Get the free Summary of Account of Trustee with Schedules A-J Attached template

Show details

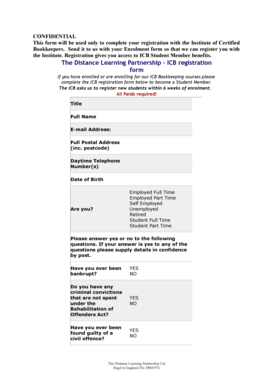

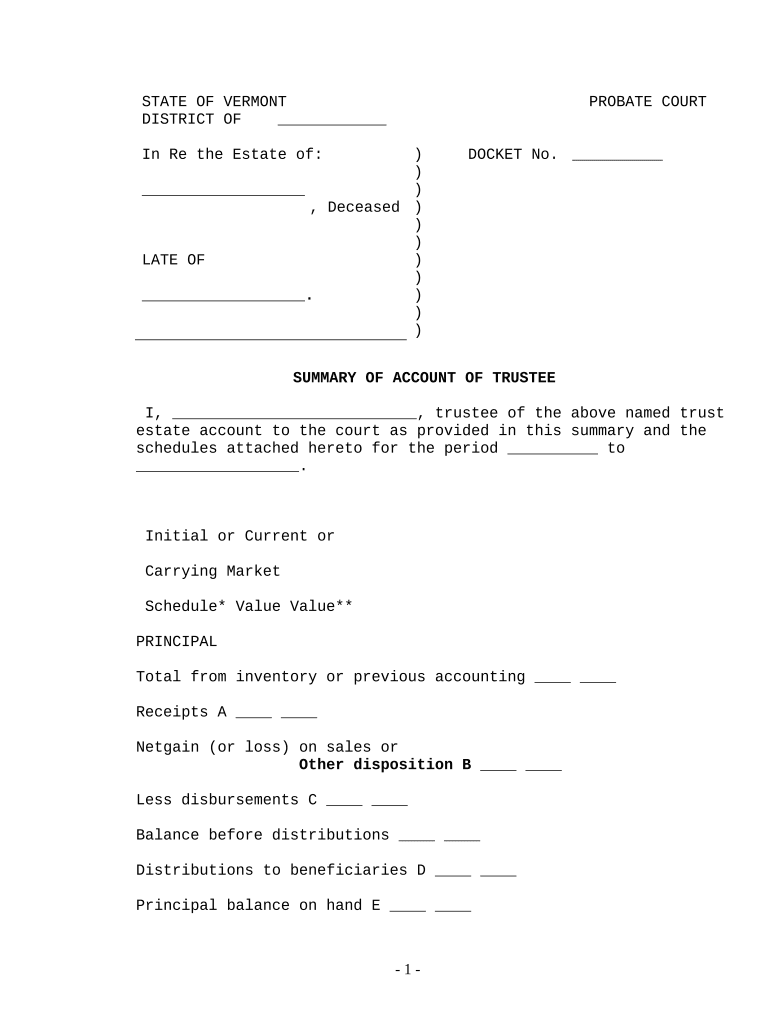

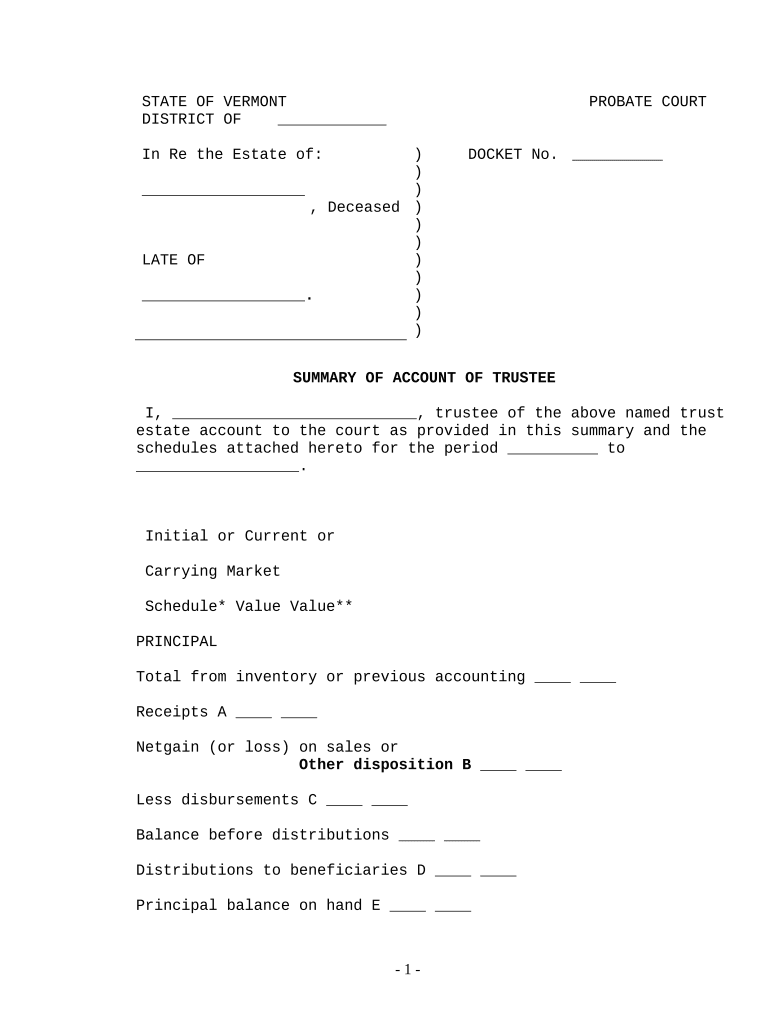

This form is used by a trustee to provide a periodic accounting of the trust estate to the court. This form has accounting schedules A through J (forms VT-056.1-P through VT-056.10-P) attached. For

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is summary of account of

A summary of account of is a concise document that outlines the key financial details and transactions related to an account over a specified period.

pdfFiller scores top ratings on review platforms

Fast. Didn't need a tutoring seession to know how it works

Wow finally a place I can find fillable IRS forms!

easy to use. The biggest feature for me is the 24 hour available chat line. It made this a no-brainer!

Aplicaion excelente, gracias a los desarrolladore

I usually don't leave feedback, but must for you! You have made my accounting so much easier and I totally appreciate you! Thank You! Redonna at Merchants Electric.

Ease of use is important when you're busy. I like that this is easy to use.

Who needs summary of account of?

Explore how professionals across industries use pdfFiller.

Summary of account of form form: A comprehensive guide

How to fill out a summary of account form

Filling out a summary of account form involves a structured approach to detailing financial information involved in trust management. This guide will walk you through the essentials of accurately completing this important document to ensure compliance and clarity.

Understanding the summary of account

A summary of account is a formal document used in trust management to provide a financial overview of the trust's activities over a specified period. Accurate accounting is critical in probate court proceedings, serving as a basis for transparency and accountability. Trustees play a vital role in preparing this document, ensuring it reflects all financial transactions accurately.

What are the core components of the summary of account?

A well-prepared summary of account consists of several key components that convey essential financial details.

-

This includes the total from inventory, receipts, and net gains/losses. Each component's significance should be thoroughly explained for all stakeholders involved.

-

In this section, you'll find the income total and the method used for its calculation. It also discusses disbursements and their implications on overall income, clarifying how funds have been allocated.

How to fill out the statement of account

Filling out the statement of account can be straightforward if you follow a systematic approach. Start with gathering all necessary financial documents, then proceed through the form step-by-step, ensuring all required information is filled in accurately.

-

Collect necessary documents such as past statements and receipts.

-

Begin filling out the principal section with total inventory and receipts.

-

Calculate and input net gains/losses carefully.

-

Evaluate and record income and disbursements accurately.

-

Avoid leaving sections incomplete or making vague entries as this can lead to complications.

How can interactive tools help with document management?

Using tools like pdfFiller can dramatically simplify document management for trustees. These features allow for easy editing of PDFs, which is essential when making changes to the summary of account.

-

Easily modify financial figures and textual information right within the document.

-

Use eSigning capabilities to secure signatures quickly without the need for physical meetings.

-

Share documents and collaborate with beneficiaries in real time to improve communication and transparency.

What are the compliance requirements for trustees?

Trustees in Vermont are obligated to adhere to specific legal requirements when filing the summary of account. This includes ensuring that all filings are accurate and submitted on time to avoid penalties.

-

Each trustee must be aware of their responsibilities under Vermont state laws regarding probate filings.

-

Ensure that a tax clearance is obtained prior to submission, which is crucial for the probate process.

What is the finalization and submission process?

Finalizing the summary of account requires careful attention to detail. Ensure all information is double-checked and complete prior to submission.

-

Review all sections of the document for accuracy and completeness.

-

Submit the completed summary to the probate court, paying close attention to deadlines to avoid complications.

How to fill out the summary of account of

-

1.Open pdfFiller and log in to your account.

-

2.Select the option to create a new document, then choose 'Upload' to bring in the template for the summary of account of.

-

3.Review the sections where account information is required, such as account holder name, account number, and relevant dates.

-

4.Fill in each section with accurate and up-to-date information regarding the account's transactions, balances, and pertinent details.

-

5.Use the tools provided by pdfFiller to edit and format your document as needed, ensuring clarity and readability.

-

6.Once completed, review the document for any errors or omissions before finalizing.

-

7.Save your document within pdfFiller or download it to your device as a PDF file, ensuring that you have a copy for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.