CA FTB 4905 PIT 2009 free printable template

Get, Create, Make and Sign CA FTB 4905 PIT

Editing CA FTB 4905 PIT online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 4905 PIT Form Versions

How to fill out CA FTB 4905 PIT

How to fill out CA FTB 4905 PIT

Who needs CA FTB 4905 PIT?

Instructions and Help about CA FTB 4905 PIT

I am sure this really nice two-bedroom one-bathroom home at 4905 West 43rd Street you know number two in Sioux Falls for real property management express go ahead and walk through the entryway and start the tour this exceeds my left we have a nice big coat closet lots of room in there very conveniently right next to the road anthem take a step back here we can take a look at the living room it is a fireplace also has to really Nagy garden level windows lets lots of natural light in here will be through it was the dining room get a nice large garden level window have an air conditioner here keep things nice and cool in the summer as well is it war through to the kitchen you can see plenty cabinet space of the refrigerator freezer stove there's a double sink with garbage disposal and does have dishwasher here as well the very convenient makes nice and easy to do the digit it's walking down the highway we have a full bathroom the top full-size tub shower combination as well as your stool and vanity with mirror bedroom number 13 nice size room you see throughout the house very nice light neutral colors on the walls these if we'll rig nice and bright in here this room does have large closet as well and then bedroom number two really nice size room again oversized window lots of natural light, and we'll take a look it's nice large lit closet there's a walking closet, and you have a shelf and hanging space in there for more information on this property or any other party we have available please go to our website at express RPM com or call us at six or five to seven four seven three seven three

People Also Ask about

What are the requirements for Offer in Compromise to the IRS?

What should I offer for Offer in Compromise?

How hard is it to get an offer in compromise with the IRS?

Does the IRS usually accept Offer in Compromise?

What is the downside of Offer in Compromise IRS?

What is the acceptance rate for the IRS offer in compromise?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CA FTB 4905 PIT in Gmail?

How do I make changes in CA FTB 4905 PIT?

How do I edit CA FTB 4905 PIT in Chrome?

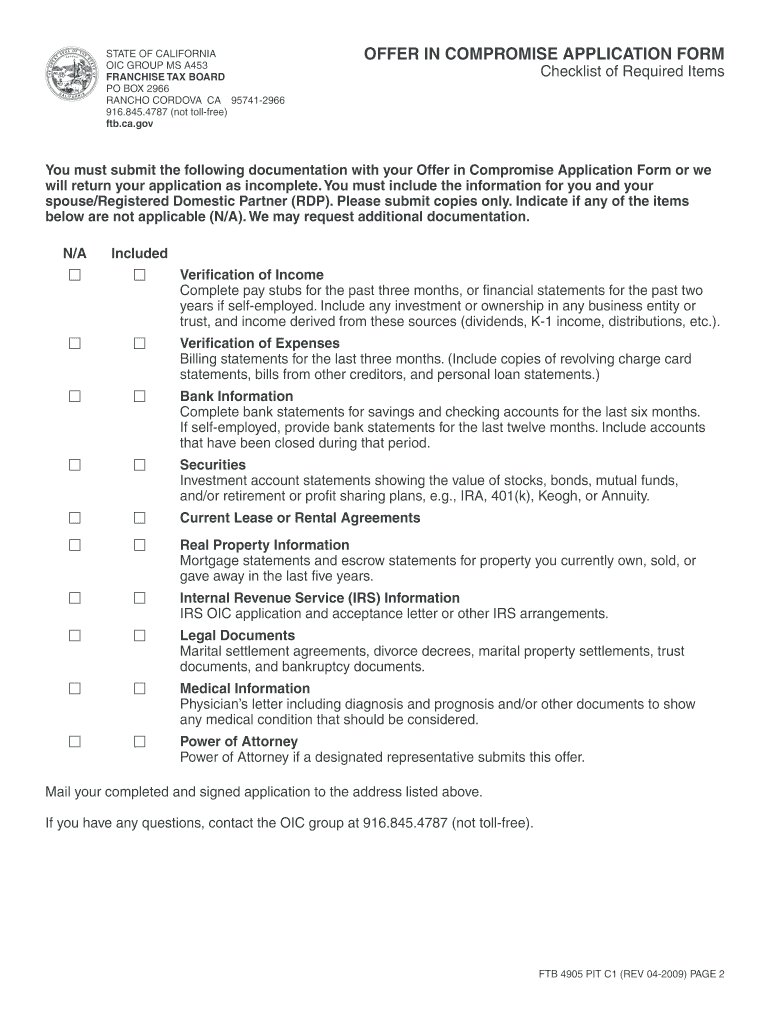

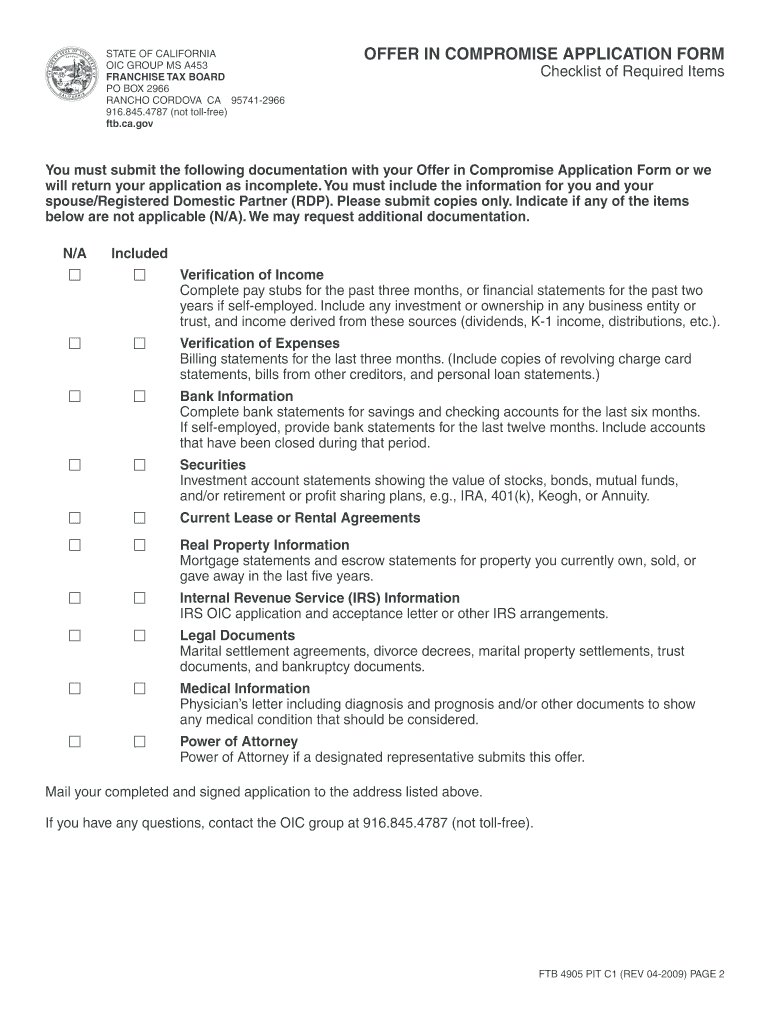

What is CA FTB 4905 PIT?

Who is required to file CA FTB 4905 PIT?

How to fill out CA FTB 4905 PIT?

What is the purpose of CA FTB 4905 PIT?

What information must be reported on CA FTB 4905 PIT?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.