Get the free Warning of Default on Residential Lease template

Show details

This Warning of Default on Residential Lease is a warning letter from landlord to tenant expressing concern that if certain conditions are not remedied, tenant will be held in default under the lease

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is warning of default on

A warning of default on is a formal notification issued by a lender or creditor indicating that a borrower has failed to meet the terms of their loan or credit agreement.

pdfFiller scores top ratings on review platforms

easy to use

Once I figured out how to use it it has been an essential part of my office.

complicated but useful

Great experience!

good

So important cause I am a teacher and a researcher!

Who needs warning of default on?

Explore how professionals across industries use pdfFiller.

How to Address a Warning of Default on Lease Agreements

What is a warning of default on a residential lease?

A warning of default refers to a formal notification issued by a landlord to a tenant indicating that they have violated certain terms of the lease agreement. Understanding this definition is crucial, as it highlights the importance of addressing any default promptly to avoid further legal implications. Ignoring such notices can lead to severe consequences, including possible eviction, legal actions, or damage to a tenant's credit history.

Why is it crucial to address a default in a lease agreement?

Timely addressing a warning of default is essential because it can protect both the landlord's investment and the tenant's rights. When tenants respond adequately to a default notice, they can often remedy the situation and avoid formal eviction processes. Additionally, landlords have a responsibility to maintain a fair and legal approach in managing defaults, ensuring that they act within the bounds of the law.

What happens if a default notice is ignored?

Ignoring a warning of default can lead to serious repercussions. Landlords may initiate eviction proceedings, resulting in a tenant losing their housing. Moreover, unpaid or unresolved defaults can also negatively impact a tenant's credit report, making future rental applications more challenging.

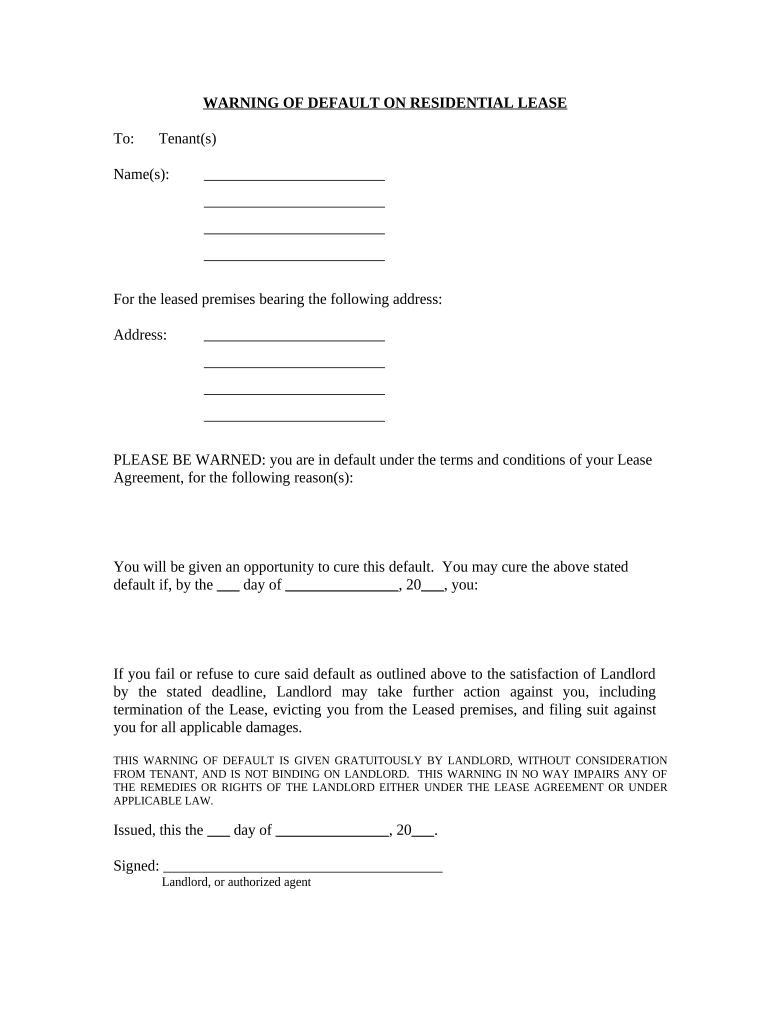

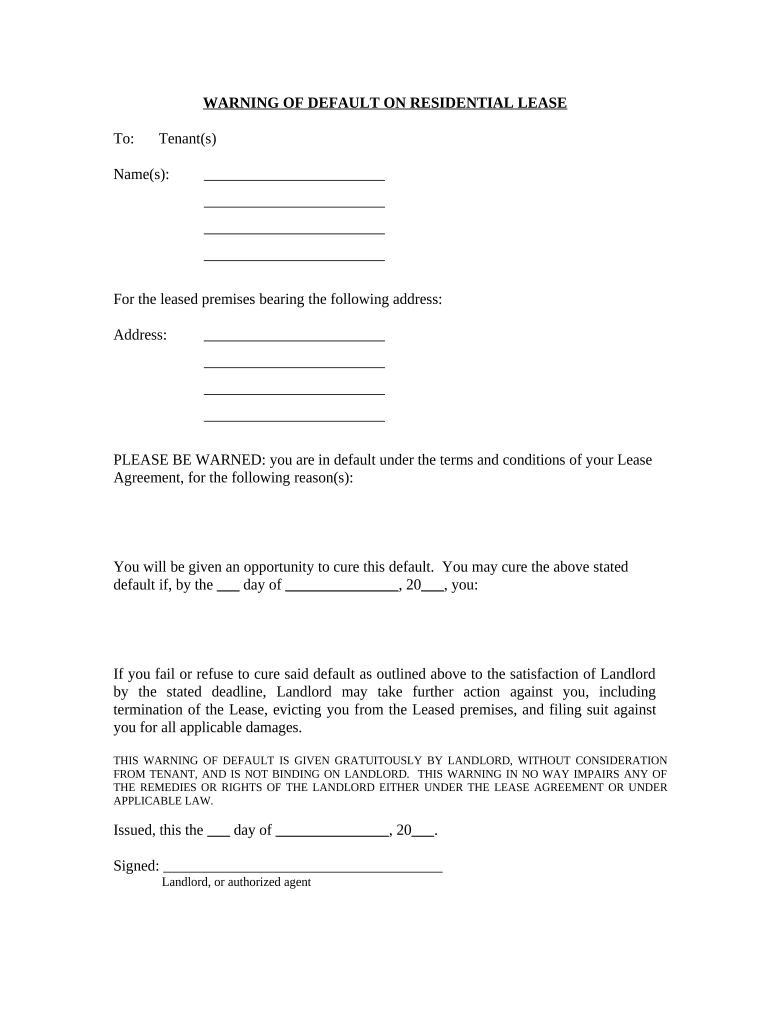

What are the key components of a warning of default letter?

A proper warning of default letter should contain specific elements to ensure clarity and legal compliance. The main components include recipient information, the address of the leased premises, reasons for the default, a cure opportunity, and the landlord's rights.

-

Clearly state the names of the tenant or tenants involved to avoid confusion.

-

Specify the full address of the rented property to ensure both parties understand the context of the lease.

-

Articulate the reasons for the notice in clear, straightforward language to avoid disputes.

-

Provide a deadline for correcting the default, giving tenants a fair chance to remedy the situation.

-

Outline potential actions and remedies that the landlord may pursue if the default is not cured.

How to fill out the warning of default form?

Filling out a warning of default form accurately is vital to avoid potential legal challenges. Begin by completing the tenant information carefully, ensuring that the names and relevant details correspond to the signed lease. Next, detail the property address to maintain specificity.

-

Include complete details for each tenant listed in the lease agreement to ensure proper identification.

-

Use the exact address as stated in the lease to avoid any ambiguity.

-

Use direct and clear language to explain the reasons leading to the default notice.

-

Establish a clear deadline when a tenant can remedy the default to avoid eviction processes.

-

Include your signature and the date to confirm the authenticity of the notice.

What are the legal implications of a warning of default?

Many jurisdictions have laws governing lease agreements that dictate the processes following a warning of default. Understanding these laws is essential for both landlords and tenants to protect their rights. Tenants have the right to contest a default notice and should seek legal advice if they believe it may have been improperly issued.

Considerations for handling a warning of default

When faced with a warning of default, both parties should be aware of their rights. Tenants can respond with documentation or alternative agreements, while landlords may initiate eviction if defaults are not remedied. Seeking legal counsel can assist in navigating these complex processes and ensuring compliance with local laws.

Resources for managing lease agreements using pdfFiller

pdfFiller provides a user-friendly platform for managing documents, including lease agreements and related forms. Users can digitally fill, edit, and eSign the warning of default form, making it easier to manage important paperwork without hassle. Collaborative features allow teams to work on these documents in real time, enhancing efficiency.

-

Users can complete and edit forms securely from any device.

-

Work with others, allowing multiple users to edit and provide feedback seamlessly.

-

Easily save and manage different versions of documents for future reference.

-

Browse templates for future lease-related documents to streamline processes.

How to fill out the warning of default on

-

1.Open your web browser and go to pdfFiller's website.

-

2.Log in to your pdfFiller account. If you do not have one, create a new account.

-

3.Use the search function to find the 'warning of default on' template.

-

4.Click on the template to open it in the editor.

-

5.Begin filling in the necessary fields, such as the borrower's name and address, account number, and loan details.

-

6.Clearly state the reason for the warning, specifying the breached terms of the agreement.

-

7.Include any relevant dates, such as the date of default and the due date of the missed payments.

-

8.Add any additional information or instructions for the borrower, if necessary.

-

9.Review the document for accuracy and completeness, ensuring all required fields are filled in properly.

-

10.Once you are satisfied with the document, save it and choose the option to print or send it electronically to the borrower.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.