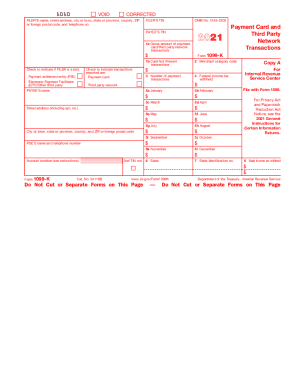

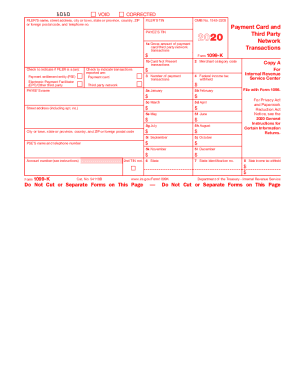

IRS Instructions 1099-K 2021 free printable template

Show details

2021Department of the Treasury

Internal Revenue ServiceInstructions for

Form 1099K

Payment Card and Third Party Network Transactions

Section references are to the Internal Revenue Code unless

otherwise

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 1099-K

Edit your IRS Instructions 1099-K form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 1099-K form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 1099-K online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Instructions 1099-K. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 1099-K Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 1099-K

How to fill out IRS Instructions 1099-K

01

Obtain Form 1099-K and the IRS Instructions for it.

02

Identify the reporting threshold for payment transactions.

03

Gather the payee’s information, including name, address, and tax identification number (TIN).

04

Review your records to determine the total number of payment transactions and the gross amount for each payee.

05

Enter the payee’s information in the designated section of Form 1099-K.

06

Fill in the total gross amount paid to the payee in the correct box.

07

Include the number of payment transactions in the designated box.

08

If applicable, fill in any backup withholding amounts.

09

Double-check the form for accuracy and completeness.

10

File the form with the IRS by the deadline, and provide a copy to the payee.

Who needs IRS Instructions 1099-K?

01

Businesses and payment settlement organizations (PSOs) that handle payments on behalf of others.

02

Any business or entity that processes credit card and payment transactions that exceed the reporting threshold.

03

Sole proprietors and other independent contractors who receive payments via third-party networks.

Fill

form

: Try Risk Free

People Also Ask about

How much should I set aside for taxes 1099-K?

Generally, the amount you may need to set aside could range from 20% to 35% of your 1099 income, less any deductions that you're eligible to claim. Examples of expenses you might be able to deduct as a 1099 worker include: Office supplies.

Do I have to pay taxes on a 1099-K?

If you're a solopreneur or sole proprietor, your 1099-Ks count toward your self-employment income, which is subject to the self-employment tax. Record the information from your 1099-Ks as income on your Schedule C.

Do I have to report a 1099-K on my taxes?

It is important that your business books and records reflect your business income, including any amounts that may be reported on Form 1099-K. You must report on your income tax return all income you receive.

Who qualifies for a 1099-K?

The new 1099-K threshold for 2022 (for returns for calendar years 2022 and afterward) is: Gross payments exceeding $600, and. Any number of transactions.

What happens if I don't report my 1099-K?

Once the IRS thinks that you owe additional tax on your unreported 1099 income, it will usually notify you and retroactively charge you penalties and interest beginning on the first day they think that you owed additional tax.

How much taxes do you pay for 1099-K?

Paying taxes as a 1099 worker As a 1099 earner, you'll have to deal with self-employment tax, which is basically just how you pay FICA taxes. The combined tax rate is 15.3%.

What is a 1099-K from the IRS?

More In Forms and Instructions A payment settlement entity (PSE) must file Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instructions 1099-K for eSignature?

To distribute your IRS Instructions 1099-K, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the IRS Instructions 1099-K electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IRS Instructions 1099-K in seconds.

How do I edit IRS Instructions 1099-K straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IRS Instructions 1099-K.

What is IRS Instructions 1099-K?

IRS Instructions 1099-K provide guidance on how to report payment card and third-party network transactions, which includes details on income received by businesses from credit and debit card payments as well as payments made through third-party networks.

Who is required to file IRS Instructions 1099-K?

Payment settlement entities (PSEs), such as payment processors and third-party networks, are required to file IRS Instructions 1099-K if they have made payments to a participating payee that exceed certain thresholds within the tax year.

How to fill out IRS Instructions 1099-K?

To fill out IRS Instructions 1099-K, one needs to enter the payer's name, address, and taxpayer identification number (TIN), the recipient's information, the gross amount of reportable transactions for the year, and any adjustments or corrections if applicable.

What is the purpose of IRS Instructions 1099-K?

The purpose of IRS Instructions 1099-K is to ensure that income from payment card transactions and third-party networks is reported to the IRS, helping to improve tax compliance and reporting for businesses.

What information must be reported on IRS Instructions 1099-K?

IRS Instructions 1099-K must report the total gross amount of all payment card transactions and third-party network transactions, as well as any adjustments made during the year, including the number of transactions.

Fill out your IRS Instructions 1099-K online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 1099-K is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.