Canada T1213 2019 free printable template

Show details

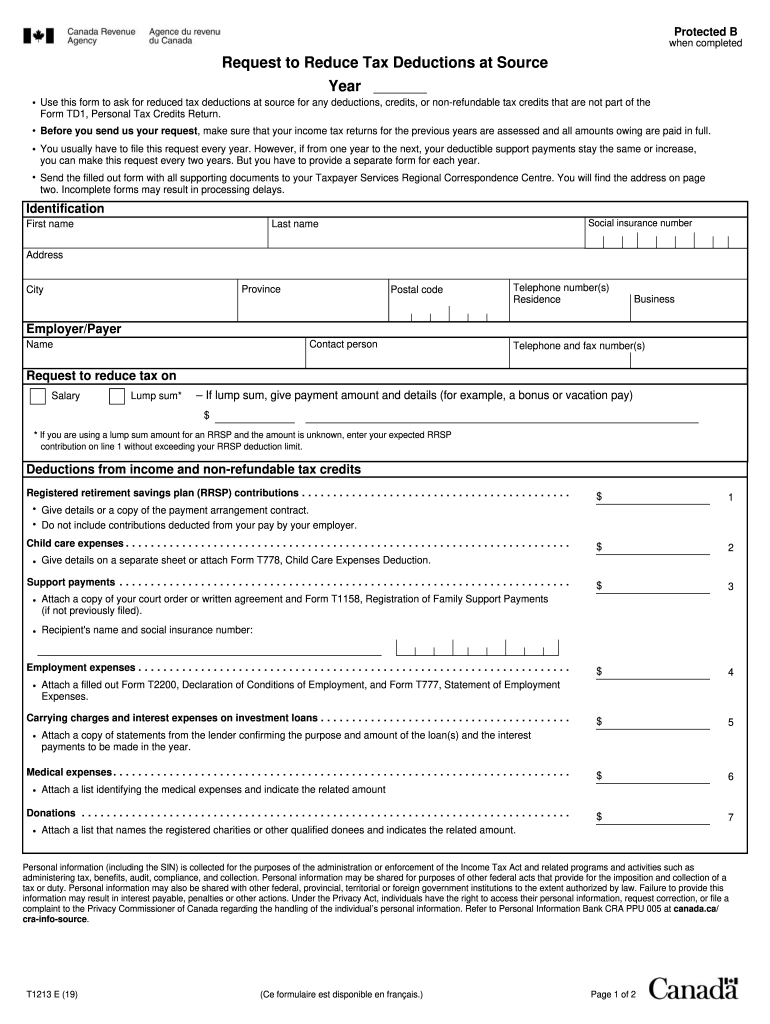

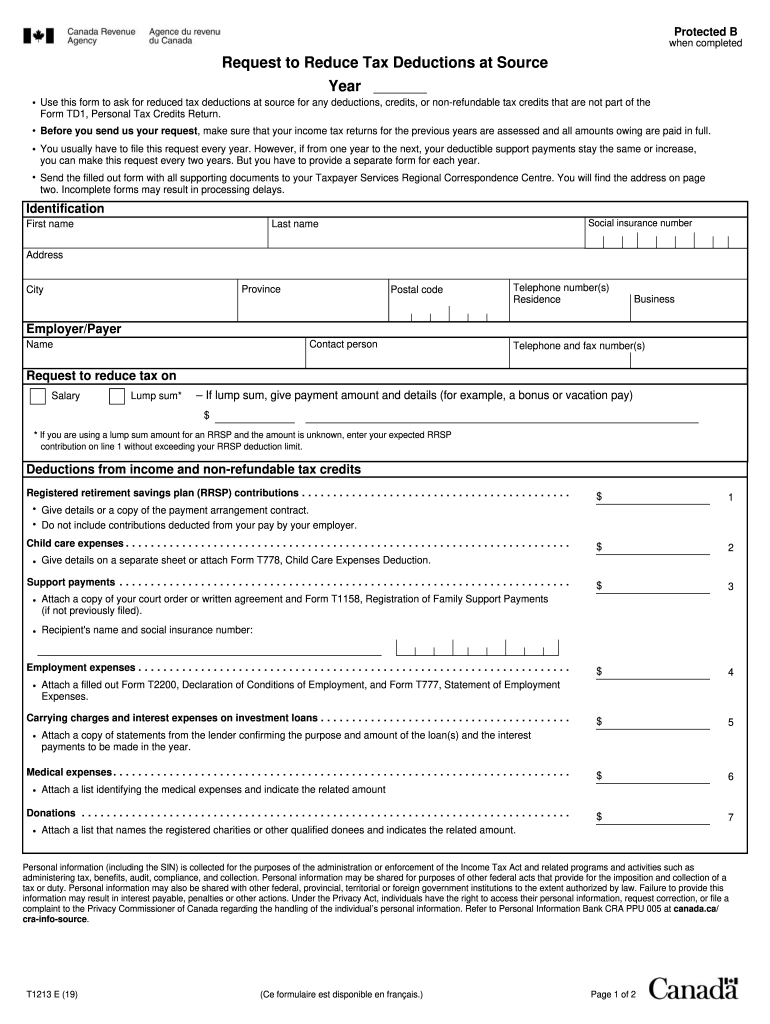

Protected B when completedRequest to Reduce Tax Deductions at Source Year Use this form to ask for reduced tax deductions at source for any deductions, credits, or nonrefundable tax credits that are

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T1213

Edit your Canada T1213 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T1213 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T1213 online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada T1213. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T1213 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T1213

How to fill out Canada T1213

01

Obtain the Canada T1213 form from the Canada Revenue Agency (CRA) website or your local CRA office.

02

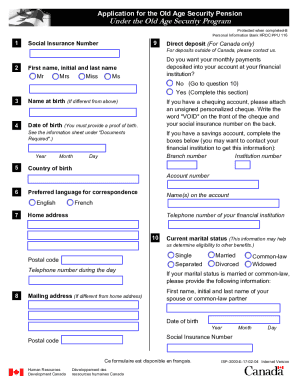

Fill in your personal information in the designated sections, including your name, address, and social insurance number.

03

Indicate your marital status if applicable.

04

Complete the 'Part C – Request for a Determination of Eligibility for the Deduction of Certain Amounts' section if it applies to you.

05

In 'Part D', specify the amounts you are requesting for tax deductions.

06

Attach any required documentation that supports your request.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate tax centre as indicated in the instructions.

Who needs Canada T1213?

01

Individuals who are receiving specific tax deductions such as child care expenses, medical expenses, or disability supports.

02

Taxpayers who have had amounts deducted from their paychecks and wish to claim those amounts on their tax returns.

03

Persons applying for a tax waiver or individuals on disability who want to ensure their refunds are processed appropriately.

Fill

form

: Try Risk Free

People Also Ask about

What is form T1213 Ontario?

What Is The T1213 Form? Essentially, the T1213 is a form that lets you request to have fewer taxes withheld at the source. It works to either pay less tax on each cheque or on a specific amount of money. It gives you the opportunity to claim deductions and non-refundable credits that don't appear on the regular form.

What is the PD7A form?

The PD7A is a Canada Revenue Agency (CRA) payroll remittance form. On it, you report EI premiums, CPP contributions, and federal income tax withheld from your employee's pay.

What is a T1213 form Canada?

To get a letter of authority, the employee has to send Form T1213, Request to Reduce Tax Deductions at Source, or a written request to the the CRA.

How do I fill out a current source deductions remittance voucher?

Fill out the table, including your account number, the remitting period, gross payroll, number of employees, cheque number (if applicable), the date of your remittance, the amounts of tax, CPP , and EI , and the amount of your payment. Ask the teller to stamp this part for your records.

What is a remittance slip?

A remittance letter is a document sent by a customer, which is often a financial institution or another type of firm, to a creditor or supplier along with payment to briefly explain what the payment is for so that the customer's account will be credited properly.

What form do I use for source deduction Canada?

Individuals use the Source Deductions Return (form TP-1015.3-V) to report the deductions and personal tax credits to which they are entitled so that you can calculate source deductions of income tax on their remuneration.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Canada T1213 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your Canada T1213 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an eSignature for the Canada T1213 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your Canada T1213 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the Canada T1213 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign Canada T1213 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is Canada T1213?

Canada T1213 is a form used to request a reduction in the amount of income tax that is withheld from your pay, particularly when you have deductions or credits that will reduce your tax liability.

Who is required to file Canada T1213?

Individuals who expect to have a tax refund because of deductions, such as childcare expenses or tuition fees, or those who have significant non-refundable tax credits may be required to file Canada T1213.

How to fill out Canada T1213?

To fill out Canada T1213, provide your personal information, indicate the reasons for requesting the reduction of tax withholding, and list details of your deductions or credits. Ensure all sections are completed accurately before submitting.

What is the purpose of Canada T1213?

The purpose of Canada T1213 is to allow taxpayers to reduce the amount of income tax withheld at source, which helps manage cash flow and allows them to retain more of their earnings throughout the year.

What information must be reported on Canada T1213?

Information that must be reported on Canada T1213 includes your name, Social Insurance Number, contact information, and details about the deductions or credits you intend to claim, including their amounts.

Fill out your Canada T1213 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t1213 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.