Last updated on Feb 20, 2026

Get the free Deed of Trust - Amended Long - with representative acknowledgment template

Show details

This is an official Washington form for use in land transactions, a Deed of Trust [Amended Long Form] (with representative acknowledgment).

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of trust

A deed of trust is a legal document that secures a loan by transferring the title of a property to a trustee until the loan is repaid.

pdfFiller scores top ratings on review platforms

First time user. PDF Filler is very user friendly

VERY GOOD ,IT IS A LITTLE HARD TO FIGURE OUT BUT IAM LEARNIG LOVE TO HAVE A PHONE # TO TALK TOO SOME ONE

Provided files that otherwise would require me to physically write information in, this can be seen unprofessional to some businesses. Worth every penny

It worked very well and allowed me to save a Cal-Fire form that they don't allow you to save once you close it.

So far - so good. going to take a little more time.

It's been good, but i'd like to learn about more of the features.

Who needs deed of trust?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Deed of Trust Form on pdfFiller

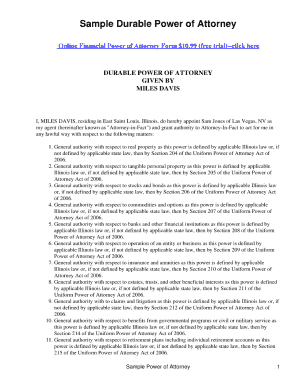

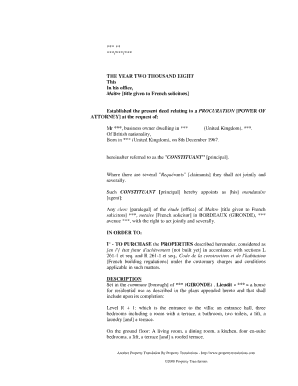

What is a deed of trust?

A deed of trust is a legal document used to secure a loan on real property. It outlines the responsibilities of the borrower and lender, ensuring that the lender has a claim against the property until the loan is paid off. The main parties involved are the grantor (borrower), trustee (neutral third party), and beneficiary (lender).

-

Defines the deed of trust as a security instrument for loan agreements, delineating the property used as collateral.

-

Involves three main parties: the grantor who takes the loan, the trustee who holds the deed on behalf of the lender, and the beneficiary who is the lender.

-

Unlike mortgages, which involve a direct agreement between borrower and lender, a deed of trust involves a third party (trustee) which can simplify the foreclosure process.

What are the essential elements of a deed of trust form?

The deed of trust form must include specific details to be legally valid. These elements ensure that the agreement is comprehensive and enforceable in court.

-

The date should reflect when the agreement is made, along with full legal names and addresses of all parties involved.

-

Includes the physical address and legal description of the property, ensuring clarity regarding which asset is secured.

-

Covers crucial financial details such as total loan amount, interest rates, and payment due dates.

How do you fill out a deed of trust form?

Filling out a deed of trust form correctly is essential to ensure its legality and effectiveness. Here’s a simplified process to guide you.

-

Before starting the form, collect all needed information, including personal details and property description.

-

Each section should be filled out thoroughly; this includes the grantor and beneficiary information, property details, and financial terms.

-

Ensure that compliant language is used, particularly in terms of legal obligations and responsibilities.

What tips exist for managing your deed of trust form using pdfFiller?

Using pdfFiller's tools can streamline the process of managing your deed of trust form. The platform provides an array of features to facilitate efficient documentation.

-

Leverage pdfFiller’s editing tools to personalize the deed and ensure that it meets your specific needs, enhancing clarity and professionalism.

-

The platform allows for easy electronic signing, and you can invite others to sign through a simple link, making collaboration seamless.

-

Utilize collaboration tools for teams, where multiple users can manage and track changes to ensure version control.

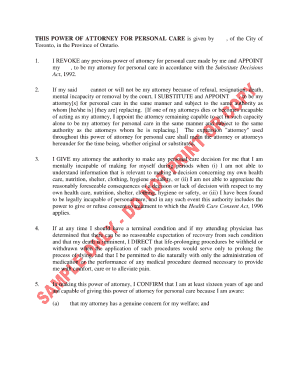

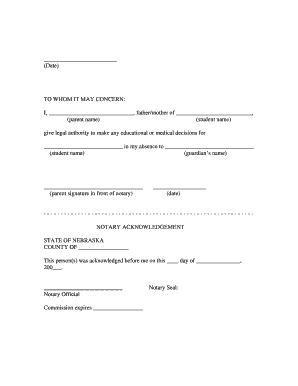

Why is notarization necessary for a deed of trust form?

Notarization adds an extra layer of validity to the deed of trust, as it confirms the identities of the signers and their understanding of the document.

-

Be aware of the specific requirements for notarization in your jurisdiction; for instance, in Washington State, you must present valid identification to the notary.

-

Select a qualified notary with a good reputation to ensure that your document is properly executed.

-

Notarization is crucial for the legal enforceability of the deed, as it prevents fraud and misrepresentation.

How do you record the signed deed of trust?

Once the deed of trust is signed and notarized, recording it with the County Recorder’s Office formalizes its existence in public records.

-

To record, submit the executed deed to the local recorder's office along with applicable fees; check local regulations for specifics.

-

Be prepared for recording fees and understand that processing times can vary; you may receive confirmation weeks later.

-

After recording, the deeds are accessible to the public, thus ensuring transparency and protecting the lender’s rights.

What are post-recording responsibilities?

Being informed about your responsibilities after recording the deed of trust is crucial for both the grantor and the beneficiary.

-

Always keep copies of the recorded deed as proof of ownership and terms agreed upon.

-

Maintain the property in good standing—failure to do so might violate the terms of the deed.

-

Understand potential foreclosure processes and remedies available to the lender if the grantor defaults on payments.

How to fill out the deed of trust

-

1.Open the deed of trust template on pdfFiller.

-

2.Fill in the borrower's name and contact details at the top of the document.

-

3.Enter the lender's information in the specified field.

-

4.Provide the property description, including the address and legal description, in the designated area.

-

5.Specify the loan amount that is being secured by the deed of trust.

-

6.Identify the trustee's name and address, who will hold the title until the loan is paid off.

-

7.Review all entered information for accuracy and completeness.

-

8.Sign and date the document where indicated, ensuring all parties agree to the terms.

-

9.Save or download the completed deed of trust in the desired format.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.