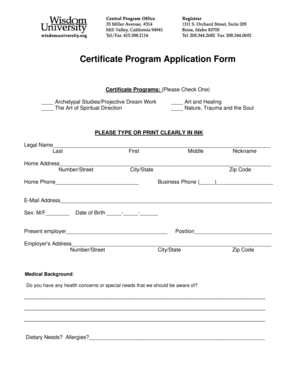

Get the free Satisfaction, Release or Cancellation of Mortgage by Corporation template

Show details

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Vermont by a Corporation. This form complies with all

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is satisfaction release or cancellation

A satisfaction release or cancellation is a legal document confirming that a debt or obligation has been fulfilled, releasing the borrower from further claims.

pdfFiller scores top ratings on review platforms

great except when i want to email something sometimes the other party can't view it as a pdf. i dont get why. I want an option to save my new document in my own hard drive but can't figure out how to other than emailing it to myself. add that option or help me find it.

NOT AT THIS TIME. I AM VERY BUSY AND CANNOT DEDICATE A TIME FOR A WEBINAR RIGHT NOW.

Love it. Simple and easy, even without any training....would recommend it to anyone--- maybe not my competition! LOL

Love how easy this makes my life and transactions!!

Just started, but this thing is useful!! Great idea, keep up the good work

pretty good, I wish there was a green color option for symbols.

Who needs satisfaction release or cancellation?

Explore how professionals across industries use pdfFiller.

How to fill out a satisfaction release or cancellation form

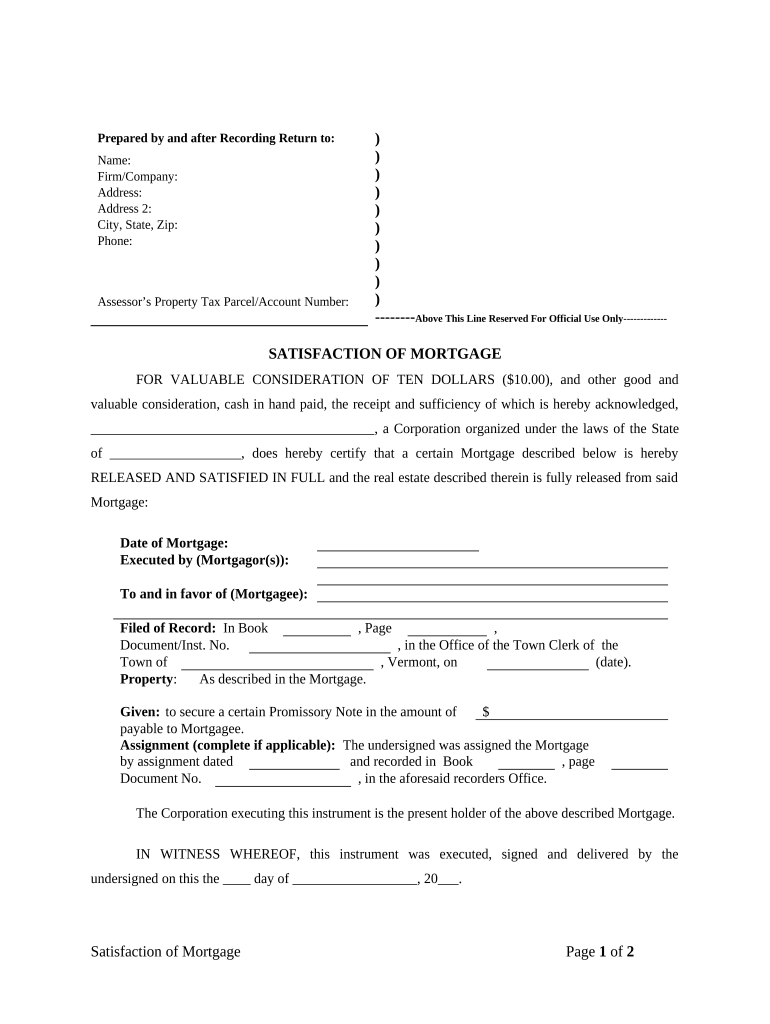

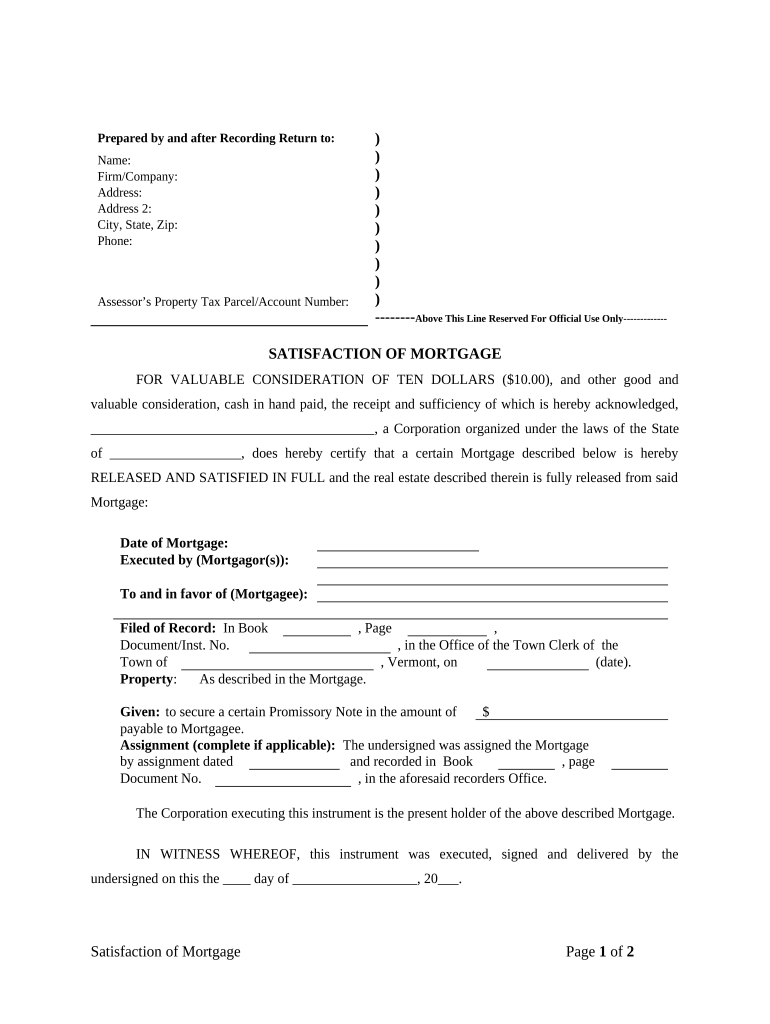

Understanding the satisfaction of mortgage form

The satisfaction of mortgage form is a crucial document in the real estate industry. It serves to officially release a borrower from the obligations of a mortgage once the loan is fully paid off. This form is essential for protecting the borrower’s credit and ensuring the property title is clear of any liens.

-

A legal document indicating the mortgage has been satisfied and the debt is cleared.

-

It confirms that the lender has relinquished its claim over the property, allowing for a clear title transfer during property sales.

-

While both serve to end the lender's claim, a Deed of Reconveyance is utilized in certain states as part of a trust deed rather than a traditional mortgage.

Key components of the satisfaction of mortgage form

A correctly filled form includes specific details to ensure its validity and recognition by authorities.

-

The name and address of the individual or organization that prepared the form should be included for official records.

-

This identifies the specific property being released from the mortgage, ensuring there’s no mix-up with other properties.

-

Include the mortgage's effective date, parties involved, and other specifics to avoid complications.

-

This section confirms that any consideration or payment required to satisfy the mortgage has been fulfilled.

-

This part must include required signatures and notarization to legitimize the document and provide authenticity.

Steps to complete the satisfaction of mortgage form

Filling out the satisfaction of mortgage form involves methodical steps to ensure all required information is accurately captured.

-

Prepare all relevant information to expedite the form filling process.

-

Follow the instructions carefully, ensuring each part of the form is completed meticulously.

-

Add your personal information, such as name and contact details.

-

Fill in the specifics of your mortgage and the stipulated compensation.

-

Ensure there are designated places for signatures to authenticate the document.

-

Double-check that all necessary parties have signed.

-

Complete the notarization if required to make the form legally binding.

Filing the satisfaction of mortgage form

After completion, the satisfaction of mortgage form needs to be filed correctly to become effective.

-

Typically, this form must be filed with the county recording office where the property is located.

-

Processing times can vary; generally, you can expect a few days to several weeks depending on the office.

-

You may request a copy from the recording office after filing; some offices may offer online access.

Best practices for managing mortgage satisfaction documents

Proper management of satisfaction documents can save time and prevent future issues.

-

Utilize pdfFiller’s services to easily edit, sign, and manage your satisfaction of mortgage forms.

-

Share documents securely with colleagues for quicker workflows.

-

Implement a structured document management system to ensure your forms are easy to locate.

Real-life examples of utilizing a satisfaction of mortgage form

Understanding real-world applications of the satisfaction of mortgage form can provide clarity.

-

Review instances where timely filing prevented title issues in property sales.

-

Typical situations include the selling of a property after paying off the mortgage.

-

Common errors include incomplete signatures or incorrect property information.

Exploring additional tools and resources on pdfFiller

Utilizing online resources can enhance how you manage mortgage satisfaction forms.

-

pdfFiller offers tools that make it easy to adjust and sign your forms digitally.

-

Use sharing features to work seamlessly with your team on document preparation.

-

Take advantage of the support resources available to answer any questions regarding your documents.

How to fill out the satisfaction release or cancellation

-

1.Open your PDFfiller account and select the 'Satisfaction Release or Cancellation' template.

-

2.Review the template to familiarize yourself with the sections that need to be filled in.

-

3.Begin by entering the names of the parties involved, including the borrower and lender, ensuring accurate spelling and correct titles.

-

4.Input the loan or obligation details, such as the original amount, date of the agreement, and any identifying numbers.

-

5.Provide the date of fulfillment, indicating when the debt was satisfied or cancelled.

-

6.Signature sections are crucial; prepare to sign electronically, or print for manual signing later.

-

7.Review the document for any errors or missing information before finalizing.

-

8.Save your completed document and choose whether to print or send it digitally.

-

9.If sending electronically, ensure the recipients have access to view and acknowledge the document.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.