IRS 8880 2020 free printable template

Show details

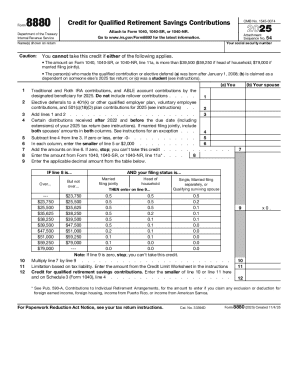

Purpose of Form Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit. Future Developments For the latest information about developments related to Form 8880 and its instructions such as legislation enacted after they were published go to www.irs.gov/Form8880. 3. Subtract line 2 from line 1. Also enter this amount on Form 8880 line 11. But if zero or less stop you cannot take the credit do not file this form. For Paperwork...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8880

Edit your IRS 8880 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8880 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 8880 online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 8880. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8880 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8880

How to fill out IRS 8880

01

Obtain IRS Form 8880 from the IRS website or your tax software.

02

Fill in your name and Social Security number at the top of the form.

03

Complete Part I by indicating your filing status (Single, Married Filing Jointly, etc.).

04

Enter your adjusted gross income (AGI) in the appropriate section of Part I.

05

Follow the instructions to calculate your retirement savings contributions credit based on your AGI and filing status.

06

Complete Part II by providing details of your eligible contributions to retirement plans during the tax year.

07

Verify that all information is accurate and complete.

08

Attach Form 8880 to your federal tax return before submitting it to the IRS.

Who needs IRS 8880?

01

Taxpayers who contribute to a qualified retirement plan such as an IRA or 401(k).

02

Individuals seeking a credit for their contributions to retirement savings.

03

Low to moderate-income earners who meet the income limits set by the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Am I required to file Form 8880?

Who Has to File Form 8880? Anyone who intends to claim the saver's credit on their taxes will need to file Form 8880; however, not everyone is eligible to receive the saver's credit. That is determined by an individual's income.

Who is not eligible to claim the Saver's credit?

Be age 18 or older. Not be a full-time student. Not be claimed as a dependent on someone else's tax return.

What qualifies for Form 8880?

Contributions you make to any qualified retirement plan can be used to satisfy the credit's eligibility requirements. Qualified retirement plans include traditional IRAs, Roth IRAs, 401(k) plans, 403(b) plans and 457 plans.

Who qualifies for the Saver's credit?

To be eligible for the retirement savings contribution credit/Saver's Credit, you must meet all of these requirements: You make voluntary contributions to a qualified retirement plan for 2022. You're at least age 18 by the end of 2022. You weren't a full-time student during any part of five calendar months in 2022.

What does not carry to form 8880?

Distributions of dividends paid on stock held by an employee stock ownership plan under section 404(k) Distributions from a military retirement plan (other than the federal Thrift Savings Plan) Distributions from an inherited IRA by a nonspousal beneficiary.

What is Form 8880 used for?

Use Form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8880 to be eSigned by others?

When you're ready to share your IRS 8880, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get IRS 8880?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific IRS 8880 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in IRS 8880?

With pdfFiller, the editing process is straightforward. Open your IRS 8880 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is IRS 8880?

IRS Form 8880 is the Credit for Qualified Retirement Savings Contributions form used to determine eligibility for the Retirement Savings Contributions Credit, which benefits taxpayers who contribute to a retirement plan.

Who is required to file IRS 8880?

Taxpayers who make contributions to eligible retirement plans and meet certain income thresholds and filing status requirements are required to file IRS Form 8880 to claim the credit.

How to fill out IRS 8880?

To fill out IRS Form 8880, gather your contribution information, determine your adjusted gross income (AGI), complete Parts I and II of the form, and follow the instructions provided in the form package or on the IRS website.

What is the purpose of IRS 8880?

The purpose of IRS Form 8880 is to provide taxpayers a way to claim a tax credit for contributions made to eligible retirement accounts, encouraging saving for retirement.

What information must be reported on IRS 8880?

On IRS Form 8880, taxpayers must report their retirement savings contributions, their adjusted gross income (AGI), filing status, and calculate the amount of the credit based on the provided tables.

Fill out your IRS 8880 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8880 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.