IRS Schedule R (Form 941) 2020 free printable template

Show details

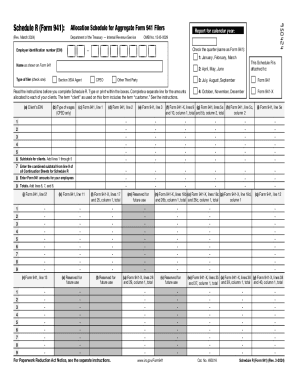

Allocation Schedule for Aggregate Form 941 Filers(Rev. June 2020)Department of the Treasury Internal Revenue ServiceEmployer identification number (EIN)950420Schedule R (Form 941):Report for calendar

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Schedule R Form 941

Edit your IRS Schedule R Form 941 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Schedule R Form 941 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Schedule R Form 941 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Schedule R Form 941. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Schedule R (Form 941) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Schedule R Form 941

How to fill out IRS Schedule R (Form 941)

01

Obtain a copy of IRS Schedule R (Form 941) from the IRS website or your tax professional.

02

Fill in your business's name and EIN (Employer Identification Number) at the top of the form.

03

Review your eligibility for the section where you report qualified sick leave wages and qualified family leave wages.

04

Complete the section for reporting amounts from Form 941 to allocate the credit to the correct quarters.

05

Provide details on the number of employees and the total qualified wages paid during the designated period.

06

Calculate the total credit you will claim for qualified wages.

07

Sign and date the form, and ensure all figures are correct before submitting.

Who needs IRS Schedule R (Form 941)?

01

Employers who claim the credit for qualified sick and family leave wages under the Families First Coronavirus Response Act (FFCRA).

02

Employers with some employees who are eligible for credits under the Employee Retention Credit.

03

Organizations that need to allocate expenses between multiple entities or lines of business.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file form 941?

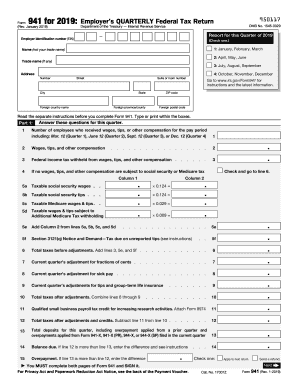

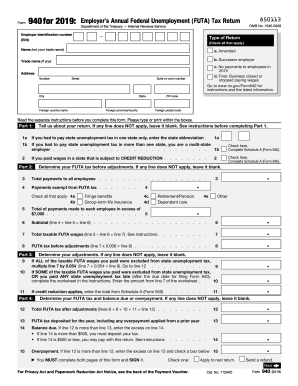

Who must file Form 941. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters.

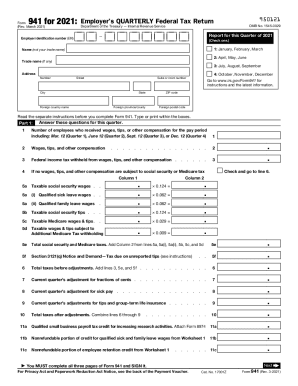

Is there a new 941 form for 3rd Quarter 2022?

TaxBandits has updated its e-filing process ingly and the third quarter Form 941 for 2022 is now available for e-filing. It will come as a welcomed relief to employers that there are no notable changes to the form for the upcoming third quarter deadline.

Is there a new Schedule B form 941 for 2022?

Is there a new 941 Schedule B for 2022? The IRS Form 941 Schedule B for 2022 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Businesses that acquire more than $100,000 in liabilities during a single day in the tax year are also required to begin filing this Schedule.

Do I need to file form 941 if no wages were paid?

Do I Have to File Form 941 If No Wages Were Paid? Most employers need to file Form 941 even if no wages were paid. However, there are a few exceptions, including employers of seasonal employees, household employees, or farm employees. However, other IRS forms may be required.

Do you have to file form 941 if no payroll?

Do I Have to File Form 941 If No Wages Were Paid? Most employers need to file Form 941 even if no wages were paid. However, there are a few exceptions, including employers of seasonal employees, household employees, or farm employees. However, other IRS forms may be required.

What is Form 941 and when must it be filed?

Generally, you must file Form 941, Employer's QUARTERLY Federal Tax Return or Form 944, Employer's ANNUAL Federal Tax Return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of

Is there a new form 941?

IRS has released an updated Form 941 for the second & third quarter of 2022, there are a few notable changes that employers will need to be aware of Employers who are required to report federal income taxes, social security taxes, or medicare taxes withheld from their employees' paychecks must submit the new revised

Who Must File form 941?

Most businesses are required to file Form 941 quarterly, with a few exceptions. Seasonal businesses only need to file for the quarters in which they are operating. Businesses that hire farm workers or household employees, such as a maid, also don't need to file Form 941 (but do need to file Schedule H from Form 1040).

How long do you have to amend 941 for employee retention credit?

You may claim the employee retention credit using Form 941-X within 3 years of the date the original Form 941 was filed or 2 years from the date you paid the tax reported on Form 941, whichever is later.

Under which condition is an employer not required to file a quarterly form 941?

Most businesses are required to file Form 941 quarterly, with a few exceptions. Seasonal businesses only need to file for the quarters in which they are operating. Businesses that hire farm workers or household employees, such as a maid, also don't need to file Form 941 (but do need to file Schedule H from Form 1040).

What is form 941 and when must it be filed?

Generally, you must file Form 941, Employer's QUARTERLY Federal Tax Return or Form 944, Employer's ANNUAL Federal Tax Return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of

What is a schedule R?

Use Schedule R (Form 1040) to figure the credit for the elderly or the disabled.

Do I need to amend 941 to claim employee retention credit?

For any tax year when wages were withheld and an Employer Retention Credit (ERC) connected to these previously withheld wages was received in a future year, taxpayers must file an updated tax return by IRS Notice 2021-49. So, you will have to amend your tax return to claim ERC.

What happens if you don't file form 941?

If you fail to File your Form 941 or Form 944 by the deadline: Your business will incur a penalty of 5% of the total tax amount due. You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.

What is a 941 R?

The Schedule R (Form 941) will provide the IRS with client-specific information to support the totals reported on an aggregate Form 941. It includes an allocation line for each client showing a breakdown of their wages and employment tax liability for the tax period.

Is there a new 941 form for 2022?

On June 23, the IRS released an updated Form 941 for the second quarter of 2022, with a few notable changes that employers need to be aware of. The tax relief programs that were passed under the American Rescue Plan Act are continuing to expire and 2022 Form 941 for the second quarter reflects these changes.

What is a form 941 used for?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

How do I get a copy of my 941 from the IRS?

Call 800-829-3676.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS Schedule R Form 941 online?

pdfFiller has made it easy to fill out and sign IRS Schedule R Form 941. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in IRS Schedule R Form 941?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your IRS Schedule R Form 941 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I fill out IRS Schedule R Form 941 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your IRS Schedule R Form 941 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

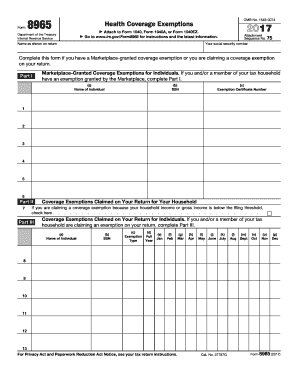

What is IRS Schedule R (Form 941)?

IRS Schedule R (Form 941) is a form used by employers to report their share of the Credit for Sick Leave and Family Leave Wages under the Families First Coronavirus Response Act (FFCRA).

Who is required to file IRS Schedule R (Form 941)?

Employers who paid qualified sick leave and family leave wages under the FFCRA must file IRS Schedule R (Form 941) to claim the related tax credits.

How to fill out IRS Schedule R (Form 941)?

To fill out IRS Schedule R (Form 941), employers should complete the form by providing information about the number of employees, the wages paid for sick leave and family leave, and the calculation of eligible tax credits.

What is the purpose of IRS Schedule R (Form 941)?

The purpose of IRS Schedule R (Form 941) is to enable employers to claim credits for the sick leave and family leave wages provided to employees, as mandated by the FFCRA.

What information must be reported on IRS Schedule R (Form 941)?

The information that must be reported on IRS Schedule R (Form 941) includes the number of employees, total sick leave and family leave wages paid, and the calculation of credits being claimed.

Fill out your IRS Schedule R Form 941 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Schedule R Form 941 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.