Organization Donation Receipt free printable template

Show details

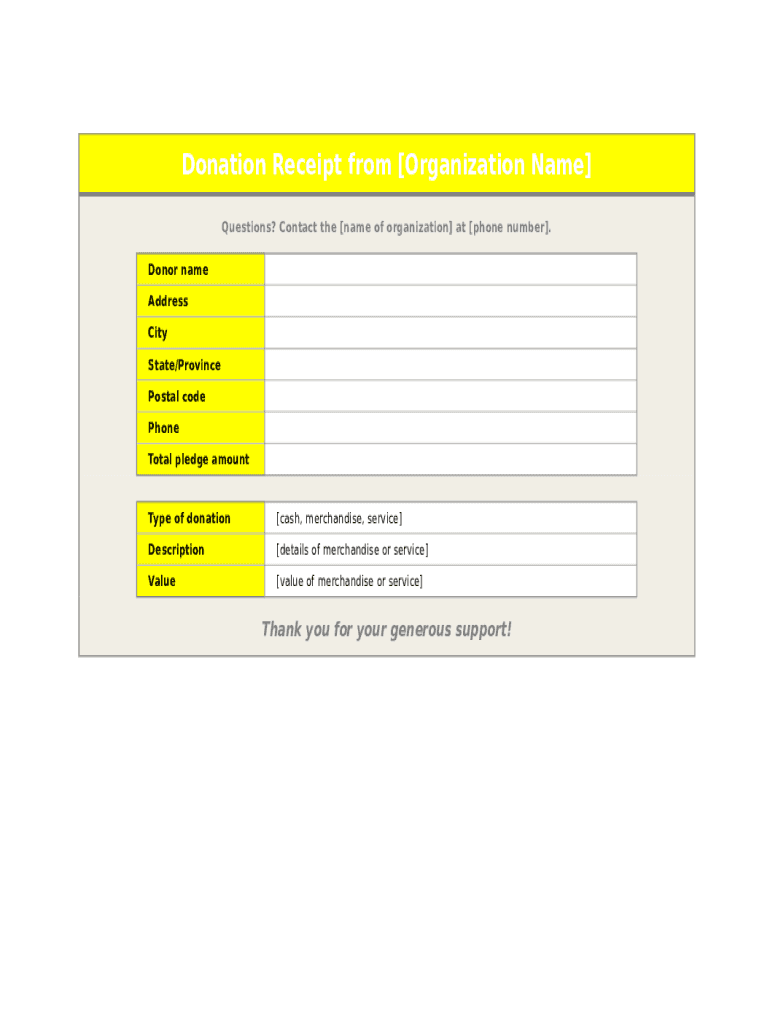

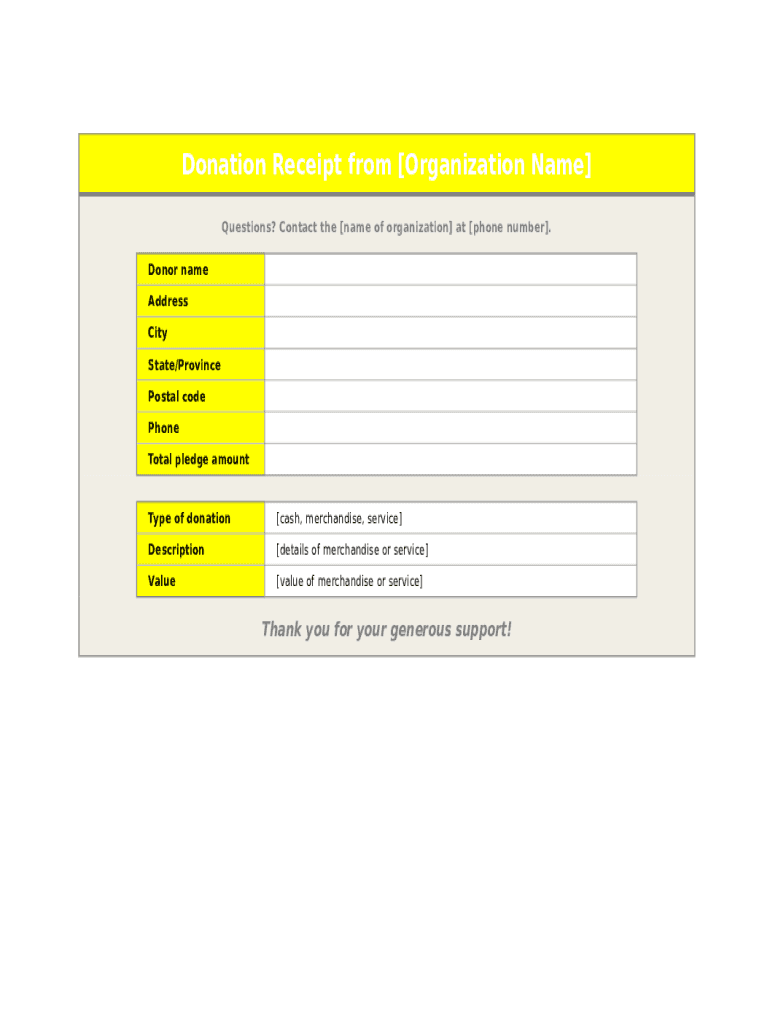

Donation Receipt from Organization Name Questions? Contact the name of organization at phone number. Donor name Address City State/Province Postal code Phone Total pledge monotype of donation cash,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign organization donation receipt form

Edit your Organization Donation Receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Organization Donation Receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Organization Donation Receipt online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Organization Donation Receipt. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Organization Donation Receipt

How to fill out Organization Donation Receipt

01

Begin with the organization's name and logo at the top of the receipt.

02

Clearly state that this document is a 'Donation Receipt'.

03

Include the date of the donation.

04

Provide a unique receipt number for tracking purposes.

05

Record the donor's name and contact information.

06

Describe the donation, including the amount and any specific details (like if it was cash, check, or in-kind).

07

Indicate whether any goods or services were provided in exchange for the donation.

08

Add a statement regarding the tax-exempt status of the organization.

09

Include a thank-you message for the donor's generosity.

10

Sign the receipt or include a signature line for the authorized person.

Who needs Organization Donation Receipt?

01

Donors who wish to claim a tax deduction for their charitable contributions.

02

Nonprofit organizations that need to provide proof of donations received.

03

Auditors or financial professionals requiring documentation for accounting purposes.

Fill

form

: Try Risk Free

People Also Ask about

How much donations can be claimed without receipts?

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity.

Can you claim donations without receipts Canada?

You get an official donation receipt from a registered Canadian charity or other qualified donee. You need an official receipt to claim a charitable donation tax credit.

How do I issue a tax receipt for donations in Canada?

An official donation receipt must include at least the following information, in a manner that cannot be readily altered: a statement saying that it is an official receipt for income tax purposes. the charity's BN (Business Registration Number) name and address in Canada as recorded with the Canada Revenue Agency.

Should I get a tax receipt for donations?

For noncash donations under $250 in value, you'll need a receipt unless the items were dropped off at an unmanned location such as a clothing bin. Noncash donations from $250 to $500 in value require a receipt that includes the charity's name, address, date, donation location, and description of items donated.

What should a donation letter include?

To write the perfect donation request letter, follow these simple steps: Start with a greeting. Explain your mission. Describe the current project/campaign/event. Include why this project is in need and what you hope to accomplish. Make your donation ask with a specific amount correlated with that amount's impact.

Do you need to include donation receipts for taxes?

1. Legal requirements: The IRS requires donation receipts in certain situations. Failure to send a receipt can result in a penalty of $10 per contribution, up to $5,000 for each specific campaign.

What information must be on a donation receipt?

the full name, including middle initial, and address of the donor. the amount of the gift. the amount and description of any advantage received by the donor. the eligible amount of the gift.

Does CRA ask for donation receipts?

You should keep your official donation receipts for six years after the end of the tax year you made a claim for, in case the Canada Revenue Agency asks to see them. If you did your taxes late, keep your receipts for six years from the date you submitted your return.

How do I fill out a donation receipt?

Receipt Requirements The charity you donate to should supply a receipt with its name, address, telephone number and the date, preferably on letterhead. You should fill in your name, address, a description of the goods and their value. If the charity gives you anything in return, it must provide a description and value.

Can a charity issue a tax receipt to a charity?

A receipt is a written acknowledgement that a donation was made to a charity. Registered charities can issue “official tax receipts”. They are also allowed to give more informal receipts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Organization Donation Receipt directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign Organization Donation Receipt and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute Organization Donation Receipt online?

Completing and signing Organization Donation Receipt online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete Organization Donation Receipt on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your Organization Donation Receipt from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is Organization Donation Receipt?

An Organization Donation Receipt is a formal document provided by a charitable organization to a donor, confirming the receipt of a donation and detailing the amount donated, date, and purpose of the contribution.

Who is required to file Organization Donation Receipt?

Typically, charitable organizations that receive donations are required to provide an Organization Donation Receipt to donors, especially if the donations are tax-deductible.

How to fill out Organization Donation Receipt?

To fill out an Organization Donation Receipt, include the organization's name and tax identification number, the donor's name and address, the date of the donation, the amount donated, a description of the donation (e.g., cash, goods), and a statement clarifying whether any goods or services were provided in exchange for the donation.

What is the purpose of Organization Donation Receipt?

The purpose of an Organization Donation Receipt is to provide documentation for donors to claim tax deductions, to acknowledge the donor's generosity, and to maintain accurate records of charitable contributions for the organization.

What information must be reported on Organization Donation Receipt?

An Organization Donation Receipt must report the organization's name and address, the donor's name and address, the date of the donation, the amount of the donation, a description of the item donated (if applicable), and a statement regarding any goods or services provided in exchange for the donation.

Fill out your Organization Donation Receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Organization Donation Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.