IRS 13844 2020 free printable template

Show details

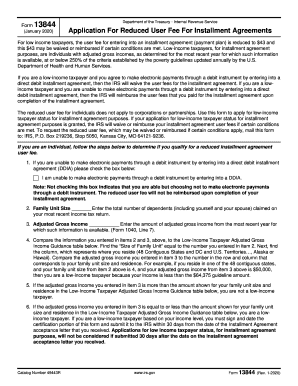

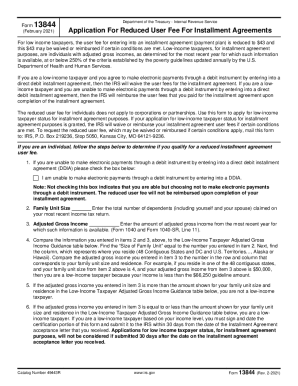

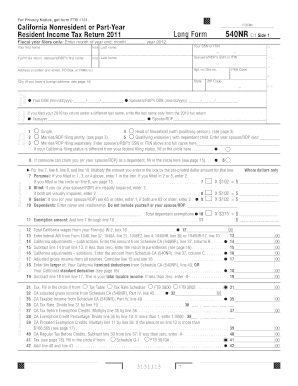

Form13844(February 2020)Department of the Treasury Internal Revenue ServiceApplication For Reduced User Fee For Installment Agreements low income taxpayers, the user fee for entering into an installment

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 13844

Edit your IRS 13844 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 13844 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 13844 online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 13844. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 13844 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 13844

How to fill out IRS 13844

01

Obtain Form 13844 from the IRS website or your tax professional.

02

Fill out the taxpayer's identifying information in the designated fields.

03

Complete Part I by answering the questions regarding your economic impact payment.

04

Provide the necessary income information in Part II.

05

Review the eligibility verification questions and answer them truthfully.

06

Sign and date the form at the bottom, certifying that the information provided is accurate.

07

Submit the completed form to the IRS according to the instructions provided.

Who needs IRS 13844?

01

Individuals who did not receive their Economic Impact Payment or received an incorrect amount.

02

Taxpayers who need to reconcile their payment eligibility with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How long does the IRS take process installment agreement plan?

How long does it take to resolve IRS back taxes? SolutionNormal Time to resolveSimple IRS agreements (extensions to pay or streamlined installment agreements)1-60 daysComplex IRS collection agreements (currently not collectible status, and agreements that involve determining your ability to pay)30-180 days3 more rows • Jul 7, 2022

How do I pay off IRS installment agreement?

After applying for a short-term payment plan, payment options include: Pay directly from a checking or savings account (Direct Pay) (Individuals only) Pay electronically online or by phone using Electronic Federal Tax Payment System (EFTPS) (enrollment required) Pay by check, money order or debit/credit card.

What is the longest IRS payment plan?

There are two types of Streamlined Installment Agreements, depending on how much you owe and for what type of tax. For both types, you must pay the debt in full within 72 months (six years), and within the time limit for the IRS to collect the tax, but you won't need to submit a financial statement.

How do I stop an IRS installment agreement?

A. Taxpayers should contact their bank directly to stop payments if they prefer to suspend direct debit payments during the suspension period. Banks are required to comply with customer requests to stop recurring payments within a specified timeframe.

What happens if I don't pay my installment plan?

If you don't pay an installment loan, you may be charged late fees and your credit score will go down. Some other consequences of not paying an installment loan include defaulting on the loan, getting pestered by debt collectors and potentially a lawsuit.

How long of a payment plan will the IRS accept?

There are two types of Streamlined Installment Agreements, depending on how much you owe and for what type of tax. For both types, you must pay the debt in full within 72 months (six years), and within the time limit for the IRS to collect the tax, but you won't need to submit a financial statement. 1.)

What is the longest term for IRS payment plan?

There are two types of Streamlined Installment Agreements, depending on how much you owe and for what type of tax. For both types, you must pay the debt in full within 72 months (six years), and within the time limit for the IRS to collect the tax, but you won't need to submit a financial statement.

Will the IRS accept less than I owe?

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

Why would the IRS terminate an installment agreement?

The IRS defines default of an installment agreement as providing inaccurate or incomplete information, or not meeting required terms of the agreement. In this case, the IRS may propose termination of installment agreement and terminated installment agreements. Taxpayers may appeal proposed terminations.

How much does an IRS installment agreement cost?

Fees for IRS installment plans If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465.

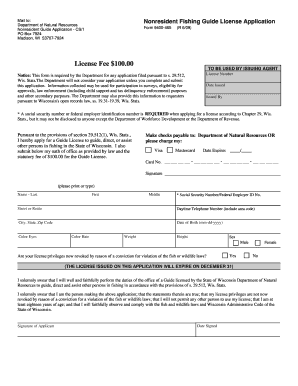

What is IRS Form 13844?

If you believe that you meet the requirements for low income taxpayer status, but the IRS did not identify you as a low-income taxpayer, please review Form 13844: Application for Reduced User Fee for Installment AgreementsPDF for guidance.

How do I know if the IRS accepted my installment agreement?

You can also confirm your installment agreement with the IRS by calling them at 1-800-829-1040 Monday - Friday, 7:00 am - 7:00 pm local time once your return has been fully processed (allow 2 weeks for processing).

What if you owe the IRS over $100 000?

The IRS may take any of the following actions against taxpayers who owe $100,000 or more in tax debt: File a Notice of Federal Tax Lien to notify the public of your delinquent tax debt. Garnish your wages or seize the funds in your bank account. Revoke or deny your passport application.

What happens if I can't pay my IRS installment agreement?

Call the IRS immediately at 800-829-1040. Options could include reducing the monthly payment to reflect your current financial condition. You may be asked to provide proof of changes in your financial situation so have that information available when you call.

What is the minimum payment the IRS will accept?

The minimum payment is equal to your balance due divided by the 72-month maximum period. If you can't pay an amount equal to what you owe divided by 72, you will need to complete Form 433-F unless you qualify for an exception.

How many times can you do a payment plan with the IRS?

Can you take out another installment agreement? Unfortunately, the answer is no. There can only be one installment agreement that includes all of the tax years for which you owe an outstanding tax debt. A new, unpaid tax balance due would automatically put your existing installment agreement into default.

How many months will IRS do payment plans?

Short-term Payment Plans (up to 180 days) If you can't pay in full immediately, you may qualify for additional time --up to 180 days-- to pay in full. There's no fee for this full payment; however, interest and any applicable penalties continue to accrue until your liability is paid in full.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 13844 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IRS 13844 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send IRS 13844 to be eSigned by others?

Once your IRS 13844 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out IRS 13844 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IRS 13844 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IRS 13844?

IRS Form 13844 is a form used by taxpayers to request a refund of overpayments made to their tax liabilities.

Who is required to file IRS 13844?

Taxpayers who have made overpayments and seek a refund are required to file IRS Form 13844.

How to fill out IRS 13844?

To fill out IRS Form 13844, provide personal information such as your name, address, and Social Security number, and include details of the overpayment with the appropriate calculations and documentation.

What is the purpose of IRS 13844?

The purpose of IRS Form 13844 is to enable taxpayers to formally request a refund for any taxes they have overpaid to the IRS.

What information must be reported on IRS 13844?

On IRS Form 13844, you must report your personal information, specifics of the overpayment, the tax period in question, and any relevant calculations or supporting documentation.

Fill out your IRS 13844 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 13844 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.