UK CT600 2020 free printable template

Show details

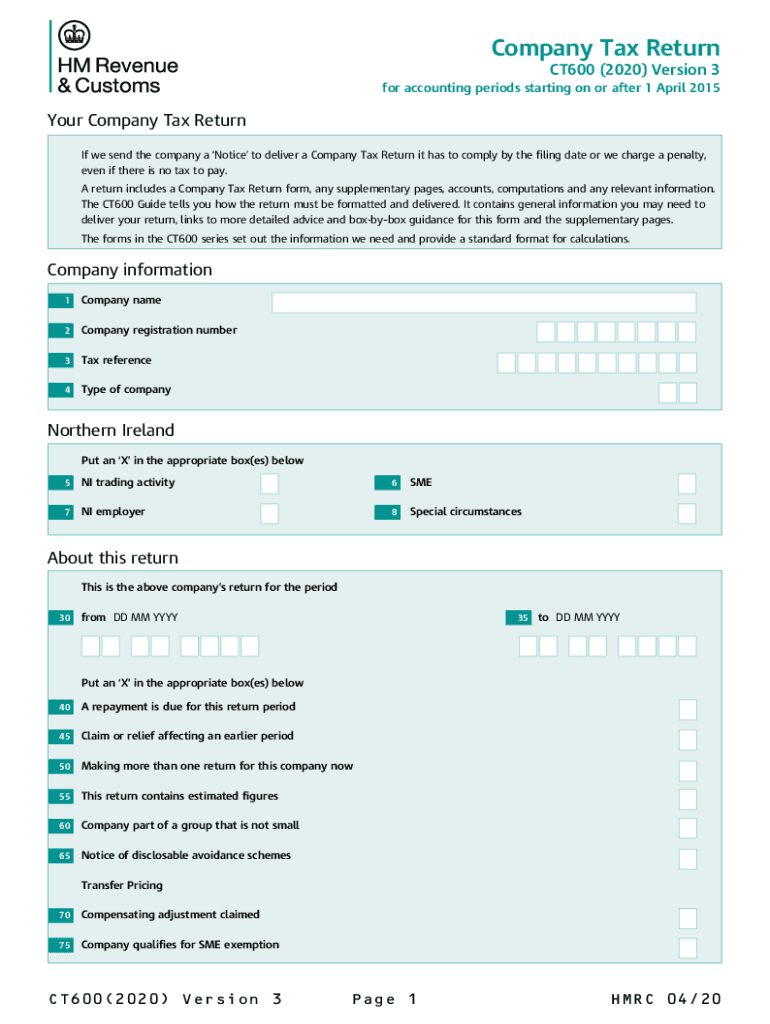

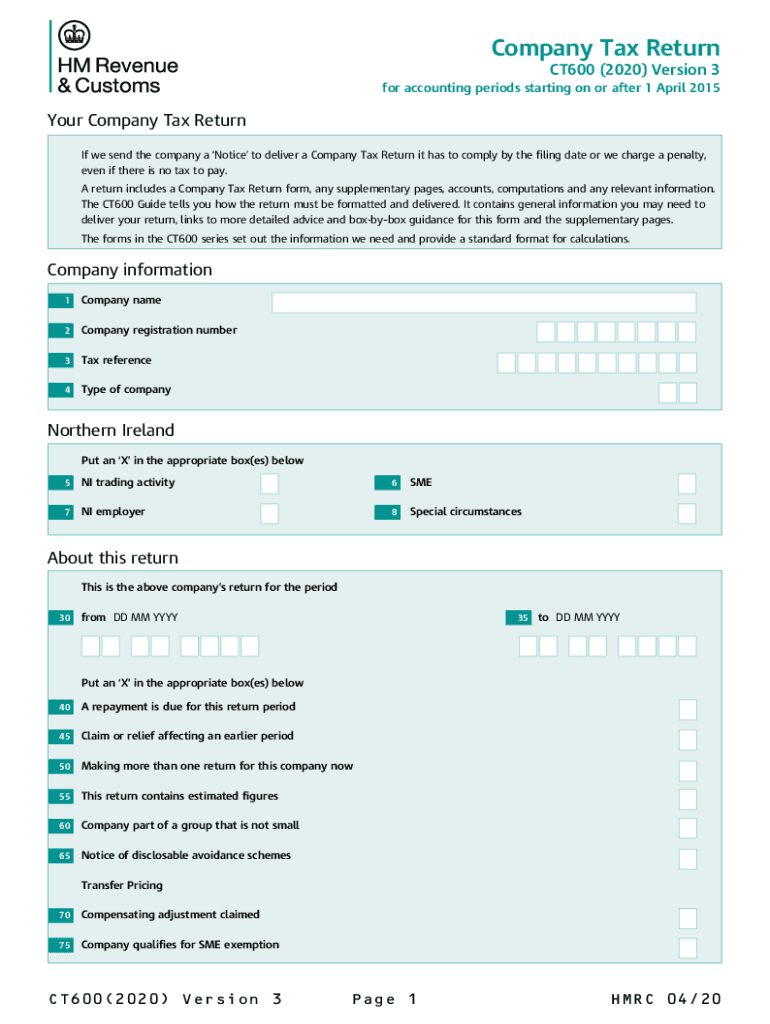

Company Tax Return

CT600 (2020) Version 3for accounting periods starting on or after 1 April 2015Your Company Tax Return we send the company a Notice to deliver a Company Tax Return it has to comply

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK CT600

Edit your UK CT600 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK CT600 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK CT600 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UK CT600. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

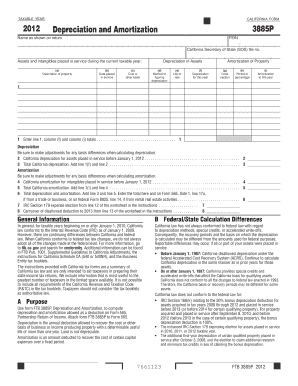

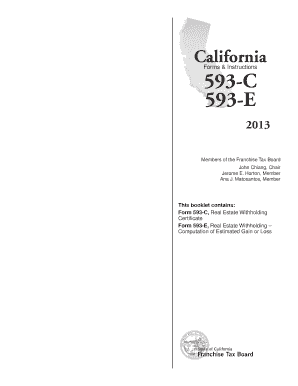

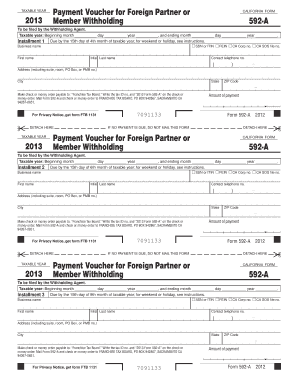

UK CT600 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK CT600

How to fill out UK CT600

01

Obtain the CT600 form from the HMRC website or through your accountant.

02

Fill out your company's name and registration number at the top of the form.

03

Complete the accounting period details including the start and end dates.

04

Enter the company's financial figures including income, expenses, and profit.

05

Calculate the corporation tax payable based on the profits recorded.

06

Provide any additional information as required, such as claims for reliefs or adjustments.

07

Review the completed form for accuracy.

08

Submit the completed CT600 electronically via HMRC's online service or by mail if necessary.

Who needs UK CT600?

01

Any company based in the UK or operating in the UK that is liable for corporation tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the CT600?

A CT600 form is part of a Company Tax Return. The form and other supporting documents constitute the Company Tax Return, which must be submitted to HMRC if a company receives a 'Notice to Deliver a Company Tax Return'. Limited companies use the information in a CT600 form to calculate the Corporation Tax that they owe.

Can Corporation Tax losses be offset against capital gains?

Corporate capital losses in a nutshell Such losses are deducted from any chargeable gains which the company has for the same accounting period. If there are insufficient gains to make use of all or part of a loss in this way, the remainder is carried forward for set off against gains of future periods.

How do I carry back Corporation Tax losses on CT600?

Summary of the steps: Go to the Trading profit screen in the later loss making period. Enter the loss in the Loss to carry back to previous period in the Trading losses summary section. Tick Claim or relief affecting an earlier period in the company information screen. Go to the previous profit making period.

Can you carry back Corporation Tax losses?

You can make a claim to carry back a trading loss when you submit your Company Tax Return for the period when you made the loss. You can make your claim in your return or in an amendment to the return, as long as you're within the time limit to amend it. You can also make your claim in a letter.

Who can approve CT600?

Form CT600 which must be signed by an authorised signatory; director, company secretary, or authorised tax representative. The Company accounts, known as statutory accounts.

How to print CT600?

How do I print a copy of my return? Open the tax return. Click on Check and Finish. Click on Print. Click on Next Step in the HMRC warning message (if applicable). Specify which options you require from the printing preferences list.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in UK CT600 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your UK CT600, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the UK CT600 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your UK CT600 in seconds.

How do I fill out UK CT600 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your UK CT600. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is UK CT600?

The UK CT600 is a corporate tax return that companies in the UK must file annually to report their income, expenses, and calculate their Corporation Tax liability.

Who is required to file UK CT600?

All companies in the UK that are registered for Corporation Tax and have made profits are required to file the UK CT600.

How to fill out UK CT600?

To fill out the UK CT600, companies need to provide accurate financial information, including income, expenses, and tax calculations, using the appropriate sections of the form.

What is the purpose of UK CT600?

The purpose of the UK CT600 is to report a company's financial performance and determine the amount of Corporation Tax that is owed to HM Revenue and Customs (HMRC).

What information must be reported on UK CT600?

The UK CT600 must include details such as company name, registered number, accounting period, profit before tax, taxable profits, deductions, and the calculation of Corporation Tax owed.

Fill out your UK CT600 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK ct600 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.