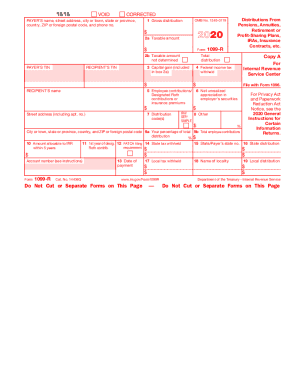

IRS 8963 2020-2026 free printable template

Show details

Page 2 of 2Report of Health Insurance

Provider Information OMB No.15452249 Read the instructions before you complete Form 8963.

Go to www.irs.gov/Form8963 for instructions and the latest information.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 8963 form

Edit your 8963 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 8963 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing the irs 8963 form is editing and submitting the form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 8963 instructions. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8963 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 8963 irs

How to fill out IRS 8963

01

Obtain IRS Form 8963 from the IRS website or through tax software.

02

Provide your name, address, and taxpayer identification number (TIN) at the top of the form.

03

Complete Part I by identifying the entity or entities for which you're reporting.

04

Fill out Part II, detailing the amount of premium tax credit for which the entities qualify.

05

Ensure that all relevant supporting documentation and attachments are included.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit IRS Form 8963 along with your tax return or as instructed.

Who needs IRS 8963?

01

Individuals or entities that need to report premium tax credits related to health insurance under the Affordable Care Act.

02

Taxpayers claiming an exemption from the requirement to maintain health coverage.

03

Certain organizations or entities that are required to report specific tax-related information to the IRS.

Fill

keyword8963

: Try Risk Free

People Also Ask about form 363

What is a 8962 form used for?

Use Form 8962 to: Figure the amount of your premium tax credit (PTC). Reconcile it with any advance payments of the premium tax credit (APTC).

Why is the IRS asking me for form 8962?

You must file Form 8962 to compute and take the PTC on your tax return. Advance payment of the premium tax credit (APTC). APTC is a payment during the year to your insurance provider that pays for part or all of the premiums for a qualified health plan covering you or an individual in your tax family.

What is a 8963 tax form?

This form allows insurance providers to report net premiums written for health insurance of United States health risks. The information reported will be used by the IRS to calculate the annual fee on health insurance providers.

How does form 8962 affect tax return?

To reconcile, you compare two amounts: the premium tax credit you used in advance during the year; and the amount of tax credit you qualify for based on your final income. You'll use IRS Form 8962 to do this. If you used more premium tax credit than you qualify for, you'll pay the difference with your federal taxes.

Who must file form 8941?

Eligible small employers use Form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. For tax years beginning after 2013, the credit is only available for a 2 consecutive tax year credit period.

What happens if I don't file form 8962?

What if I file but don't include Form 8962? For any year when you received advanced premium tax credits, you are required to file a federal income tax return, including Form 8962. If you fail to do this — it is called “failure to reconcile” — you may be unable to apply for premium tax credits for the following year.

Who needs to fill out form 8962?

Form 8962 is a form you must file with your federal income tax return for a year if you received an advanced premium tax credit through the Marketplace during that year.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 8963 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your IRS 8963 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete IRS 8963 online?

pdfFiller has made filling out and eSigning IRS 8963 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit IRS 8963 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your IRS 8963 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is IRS 8963?

IRS Form 8963 is used to report the operations of a business and its related entities to ensure compliance with various tax obligations.

Who is required to file IRS 8963?

Any entity that has a requirement to report financial information related to tax obligations and business activities must file IRS Form 8963.

How to fill out IRS 8963?

To fill out IRS Form 8963, you should gather all necessary financial documents, complete each section of the form accurately, and ensure that all required signatures are provided before submission.

What is the purpose of IRS 8963?

The purpose of IRS Form 8963 is to provide the IRS with critical information about a business's operations, which is used for monitoring tax compliance and determining tax obligations.

What information must be reported on IRS 8963?

IRS Form 8963 requires reporting of financial statements, the nature of the business operations, related entity information, and any other pertinent details that affect tax responsibilities.

Fill out your IRS 8963 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8963 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.