Get the free st108e

Show details

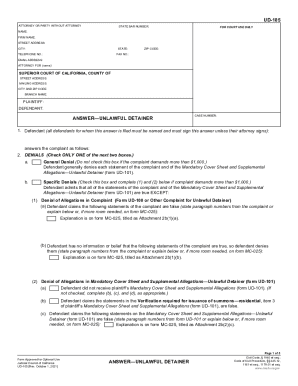

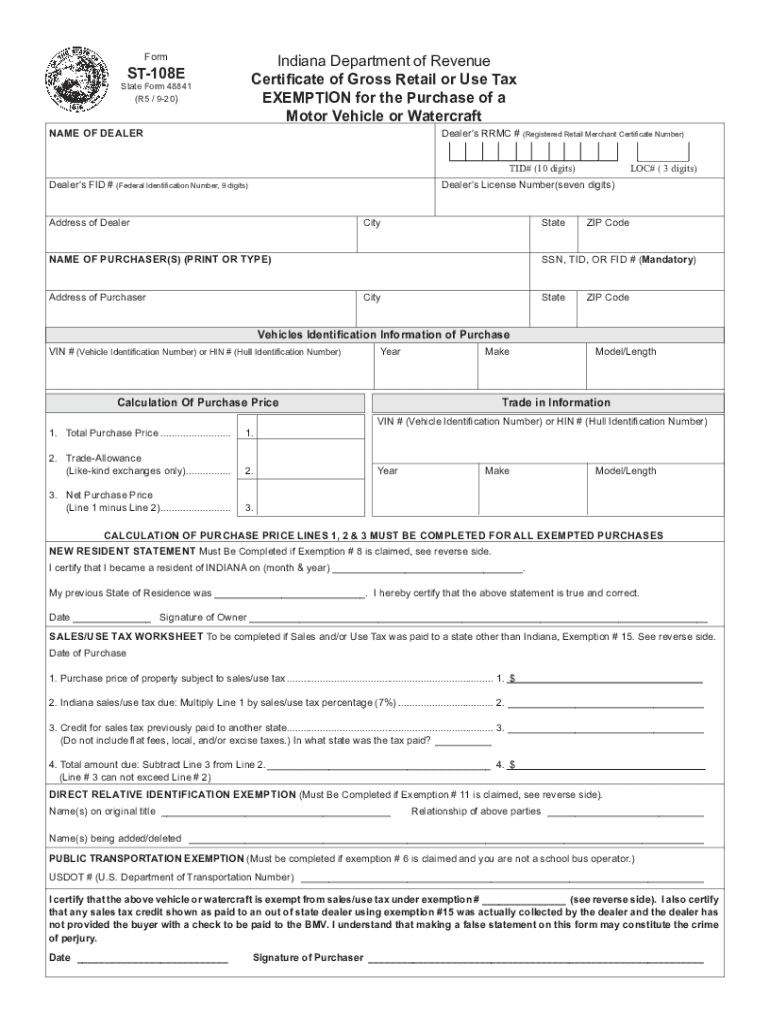

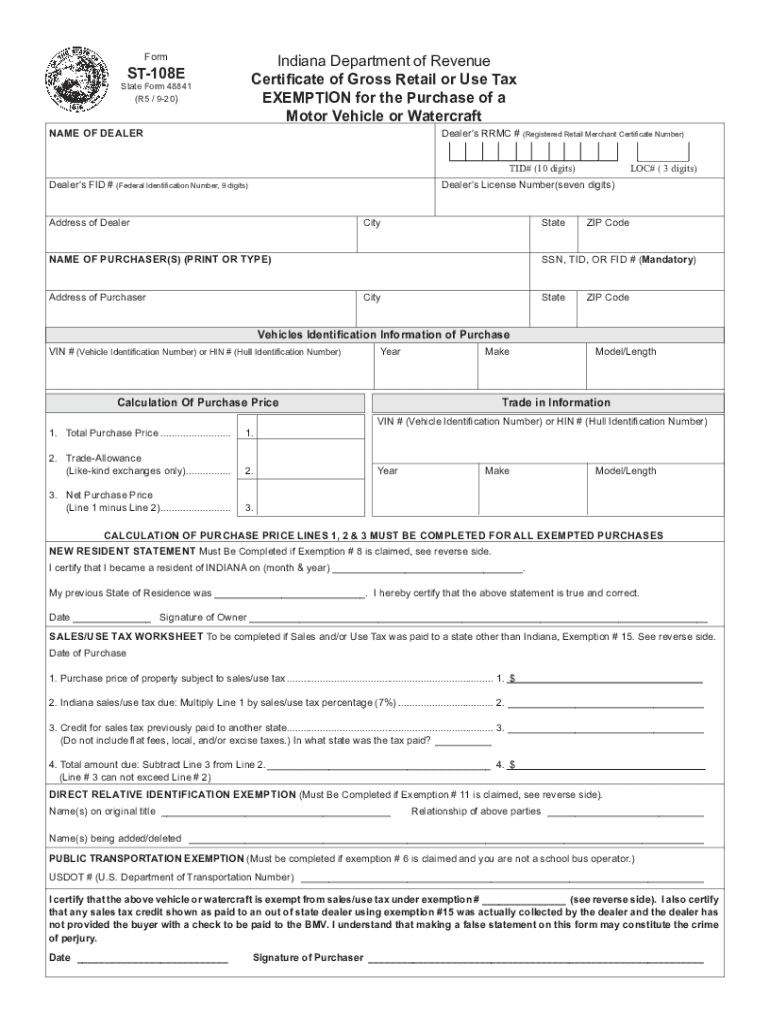

Form Indiana Department of Revenue Certificate of Gross Retail or Use Tax EXEMPTION for the Purchase of a Motor Vehicle or Watercraft ST-108E State Form 48841 R4 / 3-08 NAME OF DEALER Dealer s RRMC Registered Retail Merchant Certificate Number Dealer s FID Federal Identification Number 9 digits Dealer s License Number seven digits TID 10 digits Address of Dealer City State NAME OF PURCHASER S PRINT OR TYPE Address of Purchaser LOC 3 digits Zip Code SSN TID OR FID...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st108e

Edit your st108e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st108e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st108e online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit st108e. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st108e

How to fill out IN ST-108E

01

Obtain the IN ST-108E form from the appropriate tax authority website or office.

02

Fill in your personal information, including name, address, and taxpayer identification number.

03

Provide the details of the transactions for which you are claiming the exemption.

04

Ensure you include the necessary documentation to support your claim.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form before submitting it to the required tax authority.

Who needs IN ST-108E?

01

Businesses and individuals seeking tax exemptions on certain eligible purchases.

02

Entities that have made exempt purchases related to specific tax activities or programs.

03

Anyone looking to claim sales tax exemptions for purchases covered under the relevant tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a ST 108 form in Indiana?

The ST-108 allows the dealer to indicate the amount of tax collected from the purchaser. The dealer is then required to submit the sales/use tax to the Department of Revenue on a sales and use tax report.

How do I get a resale certificate in Indiana?

Indiana does not require registration with the state for a resale certificate. How can you get a resale certificate in Indiana? To get a resale certificate in Indiana, you will need to fill out the Indiana General Sales Tax Exemption Certificate (ST-105).

Does Indiana sales tax exemption expire?

There is typically no fee to renew an exemption. Of the 11 states, all but two (Alabama and Indiana) exempt entities for five year periods.

What qualifies for tax exempt in Indiana?

While the Indiana sales tax of 7% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Indiana.Other tax-exempt items in Indiana. CategoryExemption StatusFood and MealsMachineryEXEMPTRaw MaterialsEXEMPTUtilities & FuelEXEMPT19 more rows

What is the sales tax on a car in Ohio?

Ohio's 5.75% sales tax rate applies to all car sales, but your specific rate will also depend on your county and local taxes.

What are the sales tax rules for Indiana?

If your business sells goods or tangible personal property, you'll need to register to collect a seven percent sales tax. This registration allows you to legally conduct retail sales in the state of Indiana.

What is Form ST 108 in Indiana?

The ST-108 allows the dealer to indicate the amount of tax collected from the purchaser. The dealer is then required to submit the sales/use tax to the Department of Revenue on a sales and use tax report.

What qualifies for sales tax exemption in Indiana?

Purchases of tangible personal property, accommodations, or utilities made directly by the United States government, its agencies, and instrumentalities are exempt from Indiana sales tax. Sales by these same entities are also exempt from sales tax.

How do I fill out a title application in Indiana?

0:41 4:13 Indiana Title Transfer Instructions - Seller - YouTube YouTube Start of suggested clip End of suggested clip Reading exactly as it appears on the odometer. And the space provided. That's not required that'sMoreReading exactly as it appears on the odometer. And the space provided. That's not required that's more than 10 years. Old. Make sure that you don't include tents.

How long are Indiana tax exempt certificates valid?

Tax exemption certificates last for one year in Alabama and Indiana. Certificates last for five years in at least 9 states: Florida, Illinois, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find st108e?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific st108e and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit st108e on an Android device?

You can edit, sign, and distribute st108e on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete st108e on an Android device?

Use the pdfFiller Android app to finish your st108e and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is IN ST-108E?

IN ST-108E is a sales tax exemption certificate that allows certain organizations or individuals to make tax-exempt purchases in Indiana.

Who is required to file IN ST-108E?

Organizations that claim tax-exempt status, such as non-profit organizations, religious institutions, and government entities, are required to file IN ST-108E.

How to fill out IN ST-108E?

To fill out IN ST-108E, provide the exempt organization's name, address, and tax-exempt number, as well as details about the purchases being made and the reason for the exemption.

What is the purpose of IN ST-108E?

The purpose of IN ST-108E is to document and validate tax-exempt purchases, ensuring compliance with state tax laws.

What information must be reported on IN ST-108E?

IN ST-108E must include the purchasing organization's name, address, tax-exempt number, and details about the items purchased, including the purpose of the purchase.

Fill out your st108e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

st108e is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.