Get the free Non-motor Claims

Show details

This document serves as a claim form for losses or damages under R20,000 to be submitted to Zurich Insurance Company South Africa Limited.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-motor claims

Edit your non-motor claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-motor claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-motor claims online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-motor claims. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

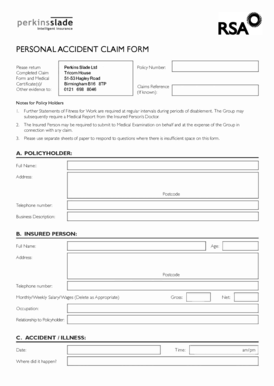

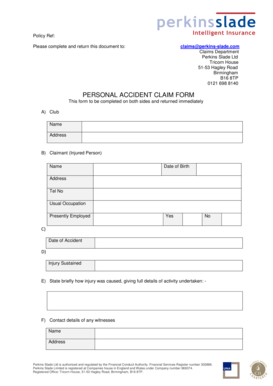

How to fill out non-motor claims

How to fill out Non-motor Claims

01

Gather all necessary documentation related to your non-motor claim.

02

Fill out the claim form provided by the insurance company.

03

Provide personal details such as name, address, and contact information.

04

Include details of the incident that led to the claim, including dates and descriptions.

05

Attach supporting documents like photos, police reports, or witness statements.

06

Review the completed form for accuracy and completeness.

07

Submit the claim form along with all attachments to the appropriate insurance department.

08

Keep a copy of the submitted claim for your records.

Who needs Non-motor Claims?

01

Individuals who have sustained damage or loss to non-motor assets.

02

Property owners seeking compensation for theft, vandalism, or damage.

03

Businesses that experience financial loss due to non-motor related incidents.

04

Homeowners needing to claim for damages specific to homeowners insurance.

05

Renters who want to claim for personal belongings lost or damaged.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of non-motor insurance?

This insurance provides coverage for legal liability made by third parties against the insured under the following circumstances: For accidental loss or damage to property that belong to a third party. Bodily injury or death to a third party.

What is the meaning of motor claims?

Motor insurance claims allow you to receive benefits from your motor insurance insurer for repairs or replacing damaged vehicle parts. This process provides financial help for vehicle repairs, medical expenses and injuries from accidents.

What is a motor claim?

Motor insurance claims allow you to receive benefits from your motor insurance insurer for repairs or replacing damaged vehicle parts. This process provides financial help for vehicle repairs, medical expenses and injuries from accidents.

How many claims does a motor insurance have?

The ABI's latest claims data shows: Over the course of 2024 insurers dealt with 2.4 million motor insurance claims.

What does a claim mean in car insurance?

An auto insurance claim is essentially your way of notifying your insurance provider that you'll need to use your policy to cover expenses after your car is damaged in a covered incident.

How to fill a motor claim form?

Apart from these details, the insurance company will require the policyholder to furnish the following details related to the accident: Date and time of the accident. Location of loss. Vehicle number. Model and make of vehicle. Brief description of the accident.

How many claims does a motor insurance have?

The ABI's latest claims data shows: Over the course of 2024 insurers dealt with 2.4 million motor insurance claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Non-motor Claims?

Non-motor claims refer to insurance claims that relate to damages or losses not involving vehicles. This can include claims for property damage, liability, or personal injury that do not arise from a motor vehicle incident.

Who is required to file Non-motor Claims?

Individuals or entities that have incurred a loss or damage unrelated to motor vehicles are required to file non-motor claims. This typically includes property owners, tenants, or individuals seeking damages for liability or personal injuries.

How to fill out Non-motor Claims?

To fill out non-motor claims, one should obtain the appropriate claim form from the insurance provider, complete all required fields with accurate information regarding the incident, describe the nature of the claim, provide any supporting documents or evidence, and submit the form as directed by the insurer.

What is the purpose of Non-motor Claims?

The purpose of non-motor claims is to provide a mechanism for policyholders to seek compensation for losses or damages that occur outside of motor vehicle incidents, ensuring they are financially protected against various types of risks.

What information must be reported on Non-motor Claims?

The information that must be reported on non-motor claims typically includes the claimant's personal details, details of the incident (date, time, location), a description of the loss or damage, any involved parties, relevant policy information, and supporting evidence such as photographs or repair estimates.

Fill out your non-motor claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Motor Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.