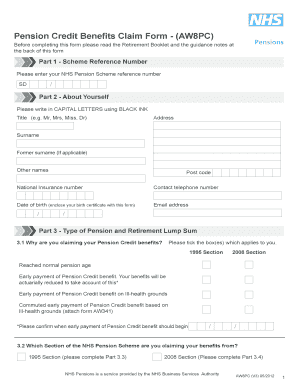

UK NHS AW8P 2020 free printable template

Get, Create, Make and Sign UK NHS AW8P

How to edit UK NHS AW8P online

Uncompromising security for your PDF editing and eSignature needs

UK NHS AW8P Form Versions

How to fill out UK NHS AW8P

How to fill out UK NHS AW8P

Who needs UK NHS AW8P?

Instructions and Help about UK NHS AW8P

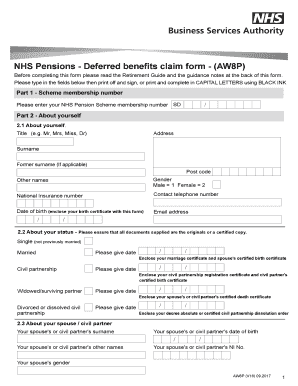

Music how you claim your benefits will depend on what type of member you are if you left NHS employment your classed as a defers member and will follow Joe if you are currently in NHS employment you will follow our active member Sofia please watch our other video how to claim your a time of benefits if you're an active member if you are a deferred member like Joe you can download the deferred benefits claim form a who from our website make sure you follow all the instructions and provide all the information requested if any information admitting it may lead to a delay in processing your application there are some useful guidance terms at the back of Chrome to help you don't forget to send Rival or certified copies of any requested certificates to us with your application post your completed form and supporting documents to NHS pension once your application has been processed we will send you a letter confirming your pension benefits further information about NHS pension scheme benefits is available on our website our online knowledge base can answer your questions 24 hours a day seven days a week alternatively you can contact our member help lines on oh three hundred three zero one three four six Music you

People Also Ask about

What is an AW8P form?

How can I access my NHS Pension if I quit?

What is a AW8P form?

What form do I need to claim my NHS pension?

How to calculate 1995 NHS pension?

Can I access my NHS pension details online?

How do I claim my NHS Pension?

How do I find out about my old NHS pension?

Who do I contact about my old NHS pension?

Can I claim back my NHS Pension contributions?

Who do I send my AW8 to?

How many years do you need for a full NHS Pension?

How do I find out how much my old NHS pension is worth?

How do you complete AW8?

How do you get AW8 form?

When can I claim my NHS Pension?

What form do I need to claim my NHS Pension?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UK NHS AW8P on a smartphone?

How do I fill out UK NHS AW8P using my mobile device?

How do I edit UK NHS AW8P on an iOS device?

What is UK NHS AW8P?

Who is required to file UK NHS AW8P?

How to fill out UK NHS AW8P?

What is the purpose of UK NHS AW8P?

What information must be reported on UK NHS AW8P?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.