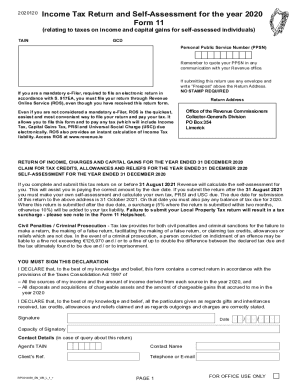

What is Form 11?

Form 11 is called the Pay and File Income Tax Return. It must be completed by the individuals chargeable under self-assessment. This self-assessment tax return must be filled out by all self-employed individuals. Those who have nontaxable investment or rental income must also complete this form. Civil partners and married couples must file a single form that will show total income. If you want to file separately, you may make an official election.

What is Form 11 for?

You must use this form to report your income. Be careful when completing it as everything indicated in the document will be shown in the assessment. All your income must be described in the form.

When is Form 11 Due?

You must submit your tax return by 31 October 2017. It will be your annual income report. If you fulfill this deadline, the Revenue Office will calculate your tax liability. If you file your form after 31 August, you will have to calculate it by your own.

Is Form 11 Accompanied by Other Forms?

You may be required to provide your bank details when filing this form. No other attachments are required.

What Information do I Include in Form 11?

You must include the following information in the Pay and File Income Tax Return Form:

-

Nature of primary trade, business or activity;

-

Business address;

-

Main residence address;

-

Telephone;

-

PPS number;

-

Bank details;

-

Marital status;

-

Date of birth;

-

Type of assessment;

-

Income details.

The return must be signed and dated.

Where do I Send Form 11?

Submit your tax return to the following address:

Office of the Revenue Commissioners,

Collector General’s Division,

PO Box 354,

Limerick.