SBA 1919 2020 free printable template

Show details

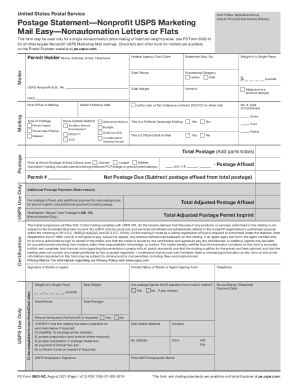

SBA 7a Borrower Information Form For use with all 7(a) Programs OMB Control No.: 32450348 Expiration Date: 09/30/2023Purpose of this form: The purpose of this form is to collect information about

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SBA 1919

Edit your SBA 1919 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SBA 1919 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SBA 1919 online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SBA 1919. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SBA 1919 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SBA 1919

How to fill out SBA 1919

01

Start by downloading the SBA Form 1919 from the official SBA website.

02

Fill in your business information at the top of the form, including your legal business name, trade name (if applicable), and business address.

03

Complete Section 1 by providing information about the applicant, including ownership percentage and social security number.

04

Move to Section 2 and disclose the ownership structure of your business, listing all owners and their stakes.

05

Fill out Section 3, which requires information about management experience and operational qualifications.

06

In Section 4, provide additional information related to business operations and the amount of financing needed.

07

Review the form thoroughly for any errors or missing information.

08

Sign and date the form as required.

09

Submit the completed form along with any necessary documentation to your lender.

Who needs SBA 1919?

01

Business owners looking for financial assistance through the SBA loan programs, particularly those applying for the Paycheck Protection Program (PPP) or Economic Injury Disaster Loans (EIDL).

02

Entrepreneurs who are seeking to establish or expand their small businesses and need access to funding.

Fill

form

: Try Risk Free

People Also Ask about

Who fills out SBA form 1919?

When applying for an SBA 7(a) loan, you must complete SBA Form 1919. The form is required for each owner, partner, officer and director with a 20% stake or more in the business and/or managing member who handles day-to-day operations.

What is the SBA form 1919?

SBA Form 1919, Borrower Information Form, collects information about the Small Business Applicant(s) and its Principal(s). The form is completed by the Small Business Applicant(s) and its Associates(s)/Principal(s)/Key Personnel for submission to an SBA Lender.

What does SBA look for to approve a loan?

In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding.

What disqualifies you from getting an SBA loan?

Ineligible businesses include those engaged in illegal activities, loan packaging, speculation, multi-sales distribution, gambling, investment or lending, or where the owner is on parole.

Is SBA Form 912 required?

SBA Form 912 is required for most types of SBA loans, including the two most popular SBA loan programs: SBA 7(a) and SBA 504/CDC.

What is the easiest SBA loan to get?

SBA Express This term loan or line of credit offers fixed or variable SBA loan rates as well as the easiest SBA application process, quick approval times, flexible terms, and lower down payment requirements than conventional loans.

What reporting is required of the borrower for an SBA loan?

Reporting requirements On a monthly basis, lenders report all SBA loans on the SBA 1502 report. When the loan is transferred into liquidation status, you must change the status code on your monthly 1502 report to “5” for in-liquidation status.

How to fill out SBA 912?

How to fill out Form 912 in 7 steps Your basic contact and business information. This is the easy part: It's just personal information about you, your business and your lender. Loan application information. Your personal information. Current charges against you. Past charges. Probation, convictions or pleas. Sign and initial.

Who needs to fill out SBA form 912?

Form 912 should be completed by the business owner and his or her partners. If you have a criminal record, you'll need to provide details about your criminal history. Make sure you're getting the best financing terms and apply through Janover.

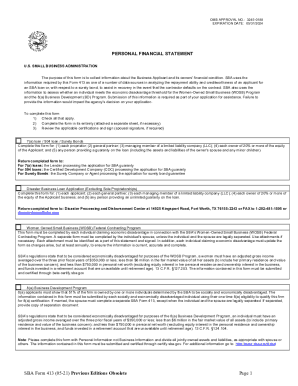

What forms are needed for SBA loan?

What do I need to apply? Borrower information form: Complete SBA Form 1919 and submit it to an SBA-participating lender. Financial statements: Complete SBA Form 413 (personal financial statement). Business financial statements: Submit the following to help show your ability to repay a loan:

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my SBA 1919 in Gmail?

SBA 1919 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get SBA 1919?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the SBA 1919 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit SBA 1919 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign SBA 1919. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is SBA 1919?

SBA Form 1919 is the Small Business Administration's application form used for obtaining a loan through the Paycheck Protection Program (PPP).

Who is required to file SBA 1919?

Any business entity applying for a PPP loan through an SBA-approved lender is required to file SBA Form 1919.

How to fill out SBA 1919?

To fill out SBA Form 1919, applicants need to provide information about their business, including its legal structure, ownership details, and number of employees. Each section must be completed accurately, and necessary documentation should be attached.

What is the purpose of SBA 1919?

The purpose of SBA Form 1919 is to collect essential information from applicants seeking financial assistance through the PPP, enabling lenders to assess eligibility and process the loan applications.

What information must be reported on SBA 1919?

SBA Form 1919 requires information such as the applicant's business name, business type, number of employees, ownership details, and other pertinent data necessary for loan processing.

Fill out your SBA 1919 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SBA 1919 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.