India Form J 2009 free printable template

Get, Create, Make and Sign India Form J

How to edit India Form J online

Uncompromising security for your PDF editing and eSignature needs

India Form J Form Versions

How to fill out India Form J

How to fill out India Form J

Who needs India Form J?

Instructions and Help about India Form J

I'm going to give you guys three numbers. A three number sequence and I have a rule in mind that these three numbers obey and I want you to try to figure out what that rule is. But the way you can get information is by proposing your own set of three numbers, to which I will say yes that follows my rule or no it doesn't follow my rule. And then you can propose what you think the rule is. Is that fair? Okay, so here are the three numbers: 2, 4, 8. 2, 4, 8. You don't need to continue the sequence, you can propose a totally different sequence, whatever you want to propose, and I will simply say yes or no 2, 4, 8? 16, 32 16 32 and 64? Those also follow my rule. Ok What's the rule you think? Multiply by 2? That is... not my rule. What? That's not my rule. But you're allowed, if you want, propose 3 other numbers. 3, 6, 12. 3, 6, 12? Follows my rule. 10, 20, 40. That follows the rule. I'm still multiplying by two I know [Laughter] I know what you're doing. And yes it follows my rule but no it's not my rule. 5, 10 and 20? Follows my rule 100, 200, 400? Follows my rule 500, 1000, 2000 Follows my rule. You want me to keep going? But do I just keep going? Are you going to tell me or what? [Laughter] Am I doing it the wrong way? Am I approaching this the wrong way? You're totally fine, but you're approaching the way most people approach it. Like think strategically about this. You want information. I have information. The point of the three numbers, right, is to allow you to figure out what the rule is. Okay, I'm going to give you the numbers that I don't think fits the sequence and see what you'll say. So I'll say 2, 4, 7. Fits my rule So, whatever I propose is right? So, is your rule like you can propose any number? So, the rule is anything we say is yes? No Damn it [Laughter] But you were on the right track now. Hit me with three numbers. 3, 6, 9. Follows my rule. Hmm... Oh, that didn't follow my rule. This is good, right? 5, 10, 15. That follows my rule. What? Oh... Really? Yeah, I don't believe this. 1, 2, 3? Follows the rule What about 7, 8, 9? [Laughter] Yes, that follows the rule. 8 16 39 Fits the rule. Excellent. But we're no closer to the rule. I want you get to the rule. How about 1, 7, 13 ? Follows the rule. 11, 12, 13? How does this make sense? Follows the rule. 10, 9, 8? I don't know how to do this. Does not follow the rule. 10, 9, 8 does not. Oh, so, is it all in ascending order? Boo, yeah! Up top! Yes. First ones to get it. You guys nailed it That's the rule That's the rule. Numbers in increasing order. WWW Numbers in ascending order 1, 2, 3, 4, 5, 6, 10, 15, 25, doesn't matter. Any numbers in ascending order. I was inspired to make this video by the book the black swan by Passim Tale. Now, the black swan is a metaphor for the unknown and the unexpected. I mean in the old world the theory was that all swans were white. So, each instance of a white swan would make you think, “Yeah, that theory is pretty good.” But the point is you can...

People Also Ask about

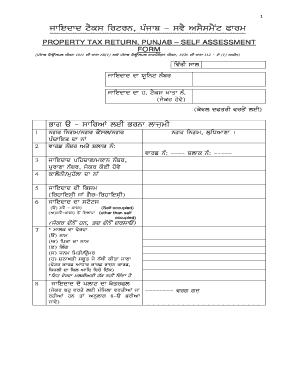

What is the form J for agricultural income in India?

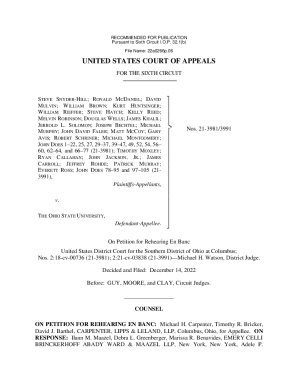

What does approved i485j mean?

What is the difference between i485 and i485j?

What is i485j form?

What is supplement J form?

What is the Schedule J form?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify India Form J without leaving Google Drive?

How do I make changes in India Form J?

Can I sign the India Form J electronically in Chrome?

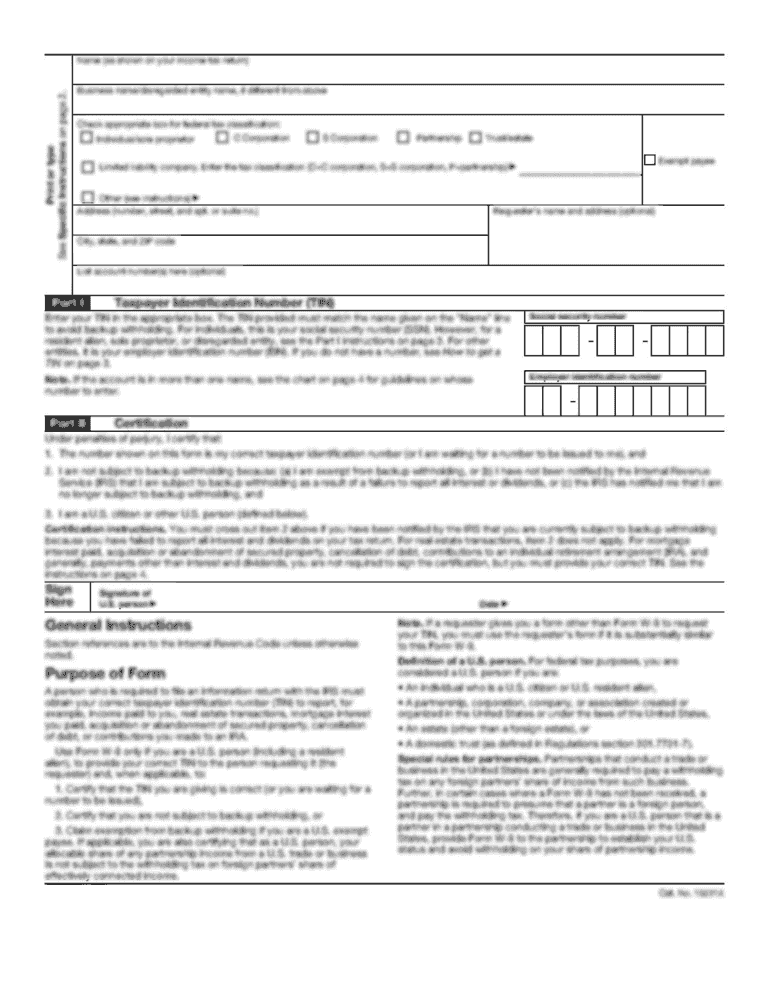

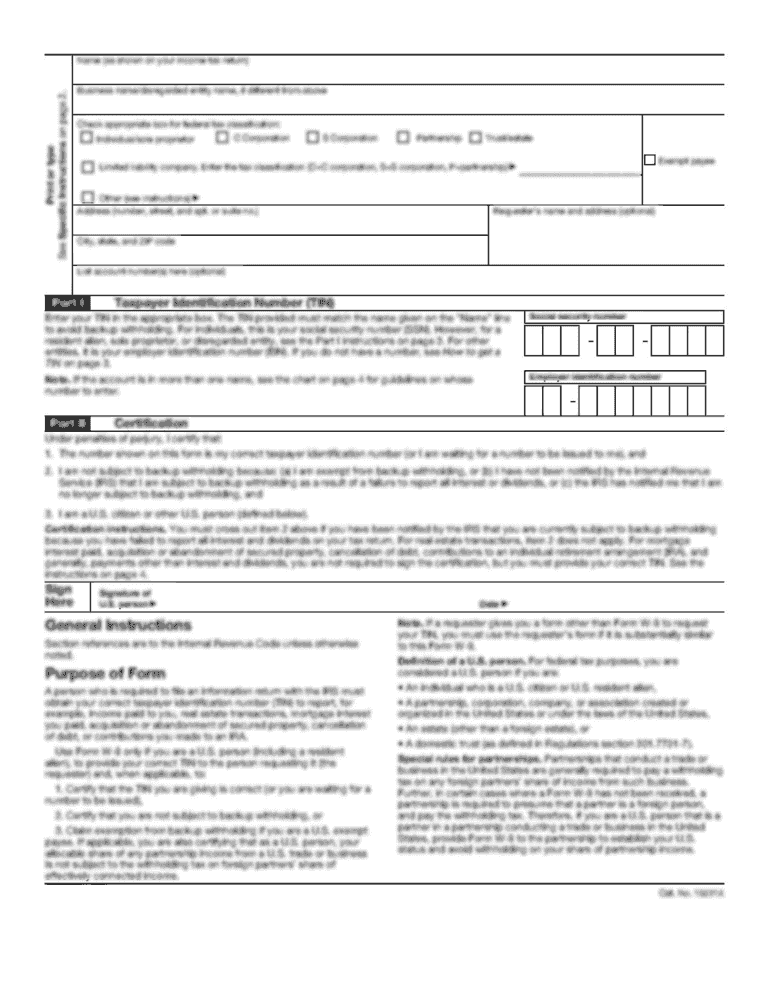

What is India Form J?

Who is required to file India Form J?

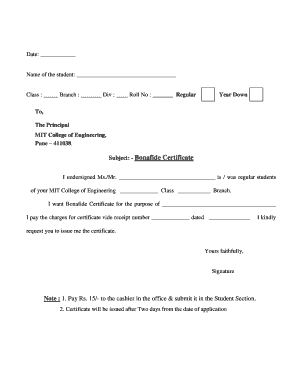

How to fill out India Form J?

What is the purpose of India Form J?

What information must be reported on India Form J?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.