PA DoR REV-516 2019-2025 free printable template

Show details

5160019105

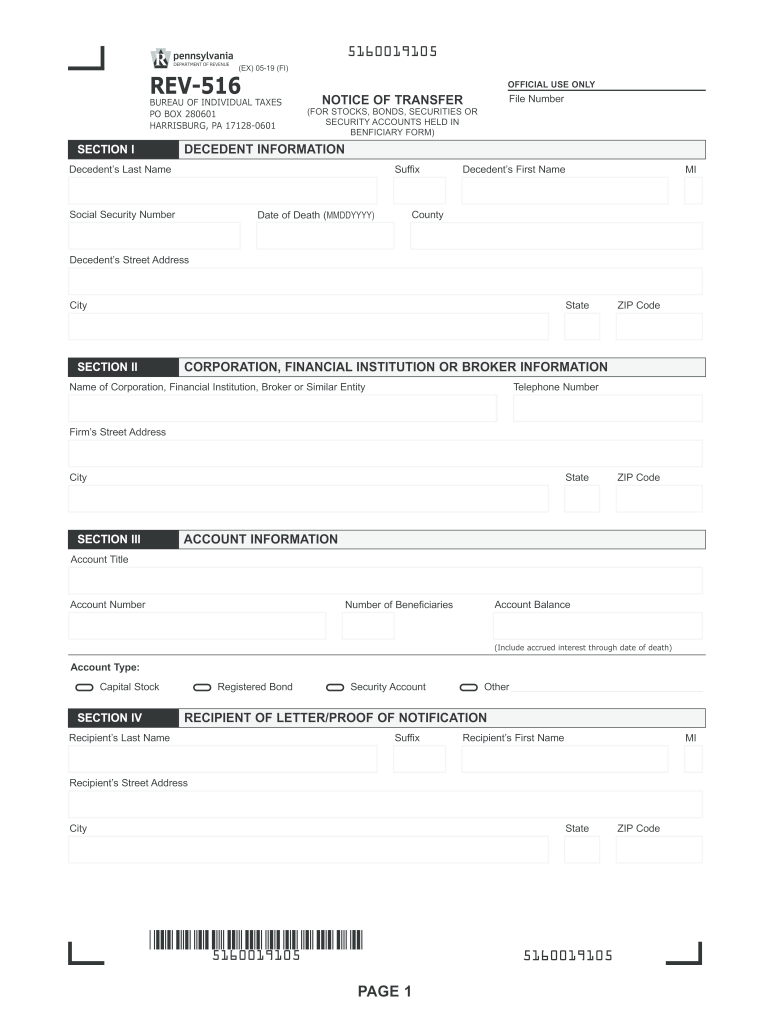

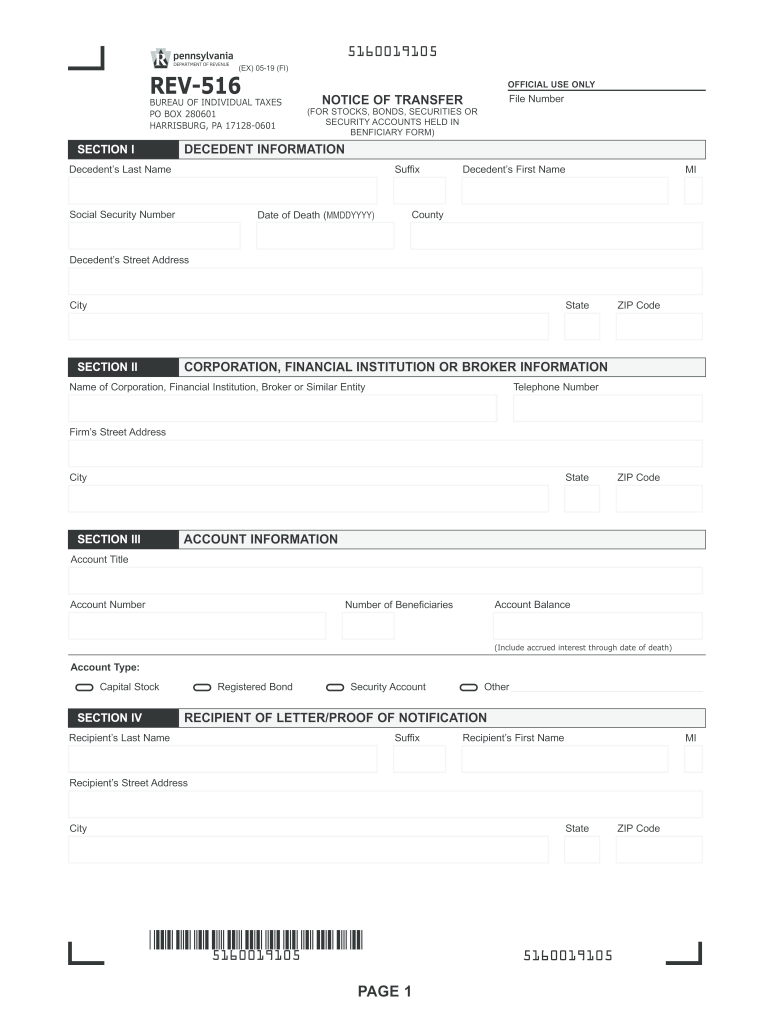

(EX) 0519 (FI)REV516OFFICIAL USE ONLYBureau of Individual Taxes

Po Box 280601

Harrisburg, Pa 171280601SECTION File NumberNOTICE OF TRANSFER

(FOR STOCKS, BONDS, SECURITIES OR

SECURITY ACCOUNTS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rev 516 tax form

Edit your rev 516 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa rev 516 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pa rev 516 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rev516 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR REV-516 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pennsylvania rev 516 form

How to fill out PA DoR REV-516

01

Obtain the PA DoR REV-516 form from the Pennsylvania Department of Revenue's website.

02

Fill out your personal information including your name, address, and contact details at the top of the form.

03

Provide the details of the property or transaction involved in the declaration.

04

Indicate the applicable tax period and any relevant identification numbers.

05

Review the instructions provided on the form for any specific requirements related to your situation.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form as directed, either electronically or by mail.

Who needs PA DoR REV-516?

01

Individuals or businesses that have undergone a change in tax-related status in Pennsylvania.

02

Anyone looking to declare specific transactions or properties for tax purposes.

03

Tax professionals assisting clients with property or transaction declarations.

Fill

tax rev 516

: Try Risk Free

People Also Ask about tax 516

What assets are not subject to PA inheritance tax?

Property owned jointly between spouses is exempt from inheritance tax.

What assets are exempt from PA inheritance tax?

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%. Inheritance tax returns are due nine calendar months after a person's death.

What IRS form do I use for inheritance?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

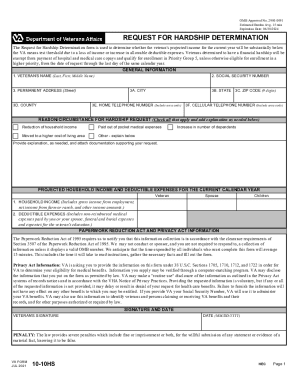

What is PA Rev 516 form for?

Form REV-516 "Notice of Transfer"(Stocks,Bonds, Securities or Security Accounts held in Beneficiary Form) to request Waiver Notice of Transfer, must be completed and submitted to Form REV-998 and Form REV-999 have replaced PA Schedule D(P/S).

How do I get around PA inheritance tax?

How To Avoid Inheritance Tax. One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.

How much can you inherit without paying federal taxes?

ing to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 516 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your rev 516 pdf and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit rev 516 2019-2025 form online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your rev 516 2019-2025 form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out rev 516 2019-2025 form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign rev 516 2019-2025 form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is PA DoR REV-516?

PA DoR REV-516 is a Pennsylvania Department of Revenue form used for reporting and remitting certain types of taxes owed by individuals or businesses in the state.

Who is required to file PA DoR REV-516?

Individuals and businesses that owe specific taxes, such as personal income tax or certain business taxes, are required to file PA DoR REV-516.

How to fill out PA DoR REV-516?

To fill out PA DoR REV-516, you need to provide your personal or business information, report your income, calculate the tax owed, and then provide the payment information as instructed on the form.

What is the purpose of PA DoR REV-516?

The purpose of PA DoR REV-516 is to ensure compliance with Pennsylvania tax laws by collecting information about taxes owed and facilitating the remittance of those taxes to the state.

What information must be reported on PA DoR REV-516?

The information that must be reported on PA DoR REV-516 includes taxpayer identification details, income details, the tax calculation, and any applicable adjustments or payments.

Fill out your rev 516 2019-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev 516 2019-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.