Last updated on Feb 20, 2026

Get the free Individual Credit Application template

Show details

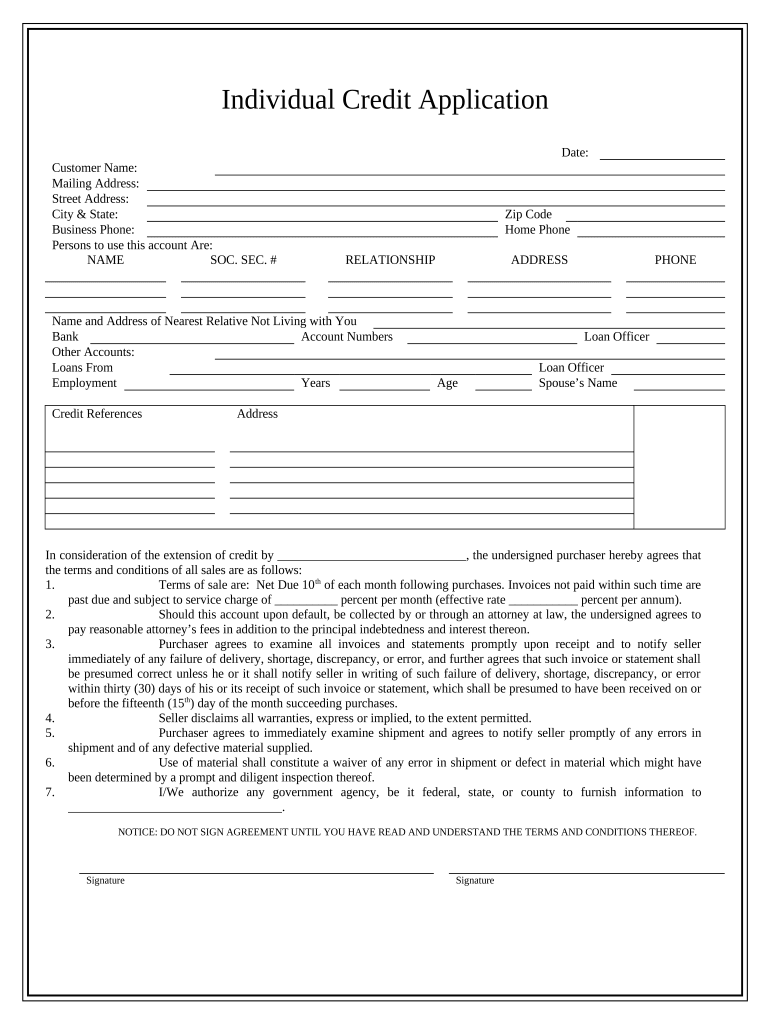

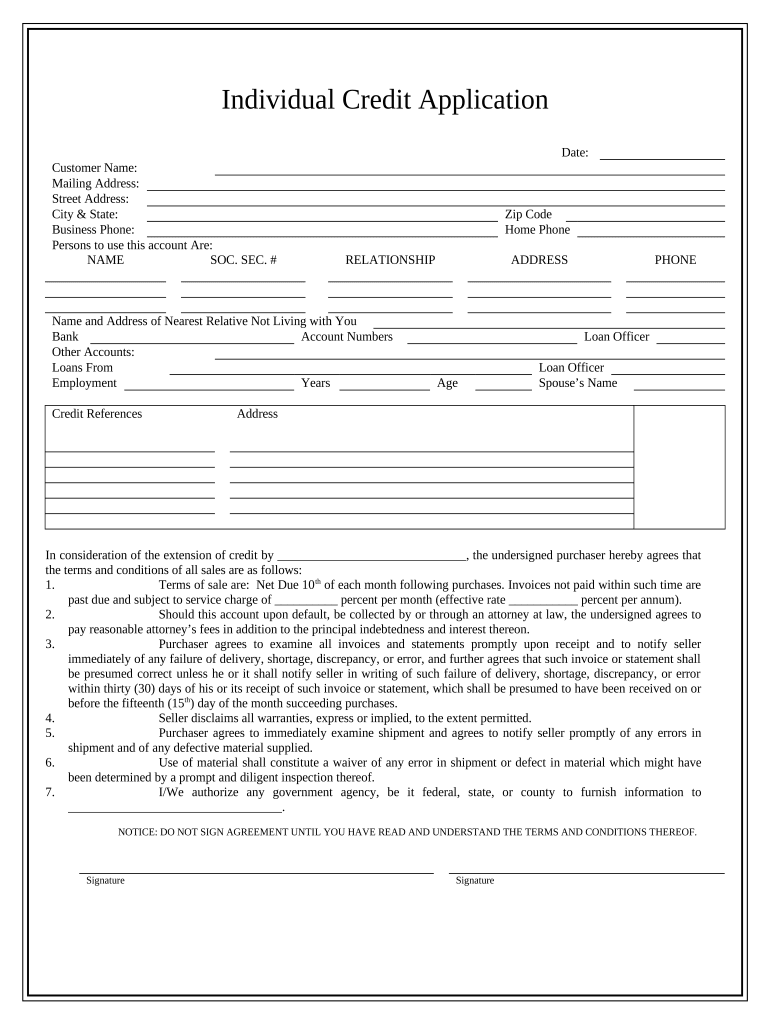

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is individual credit application

An individual credit application is a document used by lenders to evaluate a borrower's creditworthiness and loan eligibility.

pdfFiller scores top ratings on review platforms

Excellant product, very usefull. A little bit difficult to use though.

Very helpful for what I need to accomplish and price is quite reasonable and easy to use.

The method in which you edit is confusing but overall the experience was very good.

Form looks more professional. It is very easy to use

If this works I'll be happy. I've already had documents notarized & returned by Records Office.

Easy to use, quick selection of typical forms

Who needs individual credit application template?

Explore how professionals across industries use pdfFiller.

Mastering the Individual Credit Application Form

How to fill out a individual credit application form

Filling out an individual credit application form is crucial for securing loans. It requires accurate information about your personal and financial history, which lenders use to make informed credit decisions. Understanding each section of the form helps ensure a smooth application process.

What is the individual credit application process?

An individual credit application is a document submitted by a person seeking credit from a lender. Its purpose is to provide lenders with necessary personal and financial information that will influence their decision to approve or deny credit. Completing the application with precision is vital as even minor inaccuracies can lead to adverse decisions.

-

The application serves as a request for credit and outlines your ability to repay the loan.

-

Accurate information supports a positive credit decision and reduces processing time.

-

Lenders rely on the details provided to assess your creditworthiness.

What essential information do need for the application?

Certain personal and financial details are mandatory when completing an individual credit application form. This includes identification and financial data, which help lenders evaluate your profile.

-

Include your name, mailing address, contact information, Social Security number, and employment details.

-

Provide bank account numbers, any existing loan references, and credit history to give a fuller picture of your financial status.

How should fill out the individual credit application form?

A step-by-step approach is recommended to ensure completeness and accuracy when filling out the individual credit application form. Each section of the form should be considered carefully.

-

Start with your full name and contact details.

-

Provide details about your current job, employer, and income level.

-

List past creditors and your repayment history.

-

Make sure to read and understand all terms before signing.

What common mistakes should avoid?

Avoiding common pitfalls in filling out the individual credit application form can enhance your likelihood of approval. Missteps can lead to delays or rejections.

-

Always double-check for accuracy to avoid misunderstandings.

-

Familiarize yourself with all legal implications before submitting.

-

Keep a record of your application submission and follow up as necessary.

How do review and submit my application?

Once completed, it is essential to thoroughly review the application for any potential errors. Whether opting for electronic or physical submission, ensure you choose the method that best suits your needs.

-

Cross-check all information for accuracy.

-

Decide between online submissions for convenience or physical forms.

-

Utilize pdfFiller for seamless electronic submission and tracking of your application.

What should expect after submission?

After submitting your application, it’s crucial to understand the next steps. Knowing the timeline for evaluation and how to monitor your application status will keep you informed.

-

Credit evaluations can take several days to weeks, depending on the lender.

-

Track the status of your application conveniently through pdfFiller.

What are my rights as an applicant?

As an applicant, it is imperative to know your rights under the Equal Credit Opportunity Act (ECOA). These rights exist to protect you against discrimination and to ensure accuracy in your credit evaluation.

-

The ECOA prohibits discrimination in credit transactions.

-

You have the right to dispute inaccuracies in your credit report.

-

Understanding local laws can help incorporate rights into your application success.

Where can find further resources for assistance?

If you need more support, various resources can guide you through the credit application process. Whether you desire sample forms or professional assistance, reliable avenues are available.

-

Access templates to explore how to fill out your form correctly.

-

Consider hiring financial advisors or credit counselors for expert guidance.

-

Online forums and discussion groups can offer shared experiences and advice.

How to fill out the individual credit application template

-

1.Begin by accessing the PDF file of the individual credit application on pdfFiller.

-

2.Enter your personal information in the designated fields including your full name, address, and date of birth.

-

3.Provide your Social Security Number, if required, for identification purposes.

-

4.Fill in your employment details, including your job title, employer's name, and duration of employment.

-

5.Enter your financial information, such as monthly income, existing debts, and assets.

-

6.Read through the terms and conditions carefully before moving on.

-

7.Sign and date the application where indicated to confirm the truthfulness of the information provided.

-

8.Review the entire application for any errors or omissions before submitting.

-

9.Finally, submit the completed application through the platform as per the lender's instructions.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.