Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

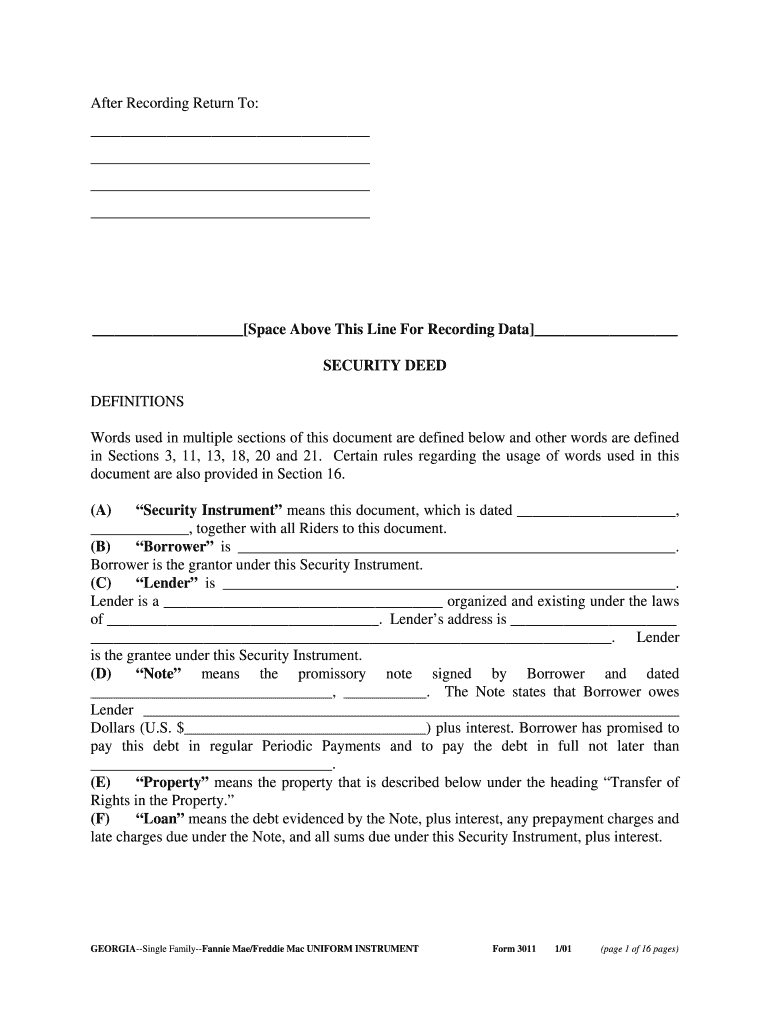

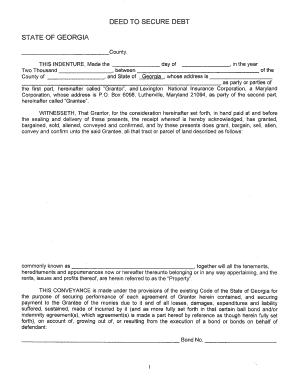

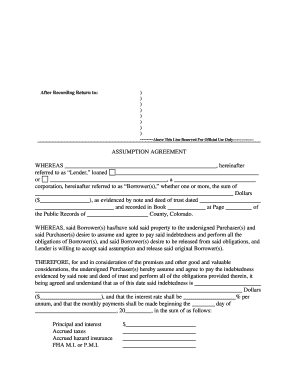

A security deed, also known as a deed of trust, is a legal document that a borrower signs when taking out a loan secured by real estate. The document gives the lender the right to foreclose on the property if the borrower fails to repay the loan. The security deed may also include other terms and conditions, such as the lender's right to inspect the property or the borrower's obligation to insure the property.

What is the penalty for the late filing of security deed?

The penalty for the late filing of a security deed typically depends on the jurisdiction in which the deed is filed. In some cases, there may be no penalty for a late filing, while in other cases there may be a monetary fine or other penalties imposed.

Who is required to file security deed?

The party required to file a security deed is usually the borrower or debtor in a loan transaction. The security deed is a legal document that grants a mortgage or security interest on a property to a lender or creditor as collateral for a loan. The borrower is responsible for signing and filing the security deed with the appropriate governmental agency, such as the county clerk's office or registry of deeds, to establish the lender's lien or claim on the property.

How to fill out security deed?

Filling out a security deed typically involves the following steps:

1. Obtain the necessary form: You can find a security deed form from various sources, such as legal document websites, office supply stores, or by consulting an attorney who specializes in real estate law.

2. Gather required information: Before filling out the form, collect all the necessary information, including the names and addresses of the grantor (borrower) and grantee (lender), the legal description of the property, and the loan amount.

3. Begin filling out the form: Start by entering the names and addresses of the grantor and grantee at the top of the form. Ensure that all names and addresses are accurate.

4. Describe the property: Provide a detailed and accurate legal description of the property, including the address, lot number, block number, and any other relevant information.

5. Enter the loan details: Include the loan amount, interest rate, and any specific terms or conditions that both parties have agreed upon. This information should be clearly stated in the document.

6. Mention any liens or encumbrances: If there are any existing liens or encumbrances on the property, disclose them in the document. These may include mortgages, taxes, or other outstanding debts.

7. Sign the document: Make sure both the grantor and grantee sign and date the security deed. Some jurisdictions may require additional witnesses or notarization, so verify the local requirements and comply accordingly.

8. Record the deed: After completing the security deed, it must be recorded with the appropriate county or city office. This ensures that the document is public record and provides legal notice of the security interest in the property.

Note: The above steps are general guidelines, and the specific requirements may vary depending on your jurisdiction. Consult with a real estate attorney or legal professional for accurate advice and assistance in filling out a security deed.

What is the purpose of security deed?

The purpose of a security deed is to establish a legal agreement between a borrower (the debtor) and a lender (the creditor) in a loan transaction. It is used in real estate transactions, specifically for mortgage loans, where the borrower offers the property as collateral to secure the loan.

The security deed, also known as a deed of trust or mortgage deed, outlines the terms and conditions of the loan, such as the amount borrowed, interest rate, repayment schedule, and any specific requirements. It grants the lender a security interest in the property, giving them the right to foreclose and sell the property if the borrower fails to repay the loan according to the agreed-upon terms.

In summary, the purpose of a security deed is to protect the lender's interests and provide a legal framework for the use of the property as collateral in a real estate loan transaction.

What information must be reported on security deed?

The information that must be reported on a security deed may vary depending on the jurisdiction and specific requirements of the transaction. However, generally, the following information is typically included:

1. Names of the parties involved: The security deed should mention the names of the borrower (also known as the grantor) and the lender (also known as the grantee).

2. Description of the property: A detailed description of the property being used as collateral should be provided. This may include the address, legal description, and other identifying information.

3. Loan details: The principal amount of the loan, interest rate, and repayment terms should be clearly mentioned in the security deed.

4. Lien information: The security deed should state that the property is being used as collateral to secure the loan. It may also mention the priority of the lien, especially if there are multiple liens on the property.

5. Signatures and notarization: The security deed should be signed by both the borrower and lender. It may also require notarization or witnessing, depending on the jurisdiction.

6. Recording information: The security deed should indicate where and when it will be recorded in the public records. Recording the deed helps establish the priority of the lien and provides notice to other potential creditors.

It is important to consult relevant laws, regulations, and legal counsel in your jurisdiction to determine the specific information that must be reported on a security deed.

How can I manage my deed to secure debt in georgia directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign security deed georgia template form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit what is a security deed in georgia straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing security deed template right away.

Can I edit what is security deed on an Android device?

You can edit, sign, and distribute georgia security deed cancellation form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.