Last updated on Feb 20, 2026

Get the free Individual Credit Application template

Show details

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is individual credit application

An individual credit application is a formal request for credit submitted by a single borrower to assess their creditworthiness and eligibility for loans or credit cards.

pdfFiller scores top ratings on review platforms

ONLY LIMITED USE FOR ME BUT A GREAT WAY TO FILL IN FORMS

Works great but $20 a month is way too expensive.

This is my second time using PDF Filler as I am returning to the real estate business and they continue to not only provide an excellent and useful product but they continue to improve it.

I had an emergency and had to down load the program I wasn't expecting it to be as user friendly as it is. Thank you very much! so far so good!!

I really like the application a lot. I am finding the fact that you do not have a field value setting which comes in handy for allowing a Check Mark to have a Value and Calculate costs based on Check Marks or Drop Down Menus. I also would love a copy and paste a single field, this comes in handy for repetitive drop down menus. Prepopulating a field from an earlier field value would be great in helping people not have to enter same information more than once.

makes life much easier when I can type information into forms

Who needs individual credit application template?

Explore how professionals across industries use pdfFiller.

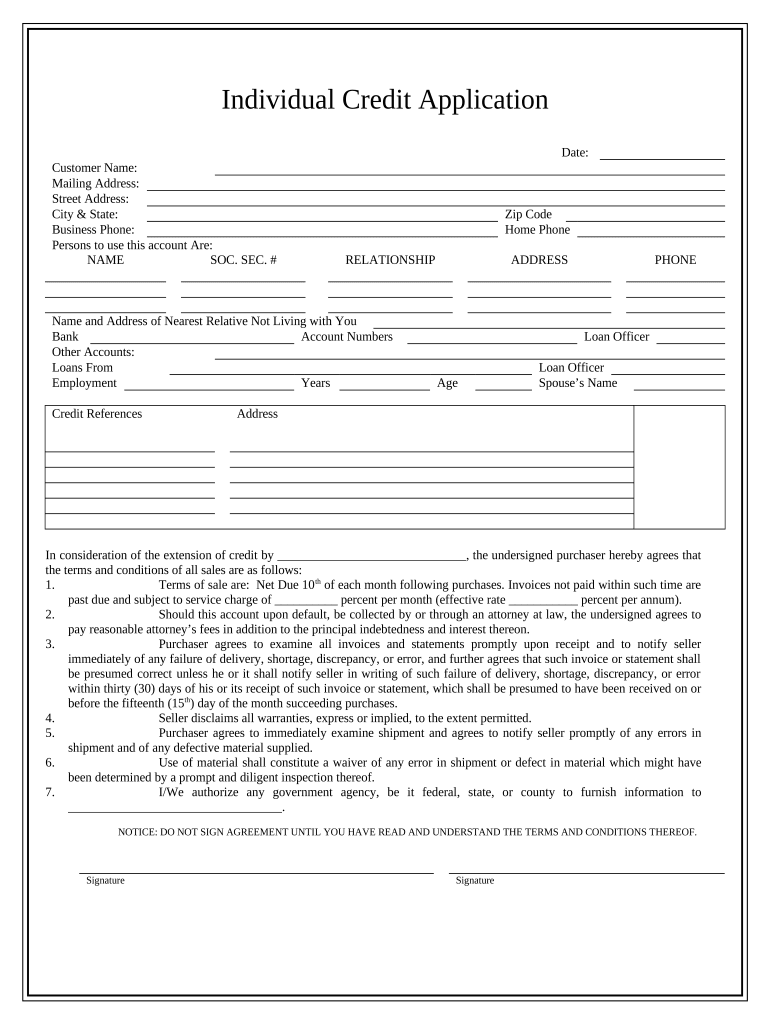

Understanding the Individual Credit Application Form

Filling out an individual credit application form is a crucial step in securing credit from lenders. This document serves as the foundation for determining your creditworthiness, outlining necessary financial and personal information. Accurate completion of the form can significantly enhance your chances of approval.

What is an Individual Credit Application?

An individual credit application is a document that prospective borrowers fill out to request credit. Its purpose is to gather relevant information that lenders need to assess the applicant's financial status and creditworthiness. Providing accurate information is critical, as errors can lead to application delays or denials.

Key Components of the Individual Credit Application Form

-

This typically includes your name, address, and contact numbers. Ensuring accuracy here is vital as lenders will seek to verify your identity.

-

Information such as employment status, income, and bank account numbers helps lenders evaluate your ability to repay the loan.

-

These sections usually require you to list contacts, such as your nearest relative and loan officer contacts, which aids in the verification process.

Step-by-Step Guide to Filling Out the Form

-

Having your financial and personal documents ready will streamline the process.

-

Focus first on personal details, then move to employment and income information.

-

Include details about your references and loan officer contacts as they can facilitate the processing of your application.

-

Understanding the fine print is essential before committing to any loan agreement.

-

Double-checking your application can help avoid common mistakes that might delay your approval.

Common Mistakes to Avoid

-

Errors here can lead to significant delays in processing your application.

-

Not providing complete financial details can negatively impact the lender's assessment of your creditworthiness.

-

This simple oversight can render your application invalid and cause further delay.

Legal Considerations When Submitting the Form

-

You must provide consent for lenders to conduct credit checks, which is crucial for the application process.

-

Submitting false information can lead to legal repercussions and disqualify you from obtaining credit.

-

Understanding your rights, such as data protection and the obligation to provide accurate information, is fundamental.

Using pdfFiller to Edit and Sign Your Application

pdfFiller provides a user-friendly platform for accessing your individual credit application form. With interactive tools for document management, you can easily fill out and edit the form online. The eSigning feature allows for a quick submission, and you can collaborate seamlessly with your lender.

Tips and Best Practices for a Successful Application

-

Before submission, ensure every detail is accurate to improve your likelihood of approval.

-

This serves as a record and can help in future communications with lenders.

-

Regularly checking on the status of your application keeps you informed and prepared for any next steps.

Comparison with Other Credit Application Models

-

Understanding different models of credit applications can help you select the best approach for your needs.

-

Individual credit applications differ significantly from business ones, particularly regarding documentation and criteria.

-

There are many modern alternatives to traditional forms that can provide quicker, more user-friendly experiences.

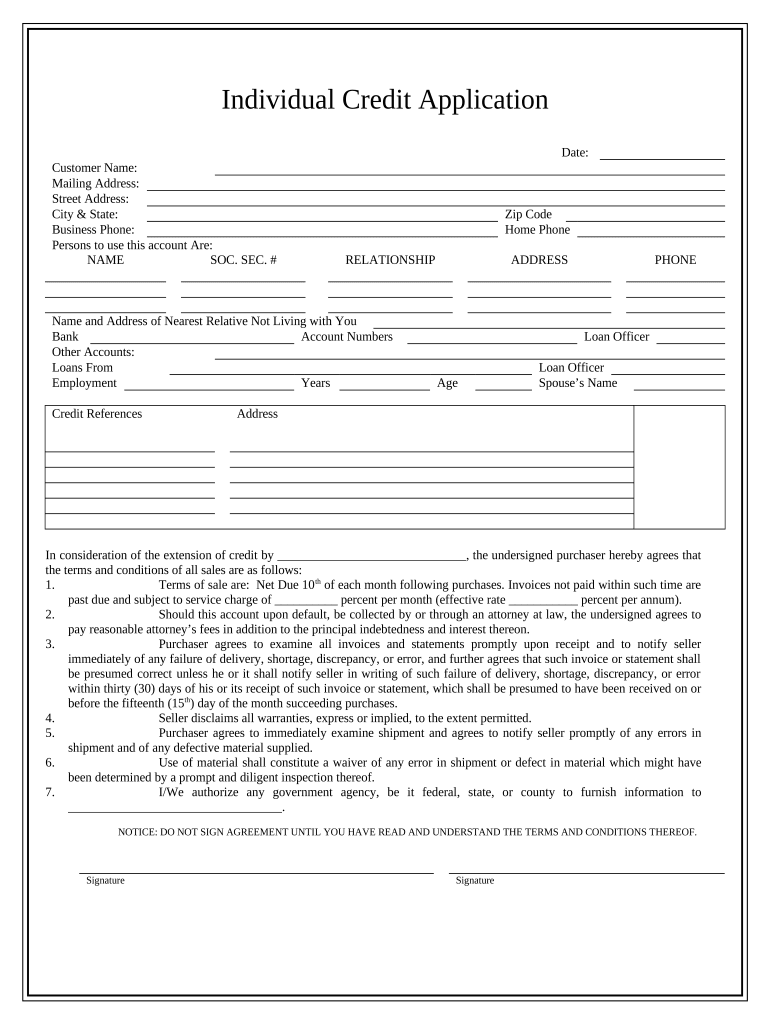

How to fill out the individual credit application template

-

1.Open the PDFfiller platform and log in to your account or create a new one if you don't have an account.

-

2.Search for the 'Individual Credit Application' form in the template library or upload your version of the document.

-

3.Once you have the form open, begin filling in your personal details such as your full name, address, and contact information.

-

4.Proceed to input information regarding your financial status, including your income, employment details, and any existing debts.

-

5.Be sure to double-check all the numbers entered to ensure accuracy, as this information is critical for credit assessment.

-

6.If the form includes sections requiring signatures, ensure to follow the prompts to electronically sign the document.

-

7.Review the completed application for any missing information or errors before finalizing it.

-

8.Once satisfied, you can submit the application directly through PDFfiller or download it for submission to your credit provider.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.