UK R40 2020 free printable template

Get, Create, Make and Sign UK R40

How to edit UK R40 online

Uncompromising security for your PDF editing and eSignature needs

UK R40 Form Versions

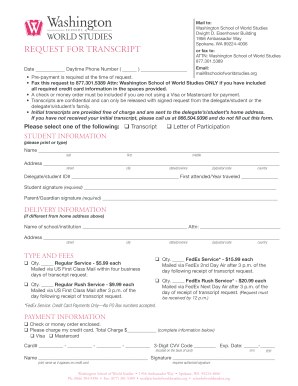

How to fill out UK R40

How to fill out UK R40

Who needs UK R40?

Instructions and Help about UK R40

Lesson 3 producing all mark 40 in this lesson I'll show you how to reduce your a payment claim form from within the PTP tax platform product unlike the other HMRC forms form our 40 is not displayed on screen for completion within PTP you actually complete an essay 100 return using a little more tax return product you'd then select their client tax returns print tax return and from within the print window you can choose to reduce formal 40 rather than the essay 100 completed all the necessary mappings have been carried out by our business analyst team and the form is completed correctly based on the entry is made within the essay 100

People Also Ask about

How do you fill in R40?

What is an R40?

How do I claim tax relief on PPI?

How do I reclaim my PPI tax back?

Is PPI refund classed as income?

Can I claim PPI myself?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the UK R40 in Chrome?

Can I create an eSignature for the UK R40 in Gmail?

How do I fill out UK R40 using my mobile device?

What is UK R40?

Who is required to file UK R40?

How to fill out UK R40?

What is the purpose of UK R40?

What information must be reported on UK R40?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.