Get the free Private Car insuranCe ProPosal Form

Show details

New Providence Grand Bahama Aback PO Box SS-6283 Rosetta Street East, Palmdale, Nassau Tel: (242) 394-5555 Fax: (242) 323-6520 info. Nassau imbbah.com PO Box F-42541, 1 Pioneers Way, Freeport Tel:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private car insurance proposal

Edit your private car insurance proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private car insurance proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private car insurance proposal online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit private car insurance proposal. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private car insurance proposal

How to fill out private car insurance proposal:

01

Gather necessary information: Start by gathering all the necessary information for filling out the private car insurance proposal. This may include personal information such as your name, address, and contact details, as well as details about the car such as its make, model, and registration number.

02

Provide details about the coverage: Specify the type of coverage you are seeking in the insurance proposal. This may include options such as liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Make sure to thoroughly understand each type of coverage and select the ones that best suit your needs.

03

Submit driving history: Many insurance companies require you to provide your driving history, such as any previous accidents or traffic violations. Make sure to accurately report this information as it can impact the cost of your insurance premiums.

04

Estimate annual mileage: Provide an estimate of the number of miles you expect to drive annually. This estimation helps insurance companies assess the level of risk associated with your vehicle.

05

Include additional drivers: If there are additional drivers who regularly use your car, such as family members or employees, make sure to include their information in the proposal. This allows the insurance company to determine their eligibility and calculate the appropriate premium.

06

Disclose any modifications or customizations: If you have made any modifications or customizations to your car, be sure to disclose them in the proposal. This includes upgrades to the engine, suspension, or body, as well as any changes that may affect the car's value or performance.

Who needs private car insurance proposal?

01

Anyone who owns a private car: Whether you own a sedan, SUV, or sports car, if you use it for personal use, you need private car insurance. It provides financial protection in case of accidents, theft, or damage to your vehicle.

02

New car owners: If you have recently purchased a car, it is crucial to get private car insurance. Insurance coverage helps safeguard your investment and ensures that any unexpected damages or accidents are taken care of.

03

Responsible drivers: Private car insurance is necessary for individuals who prioritize responsible driving. It not only protects you and your vehicle but also provides coverage in case you cause injuries or damage to others while driving.

04

Those seeking financial security: Having private car insurance offers peace of mind and financial security. It protects you from unforeseen expenses associated with accidents, repairs, medical bills, or legal claims that may arise due to driving incidents.

05

Legal requirement: In many countries, having private car insurance is a legal requirement. Failure to comply with this requirement may result in penalties, fines, or even vehicle impoundment.

In conclusion, anyone who owns a private car and wants to ensure financial protection, fulfill legal requirements, and drive responsibly should consider filling out a private car insurance proposal.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send private car insurance proposal to be eSigned by others?

To distribute your private car insurance proposal, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the private car insurance proposal in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your private car insurance proposal in seconds.

How do I fill out private car insurance proposal on an Android device?

On an Android device, use the pdfFiller mobile app to finish your private car insurance proposal. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

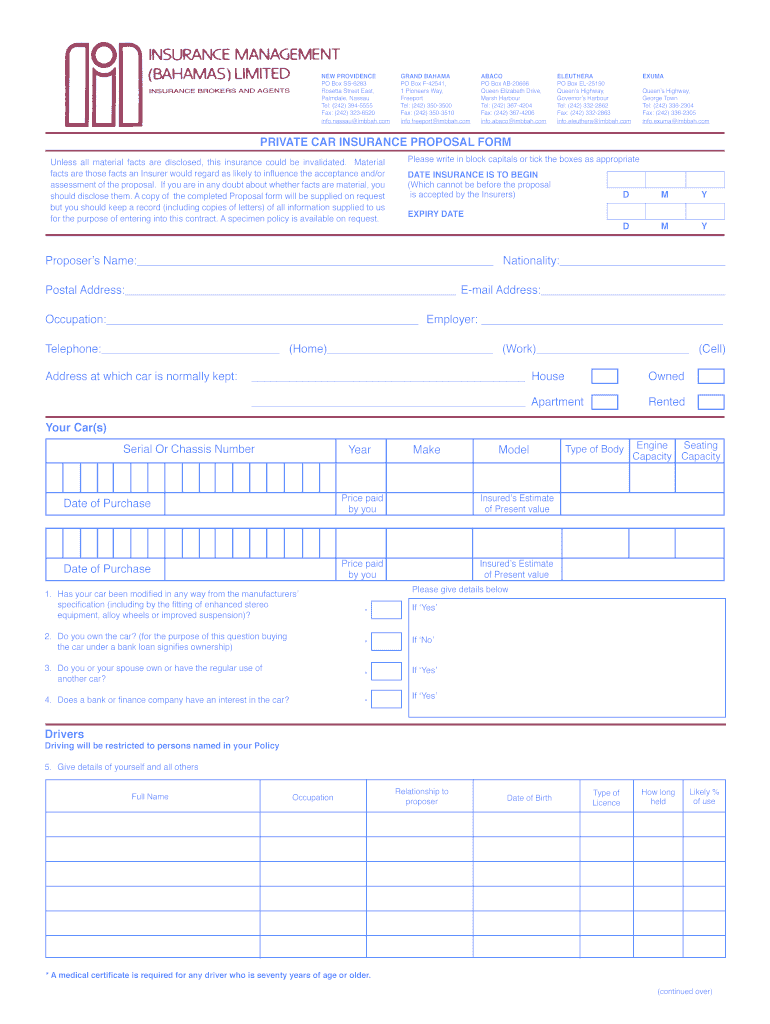

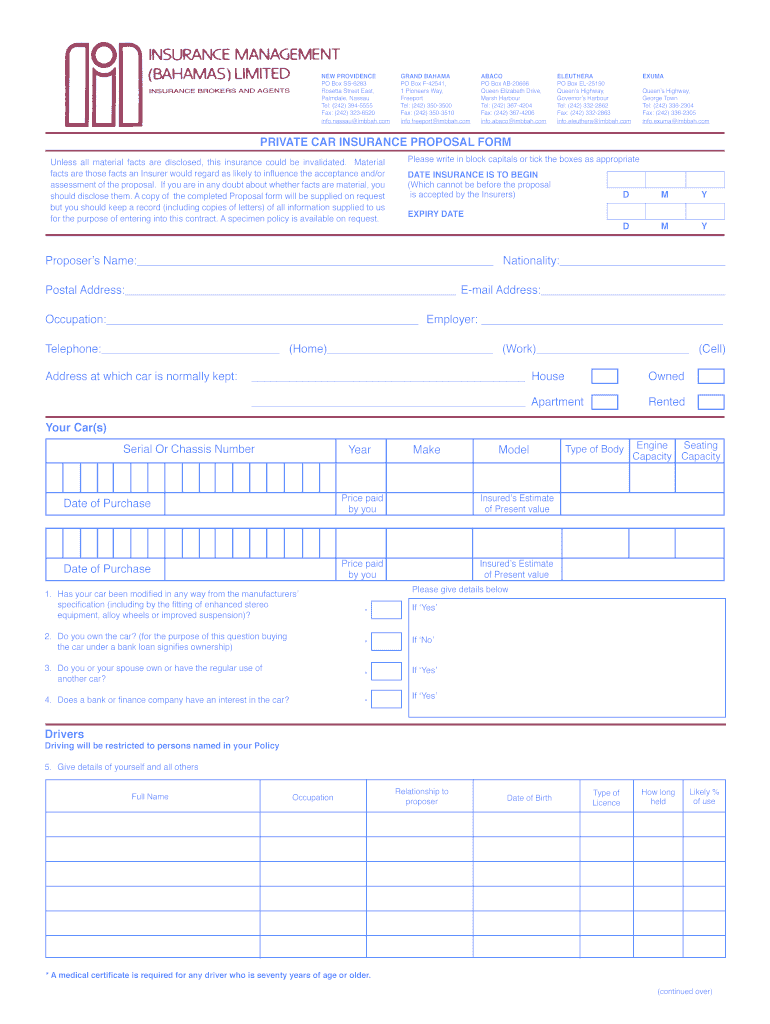

What is private car insurance proposal?

A private car insurance proposal is a document submitted to an insurance company detailing the coverage and terms requested for a private vehicle.

Who is required to file private car insurance proposal?

Any individual or entity who owns a private car and wishes to insure it.

How to fill out private car insurance proposal?

To fill out a private car insurance proposal, one must provide personal information, vehicle details, desired coverage, and any other relevant information requested by the insurance company.

What is the purpose of private car insurance proposal?

The purpose of a private car insurance proposal is to request and outline the desired insurance coverage for a private vehicle.

What information must be reported on private car insurance proposal?

Information such as personal details, vehicle make and model, desired coverage options, driving history, and any other relevant information required by the insurance company must be reported on the private car insurance proposal.

Fill out your private car insurance proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Car Insurance Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.