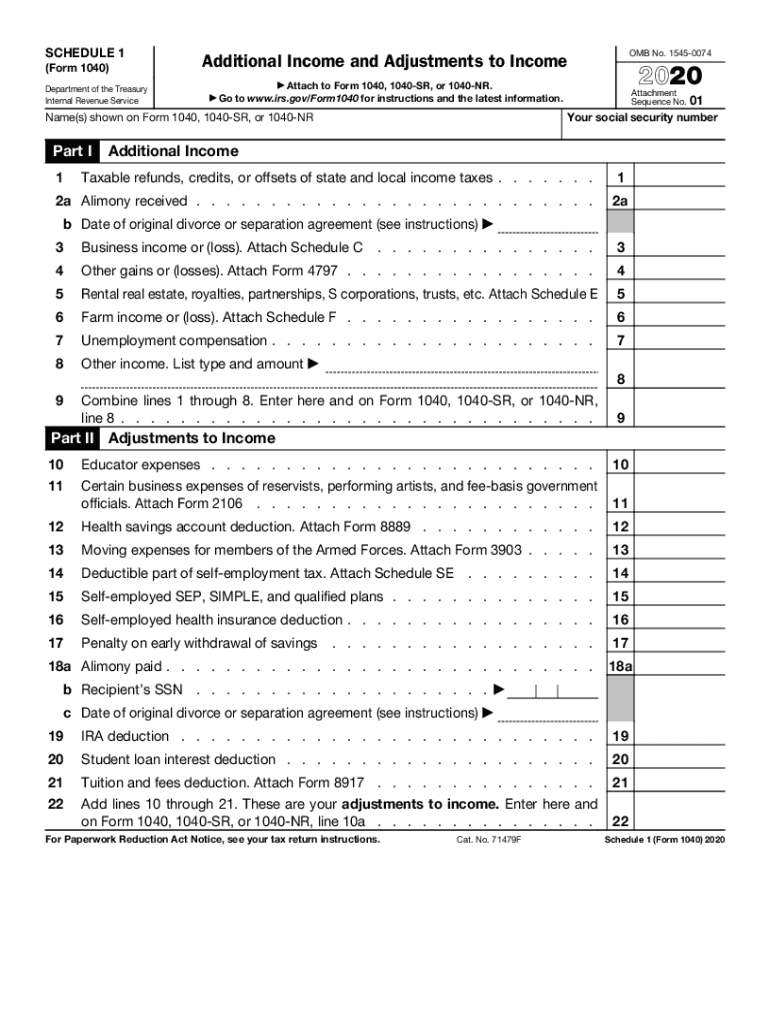

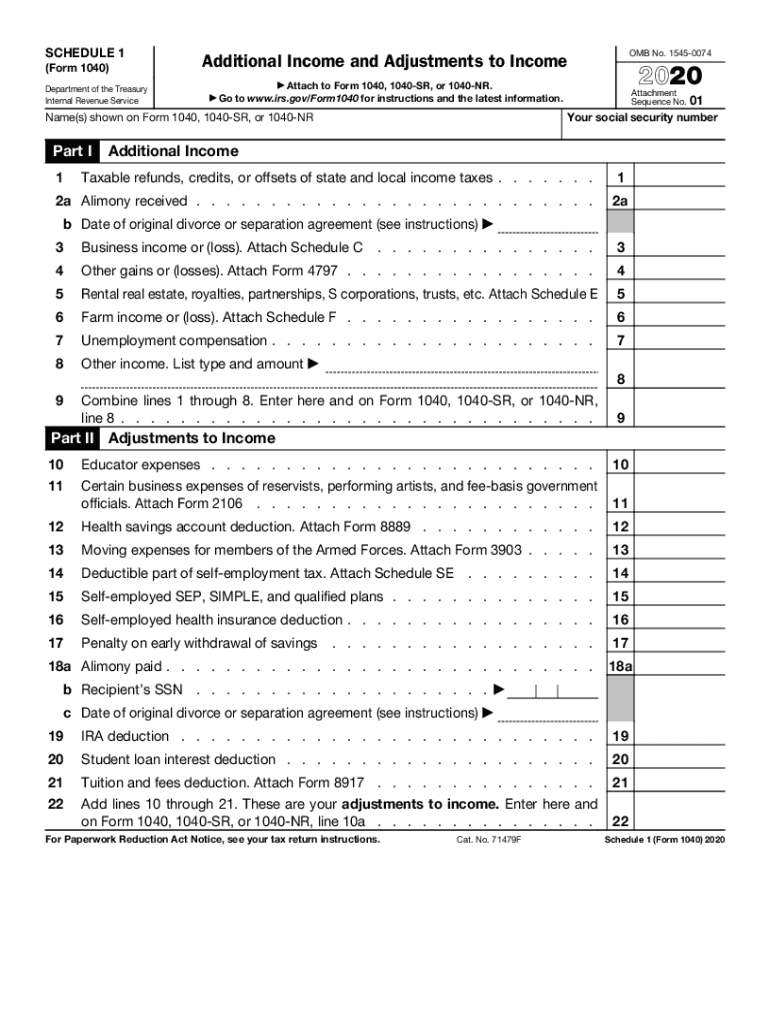

IRS 1040 - Schedule 1 2020 free printable template

Show details

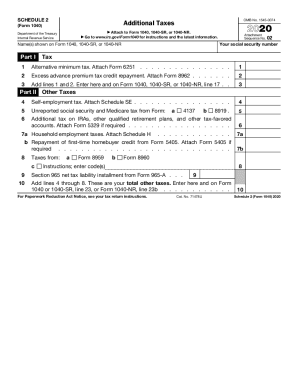

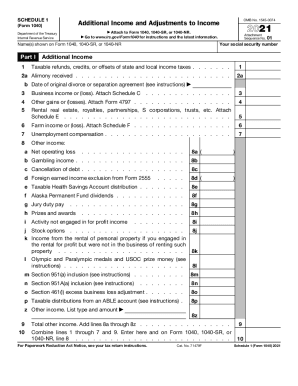

SCHEDULE 1 (Form 1040) Department of the Treasury Internal Revenue Service Go12020 Attach to Form 1040, 1040SR, or 1040NR. To www.irs.gov/Form1040 for instructions and the latest information. Attachment

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040 - Schedule 1

Edit your IRS 1040 - Schedule 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040 - Schedule 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1040 - Schedule 1 online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 1040 - Schedule 1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040 - Schedule 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040 - Schedule 1

How to fill out IRS 1040 - Schedule 1

01

Gather your documents: Collect all necessary documentation including your W-2 forms, 1099s, and any other relevant income statements.

02

Obtain IRS 1040 Schedule 1: Download the form from the IRS website or obtain a physical copy.

03

Fill out Part I: List additional income such as unemployment compensation, prize winnings, or rental income in the respective fields.

04

Complete Part II: Report deductions for certain expenses, such as educator expenses, student loan interest, or other adjustments to income.

05

Calculate Total: Add up your income and adjustments to determine your total adjusted gross income.

06

Review your entries: Double-check for accuracy and ensure all applicable sections are filled.

07

Attach Schedule 1 to IRS Form 1040: Ensure everything is securely attached when submitting your tax return.

Who needs IRS 1040 - Schedule 1?

01

Individuals who have additional income that is not reported on the standard IRS Form 1040.

02

Taxpayers claiming certain deductions or adjustments to income.

03

People who receive unemployment compensation or social security benefits.

04

Taxpayers who have rental income or are claiming educator expenses.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Schedule 1 tax form?

You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

What is a Schedule 1 example?

Schedule I drugs, substances, or chemicals are defined as drugs with no currently accepted medical use and a high potential for abuse. Some examples of Schedule I drugs are: heroin, lysergic acid diethylamide (LSD), marijuana (cannabis), 3,4-methylenedioxymethamphetamine (ecstasy), methaqualone, and peyote.

What is a Schedule 1 form?

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

What is a Schedule 1 tax form Canada?

Schedule 1 is used to calculate your net federal tax payable (the amount you owe to the federal government) on your taxable income.

Is Form 1040 the same as Schedule 1?

Schedule 1 (Form 1040) Additional Income and Adjustments to Income. Have additional income, such as unemployment compensation, prize or award money, gambling winnings. Have any deductions to claim, such as student loan interest deduction, self-employment tax, educator expenses.

Who needs to fill out a Schedule 1?

Who needs to use Schedule 1? You have income that isn't reported directly on Form 1040. You have one of the 12 types of expenses that the federal government allows you to exclude from your taxable income. These are called adjustments to income.

What is Schedule 1 tax form Canada?

Schedule 1 is used to calculate your net federal tax payable (the amount you owe to the federal government) on your taxable income.

Who would file a Schedule 1?

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

Does everyone have a Schedule 1 tax form?

Not everyone needs to attach Schedule 1 to their federal income tax return. The IRS trimmed down and simplified the old Form 1040, allowing people to add on forms as needed. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

Who fills out a Schedule 1?

Generally, taxpayers file a Schedule 1 to report income or adjustments to income that can't be entered directly on Form 1040. This question is used to help determine if you may be eligible to skip certain questions in the FAFSA form.

Do I need to fill Schedule 1?

Not everyone needs to attach Schedule 1 to their federal income tax return. The IRS trimmed down and simplified the old Form 1040, allowing people to add on forms as needed. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

Is Schedule 1 the same as 1040?

What is Schedule 1 (Form 1040)? Schedule 1 has the following Additional Income and Adjustments to Income. If entries are made on Schedule 1, the form would accompany Form 1040 or Form 1040-SR.

What is a Schedule 1?

Schedule I drugs, substances, or chemicals are defined as drugs with no currently accepted medical use and a high potential for abuse. Some examples of Schedule I drugs are: heroin, lysergic acid diethylamide (LSD), marijuana (cannabis), 3,4-methylenedioxymethamphetamine (ecstasy), methaqualone, and peyote.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

Fill out your IRS 1040 - Schedule 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040 - Schedule 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.