GA DoR G-4 2000 free printable template

Get, Create, Make and Sign form w-4 - employees

How to edit form w-4 - employees online

Uncompromising security for your PDF editing and eSignature needs

GA DoR G-4 Form Versions

How to fill out form w-4 - employees

How to fill out GA DoR G-4

Who needs GA DoR G-4?

Instructions and Help about form w-4 - employees

Hello, I’m Scott from Turbo Tax, with important news for taxpayers who have income taxes withheld from their paychecks. When you started your last job, do you remember filling out a W-4 form? It may have been one of many documents you had to complete for your employer, but because you can update it at any time, you may want to think about submitting a new one. As an employee, the IRS usually requires your employer to withhold income taxes from each paycheck you receive. Your employer will not use an arbitrary percentage to withhold; instead, it’s based on your expected annual compensation and the information you provide on a W-4 form. The main objective of withholding is to insure you pay enough taxes during the year to cover most, if not all, of your tax bill by December 31— nothing more, nothing less. Estimating your tax bill with such precision before the year is over may seem impossible, but if you prepare your W-4 using information from your recent tax returns, and nothing else significantly changes, you can get pretty close. The W-4 form uses a system of allowances that0are used to calculate the correct amount of tax to withhold. The more allowances you report on the W-4, the less tax will be withheld—meaning more money in your pocket every time you get paid. But, to avoid under withholding, you should only claim allowances for items you will be reporting on your tax return. For example, the W-4 allows you to take one allowance for your personal exemption and an additional one for each dependent you anticipate claiming on your tax return. You can also increase your allowances for other reasons such as working only one job or being the sole earner of your family if married. And if you usually use the head of household filing status, you can report an additional allowance for that as well. Other allowances are available for some tax credits you will take and for reporting itemized deductions. Essentially, each allowance represents some form of reduction to your estimated taxable income for the year. And the calculations used to determine your withholding reflects these reductions. Generally speaking, you get a tax refund when you claim too few allowances, because more tax was withheld during the year than you actually owed. When you claim too many allowances on your W-4, you could end up owing taxes at tax time. If you’d like to see exactly how different numbers of allowances affect both your paycheck and your refund, try our W-4 Calculator. Just go to TurboTax.com and click on the “Tax CalculatoranticspquTotooquoquTotoot; For more information about this and other tax topics visit TurboTax.com.

People Also Ask about

Do I need to fill out employee's withholding certificate?

Is it okay to claim 1 on W4?

What is the employee withholding allowance certificate Form W-4?

Do I claim 0 or 1 on my W4?

Do I claim 1 or 0 on W4 if single?

How to fill out Form W-4 Employee's withholding Certificate?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form w-4 - employees for eSignature?

How can I fill out form w-4 - employees on an iOS device?

How do I edit form w-4 - employees on an Android device?

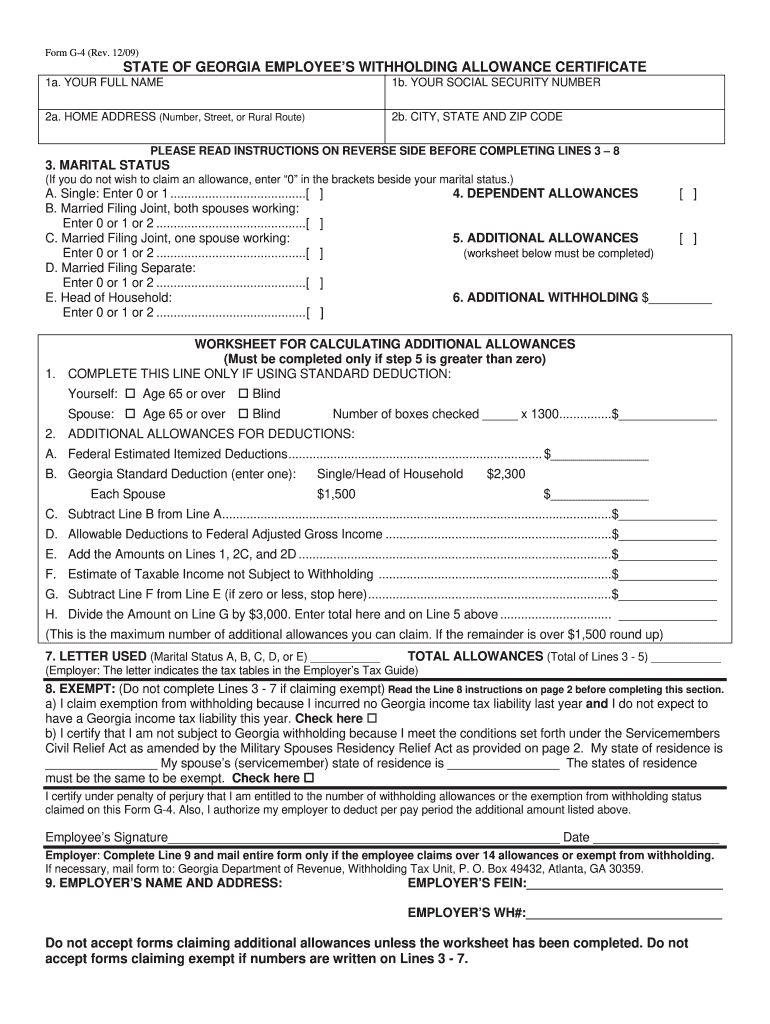

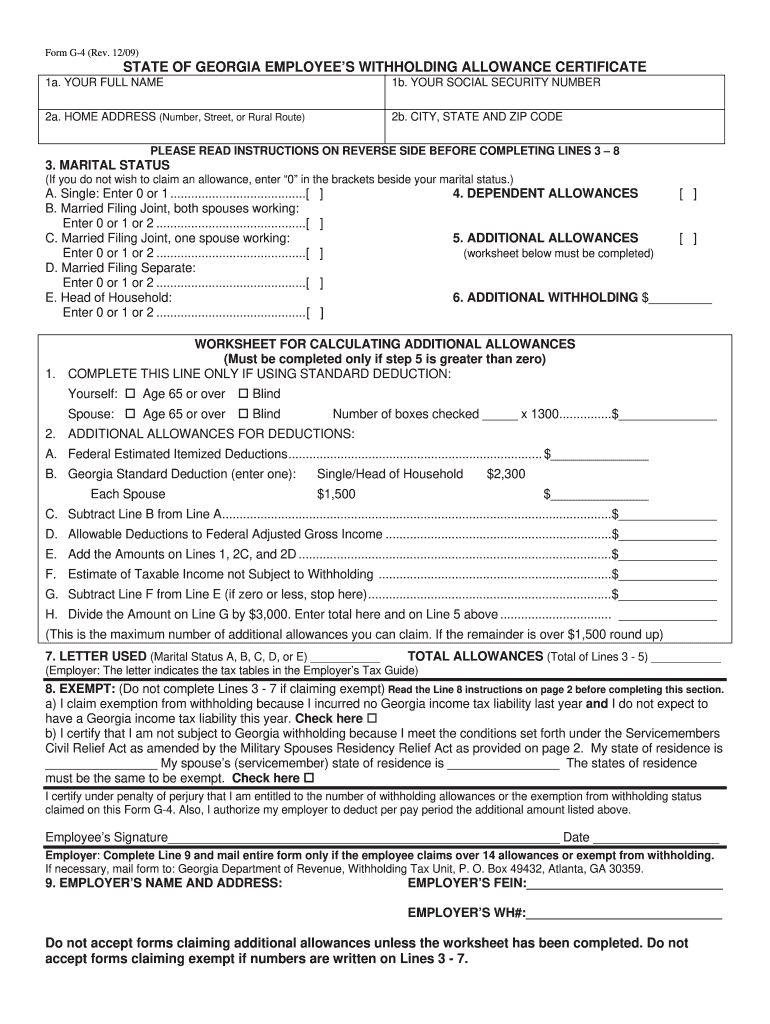

What is GA DoR G-4?

Who is required to file GA DoR G-4?

How to fill out GA DoR G-4?

What is the purpose of GA DoR G-4?

What information must be reported on GA DoR G-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.