarization is critical in validating satisfaction forms in Utah.

-

Notaries verify identity and witness the signing of forms to prevent fraud.

-

In Utah, notaries must be registered and adhere to state laws, including confirming identity.

-

Look for notary services online or at local banks and law offices; ensure they are state-compliant.

Submitting your satisfaction cancellation request

After preparing your forms, the next step is submission for processing.

-

Forms must be submitted to the county recorder's office where the property is located.

-

Be aware of filing fees that can vary by county; check local ordinances for specifics.

-

Processing times vary but expect a few weeks for the completion of recording satisfaction.

Ensuring compliance with Utah laws

Staying compliant with state laws is essential for the validity of your satisfaction documents.

-

Utah law mandates that satisfaction forms are properly executed and submitted to maintain the integrity of the property title.

-

Consistently review state updates and keep documentation organized to ensure compliance.

-

Refer to the Utah State Bar website and local county offices for accurate regulations and changes.

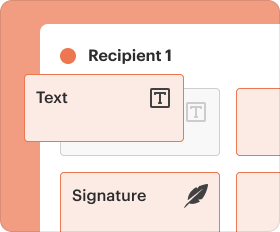

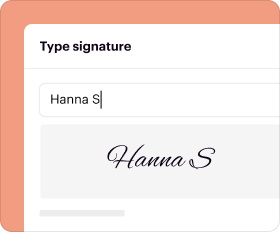

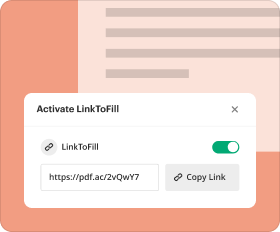

pdfFiller's features for managing satisfaction forms

pdfFiller provides invaluable tools for managing your satisfaction forms with ease.

-

With robust editing features, users can fill out, sign, and collaborate on satisfaction forms seamlessly.

-

The platform allows for easy sharing amongst teams, streamlining the satisfaction process.

-

All documents can be stored securely in the cloud, providing peace of mind against loss or damage.

How to fill out the utah satisfaction cancellation or

-

1.Start by opening the PDF form for the Utah Satisfaction Cancellation or in pdfFiller.

-

2.Fill in the top section with your name, the name of the borrower, and the property address affected by the mortgage.

-

3.Provide details about the original mortgage, including the lender's name and the mortgage document number.

-

4.Enter the date of satisfaction that you are cancelling in the designated field.

-

5.Include the notary section at the end of the form, where applicable.

-

6.Review all information you have entered to ensure it is accurate and complete.

-

7.Once satisfied with the information provided, click on the 'Save' button to store your document.

-

8.You can then either print the document for manual signing or use pdfFiller's e-signature feature for a digital signature.

-

9.Finally, submit the completed document to the appropriate county recorder’s office as required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.