TT Form TD-1 free printable template

Show details

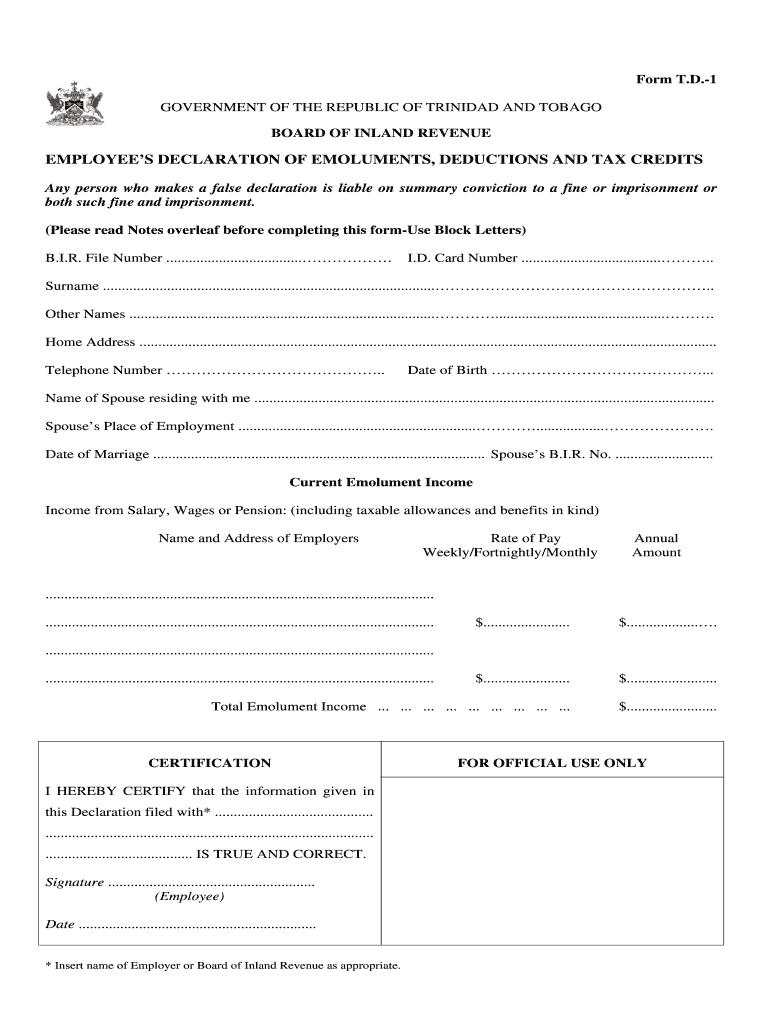

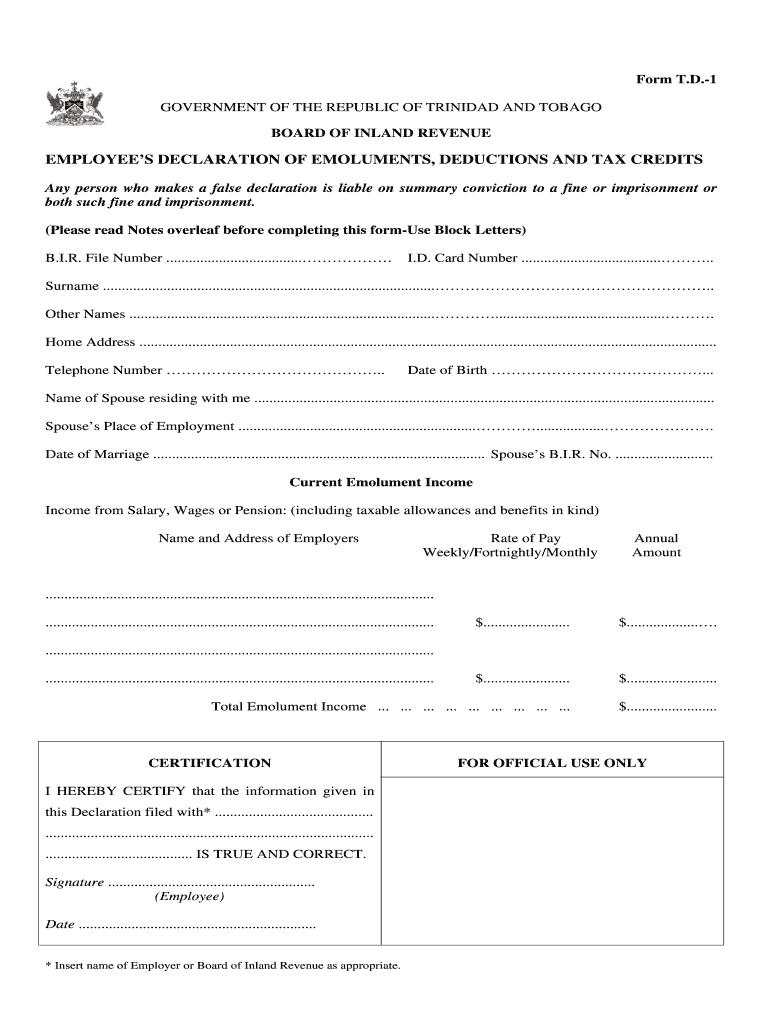

Form T.D.-1 GOVERNMENT OF THE REPUBLIC OF TRINIDAD AND TOBAGO BOARD OF INLAND REVENUE EMPLOYEE S DECLARATION OF EMOLUMENTS, DEDUCTIONS AND TAX CREDITS Any person who makes a false declaration is liable

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign fillable td1 form

Edit your td1 declaration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your td form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit printable td1 form online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit how to fill out td1 form trinidad. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out td 1 form trinidad

How to fill out TT Form T.D.-1

01

Obtain the TT Form T.D.-1 from the relevant authority or website.

02

Fill in your personal information, including name, address, and contact details.

03

Indicate the purpose for submitting the form.

04

Provide any required supporting documentation as mentioned in the form instructions.

05

Review the filled form for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the completed form to the specified office or online portal.

Who needs TT Form T.D.-1?

01

Individuals or businesses looking to apply for a specific governmental service or benefit.

02

Those seeking to formalize a request or claim that necessitates the use of the TT Form T.D.-1.

Fill

td1 form trinidad

: Try Risk Free

People Also Ask about td1 form trinidad 2024

What is the first time homeowner tax credit in Trinidad and Tobago?

From 2022, there is also the increase the first-time homeowner tax-allowance limit from TT$25,000 to TT$30,000 per household on mortgage interest for the first five years. Tax deductions on home ownership would provide extra disposable income by reducing the amount of tax paid.

What is a TD1 form Trinidad?

Tags: declaration form, tax declaration, TD-1, TD1. In order to avoid excessive deductions from your emoluments, a TD1 is used to determine the correct tax liability of an individual employee, and must be completed and lodged with the employer - on the commencement of employment.

How do I get my income tax refund money?

The best and fastest way to get your tax refund is to have it electronically deposited for free into your financial account. The IRS program is called direct deposit. You can use it to deposit your refund into one, two or even three accounts.

What is the personal allowance for Trinidad and Tobago 2023?

A personal allowance of TTD 84,000 is available to resident taxpayers. It is also available to non-residents who are in receipt of pension income accruing or derived from Trinidad and Tobago. Effective 1 January 2023, the personal allowance will be increased to TTD 90,000.

Who has to file a tax return in Trinidad and Tobago?

All employees, sole traders, partnerships and companies are legally obligated to register for a Board of Inland Revenue (BIR) file number to be used in payment of taxes and filing of returns.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my td1 inland revenue directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your td1 form trinidad and tobago and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get income tax forms?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific board of inland revenue forms and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in td1 form example?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your td1 form fillable to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is TT Form T.D.-1?

TT Form T.D.-1 is a tax form used for reporting specific financial information related to transactions and income.

Who is required to file TT Form T.D.-1?

Individuals and entities that engage in certain types of financial transactions or report specific incomes are required to file TT Form T.D.-1.

How to fill out TT Form T.D.-1?

To fill out TT Form T.D.-1, you must provide details regarding transaction amounts, dates, involved parties, and any relevant income or deductions as instructed on the form.

What is the purpose of TT Form T.D.-1?

The purpose of TT Form T.D.-1 is to provide tax authorities with necessary information for assessing taxes related to particular financial transactions and ensuring compliance.

What information must be reported on TT Form T.D.-1?

TT Form T.D.-1 must report details such as transaction dates, amounts, parties involved, types of income, and any deductions applicable to the financial transactions.

Fill out your td1 form 2024 trinidad online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Td 1 Form is not the form you're looking for?Search for another form here.

Keywords relevant to td1 form 2023

Related to td1 form trinidad 2023

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.