Distinct Funding Solutions Hard Money Information free printable template

Show details

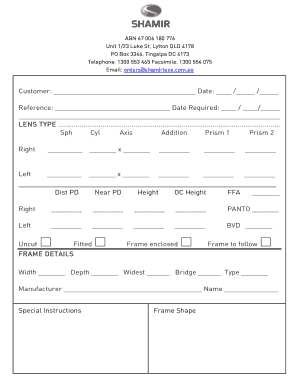

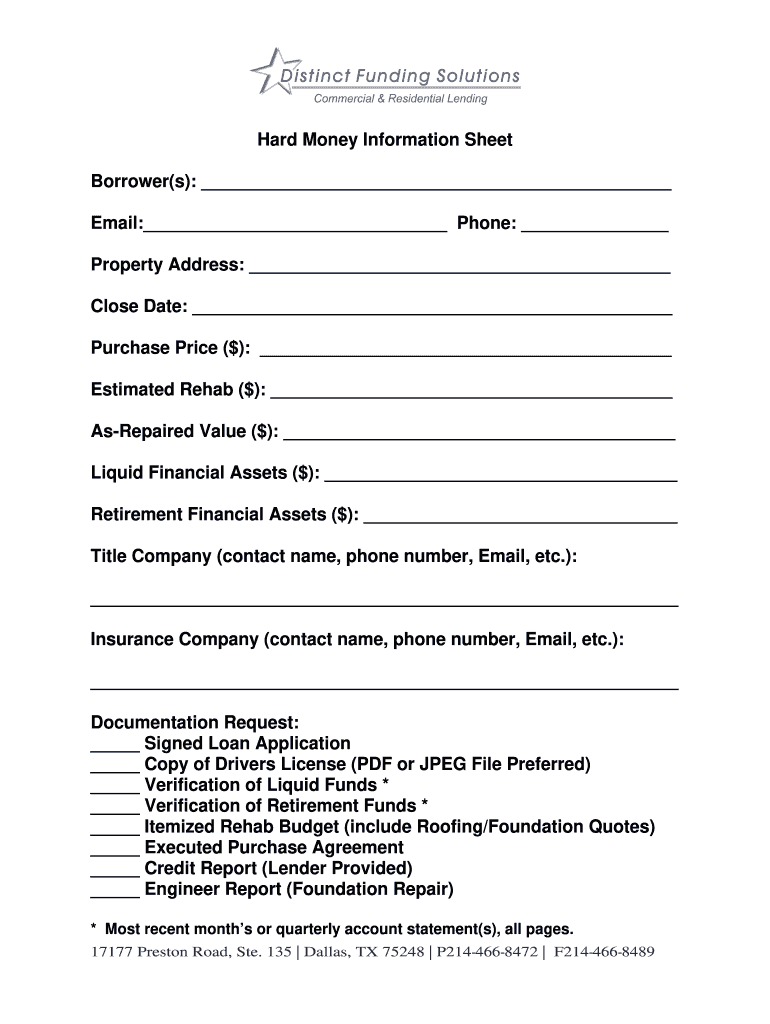

Hard Money Information Sheet Borrower(s): Email: Phone: Property Address: Close Date: Purchase Price ($): Estimated Rehab ($): Repaired Value ($): Liquid Financial Assets ($): Retirement Financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign borrowers slip form

Edit your borrower slip letter sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Distinct Funding Solutions Hard Money Information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Distinct Funding Solutions Hard Money Information online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Distinct Funding Solutions Hard Money Information. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Distinct Funding Solutions Hard Money Information

How to fill out Distinct Funding Solutions Hard Money Information Sheet

01

Start by entering your personal information, including your name, address, and contact details.

02

Provide details about the property in question, including its address and type (residential, commercial, etc.).

03

Specify the loan amount you are seeking and the purpose of the loan.

04

Include any relevant financial information, such as your income, assets, and liabilities.

05

Clearly state your investment strategy or plans for the property.

06

Attach any supporting documents, such as property appraisals or credit reports, if required.

07

Review all information for accuracy before submitting the form.

Who needs Distinct Funding Solutions Hard Money Information Sheet?

01

Real estate investors looking for financing options.

02

Individuals seeking to purchase properties quickly without traditional bank loans.

03

Borrowers needing funds for property rehabilitation or flipping.

04

Developers requiring short-term financing for projects.

Fill

form

: Try Risk Free

People Also Ask about

What is a borrowers slip form for?

A borrower‟s slip is a practice of displaying that you are borrowing something. It can be used in borrowing equipment in a laboratory or in other offices.

What is the purpose of borrowers?

A borrower is a person or business that receives money from a lender with the agreement to pay it back within a specified period of time.

What important information to write in the equipment borrower's form?

An equipment borrowing form template should include details about the item being borrowed, who is borrowing it (and for what), when the item will be returned, and so on.

What is borrower form?

The purpose of this form is to collect identifying information about the applicant, loan request, indebtedness, principals of the business, and information on current or previous government financing.

What is a 159 form?

The FCC Form 159 "Remittance Advice" and FCC Form 159-C “Continuation Sheet” is a multi-purpose form that must accompany payments to the Federal Communications Commission and is also provided after payment has been made to serve as a portion of the receipt.

What is the meaning of equipment borrowers form?

The borrower agrees to accept responsibility for the maintenance, control, and safekeeping of the equipment while it is signed out in his/her name and to return the equipment in good order and condition as it currently is, ordinary wear and tear alone excepted.

What is the second part of the borrower slip?

2. The borrower's ID should be atached to the duly filled-out slip. Transfer of borrowed materials to other borrowers is not allowed. The person whose name appears on the form is responsible for any damage/loss and returning all the items.

What important information to write in the equipment borrowers form?

An equipment borrowing form template should include details about the item being borrowed, who is borrowing it (and for what), when the item will be returned, and so on.

What is the purpose of borrowers?

Key Takeaways. The borrower is any business entity or person who seeks the help of financial institutions called lenders to borrow the desired funds for investment or personal use. The lender and the debtor must sign a legal loan agreement regarding repayment terms and the payment schedule for the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Distinct Funding Solutions Hard Money Information from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your Distinct Funding Solutions Hard Money Information into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send Distinct Funding Solutions Hard Money Information for eSignature?

Once your Distinct Funding Solutions Hard Money Information is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit Distinct Funding Solutions Hard Money Information on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign Distinct Funding Solutions Hard Money Information. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is Distinct Funding Solutions Hard Money Information Sheet?

The Distinct Funding Solutions Hard Money Information Sheet is a document that provides essential information about hard money loans offered by Distinct Funding Solutions, including terms, conditions, and loan specifics.

Who is required to file Distinct Funding Solutions Hard Money Information Sheet?

Individuals or entities applying for hard money loans from Distinct Funding Solutions are required to file the Hard Money Information Sheet.

How to fill out Distinct Funding Solutions Hard Money Information Sheet?

To fill out the Distinct Funding Solutions Hard Money Information Sheet, applicants need to provide accurate personal and financial information, details about the property in question, and any other required documentation as specified in the instructions.

What is the purpose of Distinct Funding Solutions Hard Money Information Sheet?

The purpose of the Distinct Funding Solutions Hard Money Information Sheet is to collect necessary information from borrowers to assess their eligibility for hard money loans and to streamline the loan approval process.

What information must be reported on Distinct Funding Solutions Hard Money Information Sheet?

The information that must be reported includes the borrower's name, contact information, financial details, property address, loan amount requested, and purpose of the loan.

Fill out your Distinct Funding Solutions Hard Money Information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Distinct Funding Solutions Hard Money Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.