WI-PR-1815 free printable template

Show details

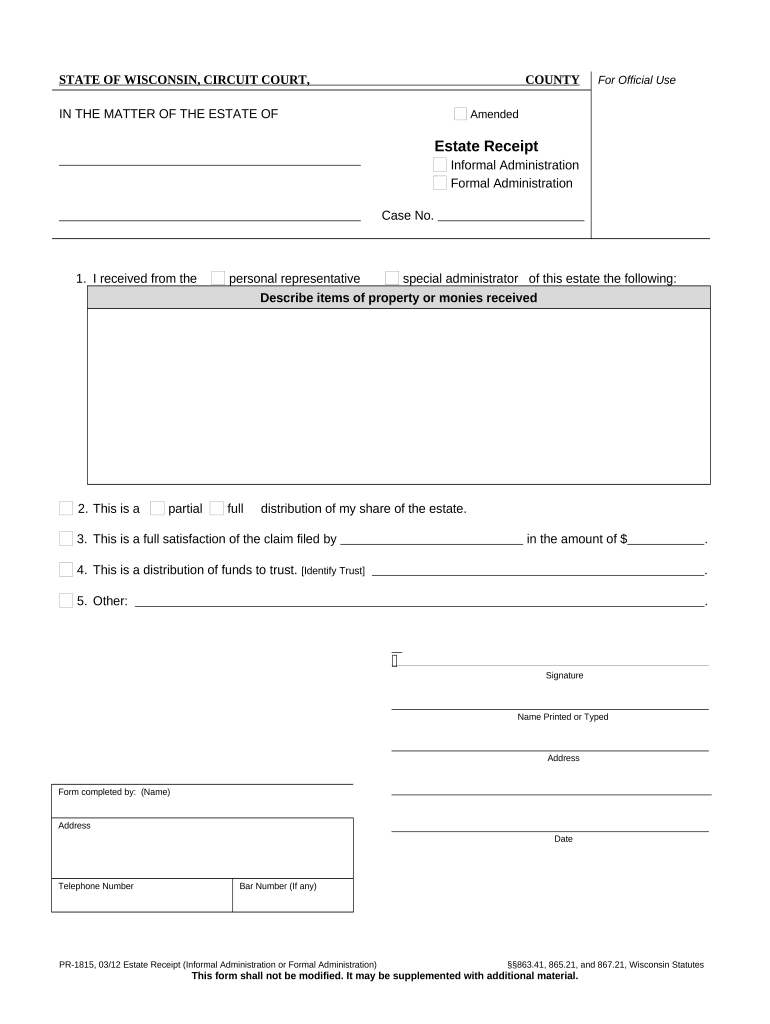

This is an Estate Receipt, to be used in the State of Wisconsin. This form is used to show that the creditors, heirs, or beneficiaries have received what is due them.

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is WI-PR-1815

WI-PR-1815 is a document used for processing personnel records within the organization.

pdfFiller scores top ratings on review platforms

I have not been disappointed with the forms I have purchased. Great job.

It was very easy to use and printing options were great.

Works very well and ideal for completing many types of forms especially from the Federal government. Works great at making your own forms.

YOU HAVE SO MUCH TO OFFER. I AM NOT VERY GOOD WITH THIS SORT OF THING SO I WOULD LOVE HELP OR THE WEBINAR

use if for grant writing to fill out the forms

I am doing my own 1099's for my business!

Who needs WI-PR-1815?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the WI-PR-1815 Form on pdfFiller

The WI-PR-1815 form is essential for individuals managing estate receipts during informal administration in Wisconsin. It plays a crucial role in documenting the transfer of property or funds by a personal representative or special administrator. Knowing how to fill out the WI-PR-1815 form accurately can streamline the administrative process and ensure compliance with legal statutes.

What is the WI-PR-1815 Form?

The WI-PR-1815 form, also known as the Estate Receipt for Informal Administration, is used in Wisconsin to acknowledge the receipt of assets during the administration of an estate. This form is pivotal in ensuring that all transfers are legally recorded, which protects the rights of beneficiaries and the estate.

-

It serves to officially document the assets received by either a personal representative or a special administrator.

-

Filing this form accurately is crucial for legal compliance and mitigating future disputes among beneficiaries.

-

Understanding terms like 'estate', 'personal representative', and 'special administrator' is vital for proper usage of the form.

What are the essential components of the WI-PR-1815 Form?

The WI-PR-1815 form comprises several key sections, each serving specific purposes in the estate management process. This ensures a comprehensive understanding and completion of the form.

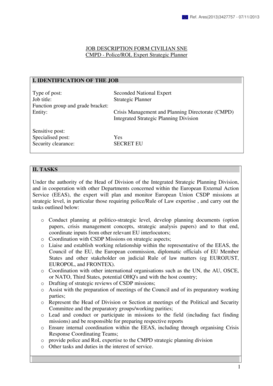

Official header information

-

Includes vital details like the State of Wisconsin, Circuit Court, and county where the estate is administered.

-

A unique identifier assigned to the estate, crucial for reference in legal contexts.

Receipt section

-

Lists all assets received, which facilitates transparency during estate distribution.

-

Clarifies whether the assets come from a personal representative or a special administrator.

Distribution information

-

Specifies whether the distribution is full or partial, impacting how further claims are handled.

-

Indicates how any outstanding claims against the estate have been satisfied prior to distribution.

How do you complete the WI-PR-1815 Form?

Completing the WI-PR-1815 form requires attention to detail and knowledge of its contents. This step-by-step guide will assist you in navigating the process effectively.

-

Submit the form at the designated Circuit Court, following specific guidelines to avoid delays.

-

Utilize pngFiller’s platform to edit and eSign the form, streamlining the process.

-

Take advantage of team features within pdfFiller for collaborative adjustments.

What are the legal compliance and guidelines for the WI-PR-1815 Form?

Filling out the WI-PR-1815 form requires adherence to specific Wisconsin statutes. These legal frameworks ensure the form is properly completed and filed.

-

Familiarize yourself with statutes like §§863.41, 865.21, and 867.21, which affect how the form is approached.

-

Altering the form incorrectly can lead to legal repercussions, making accurate completion essential.

-

Be aware of additional documents that may be required for various situations in estate management.

How do you navigate probate resources?

Navigating the various probate resources can enhance your understanding of estate administration and the WI-PR-1815 form.

-

Locate essential forms and associated resources through online directories specific to Wisconsin Circuit Courts.

-

Understand the distinctions between informal and formal probate processes to better manage estates.

-

Explore additional probate packets to streamline document gathering and filing.

How to fill out the WI-PR-1815

-

1.Open pdfFiller and upload the WI-PR-1815 document.

-

2.Start by entering the employee's full name in the designated field at the top of the document.

-

3.Next, fill in the employee ID number in the appropriate section.

-

4.Proceed to enter the dates that are relevant to the personnel record, such as start date and end date if applicable.

-

5.Complete the sections related to employment details, including position title and department.

-

6.If required, provide the reason for record processing in the specified box.

-

7.After filling in all mandatory fields, review the document for accuracy to ensure all information is correct.

-

8.Use the 'Save' option to keep a copy of the filled document, and then select 'Send' to forward it to the necessary recipients, such as HR or the employee.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.