Get the free il 1120 - www2 illinois

Show details

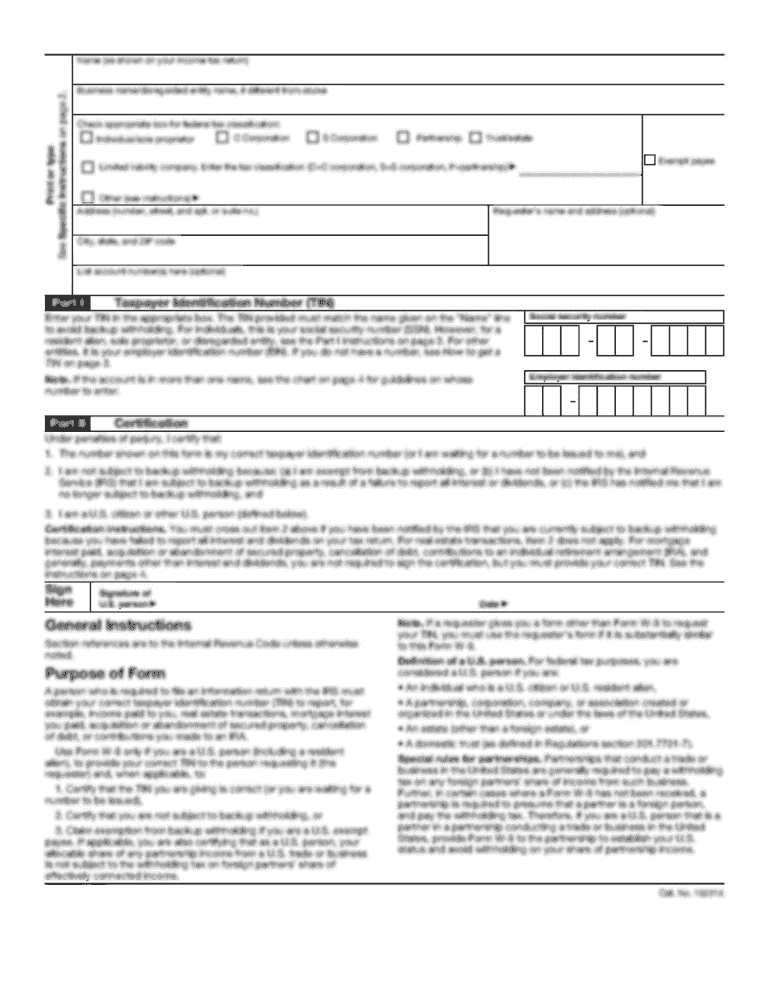

Illinois Department of Revenue 2017 Form IL-1120 Corporation Income and Replacement Tax Return See When should I file in the Form IL-1120 instructions for a list of due dates. Attach your payment and Form IL-1120-V here. If you owe tax on Line 66 complete a payment voucher Form IL-1120-V. Mark the appropriate box or boxes and see Sales companies Financial organizations Transportation companies Federally regulated exchanges Cash Accrual Other U If you are making a discharge of indebtedness V...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign il 1120 - www2

Edit your il 1120 - www2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il 1120 - www2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit il 1120 - www2 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit il 1120 - www2. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out il 1120 - www2

How to fill out IL DoR IL-1120

01

Gather all necessary financial documents related to the business.

02

Complete the identification section of the IL DoR IL-1120 by providing the business name, address, and entity type.

03

Fill out the income section by reporting all sources of income earned by the business.

04

Deduct applicable business expenses in the expense section to calculate the taxable income.

05

If applicable, include any tax credits that the business is eligible for.

06

Review the calculations for accuracy and ensure all required information is provided.

07

Sign and date the form where indicated.

08

Submit the completed IL DoR IL-1120 form to the Illinois Department of Revenue by the due date.

Who needs IL DoR IL-1120?

01

Any corporation or organization that conducts business in Illinois and is subject to Illinois corporate income tax needs to file IL DoR IL-1120.

02

Businesses with taxable income that exceeds the threshold established by the Illinois Department of Revenue are required to file this form.

Fill

form

: Try Risk Free

People Also Ask about

What is an IL 1120?

If you need to correct or change your return after it has been filed, you must file Form IL-1120-X, Amended Corporation Income and Replacement Tax Return. Returns filed before the extended due date of the return are treated as your original return for all purposes.

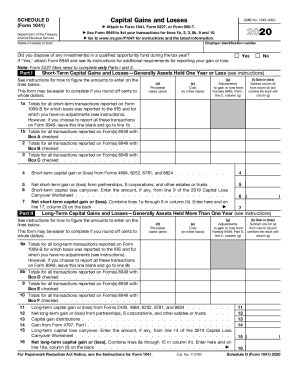

What is the difference between 1120s and 1120?

Differences Between Form 1120 and 1120-S Form 1120-S is filed by S Corps for federal taxes, while Form 1120 is filed by C Corps for taxes.

Who must file form IL 1120?

Estimated tax payments — S corporations who elect to pay PTE tax and reasonably expect their total tax liability to exceed $500 are required to make estimated tax payments using Form IL-1120-ST-V, either electronically or by mail. All other S corporations are not required to make estimated tax payments.

Is an LLC a 1120 or 1120S?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.

Is C Corp an 1120?

C corporations: C corps are separately taxable entities. They file a corporate tax return (Form 1120) and pay taxes at the corporate level. They also face the possibility of double taxation if corporate income is distributed to business owners as dividends, which are considered personal taxable income.

Is form 1120 a sole proprietorship?

If you are in business as a sole proprietorship, you report your income and expenses on a Schedule C attached to your federal Form 1040 tax return when it is filed. If you are a corporation or a partnership, you typically file a Form 1120 or a Form 1065 tax return.

Do I need to file a form 1120 if the business has no income?

It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income. An LLC that chooses to be treated as a C corporation for tax purposes is required to file Form 1120 (U.S. Corporation Income Tax Return).

What happens if you don't file form 1120?

The penalty for failure to file a federal S corporation tax return on Form 1120S — or failure to provide complete information on the return — is $195 per shareholder per month. The penalty can be assessed for a maximum of 12 months.

Is 1120 C Corp or S Corp?

C corporations use Form 1120 to calculate their taxes due. S corporations use Form 1120S as an information return. S corporations must also prepare a form 10 K-1 for each shareholder to include with their individual returns.

What type of company is 1120?

Schedule PH (Form 1120), U.S. Personal Holding Company (PHC) Tax. A corporation that is a personal holding company (PHC) uses Schedule PH (Form 1120) to figure the PHC tax.

Is form 1120 state or federal?

A 1120 tax form is an Internal Revenue Service (IRS) form that corporations use to find out their tax liability, or how much business tax they owe. It is also called the U.S. Corporation Income Tax Return. American corporations use this form to report to the IRS their income, gains, losses deductions and credits.

What kind of company is an 1120?

More In Forms and Instructions Use Form 1120-S to report the income, gains, losses, deductions, credits, etc., of a domestic corporation or other entity for any tax year covered by an election to be an S corporation.

What is a federal 1120?

Form 1120. Department of the Treasury. Internal Revenue Service. U.S. Corporation Income Tax Return. For calendar year 2021 or tax year beginning.

What type of tax is form 1120?

Use Form 1120, U.S. Corporation Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

Is state income tax deductible on form 1120?

If you own a business, you can deduct at least some of your state taxes as a write-off against your federal taxes. Your chance at a write-off depends on which taxes you pay and the structure of your business. Corporations report their income to the federal government on Form 1120.

Who files 1120 tax return?

Form 1120 is the tax form C corporations (and LLCs filing as corporations) use to file their income taxes. Once you've completed Form 1120, you should have an idea of how much your corporation needs to pay in taxes.

What is form 1120 used for and when must it be filed?

A 1120 tax form is an Internal Revenue Service (IRS) form that corporations use to find out their tax liability, or how much business tax they owe. It is also called the U.S. Corporation Income Tax Return. American corporations use this form to report to the IRS their income, gains, losses deductions and credits.

Who must file IL 1120?

If you have a corporation that (1) has net income or loss, or (2) is qualified to conduct business in the state of Illinois, you will need to file Form IL-1120.

Who must file an Illinois tax return?

You must file an Illinois tax return if: You were required to file a federal return, or. You were not required to file a federal return but your Illinois income exceeds your exemption allowance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit il 1120 - www2 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your il 1120 - www2 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete il 1120 - www2 online?

With pdfFiller, you may easily complete and sign il 1120 - www2 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete il 1120 - www2 on an Android device?

Use the pdfFiller app for Android to finish your il 1120 - www2. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

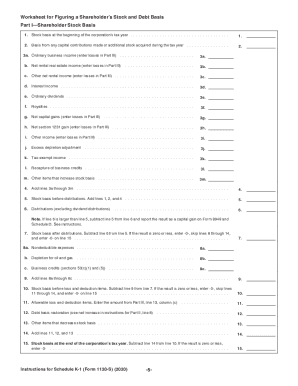

What is IL DoR IL-1120?

IL DoR IL-1120 is the Income Tax Return form used by corporations in Illinois to report their income, calculate their tax obligation, and claim any applicable credits.

Who is required to file IL DoR IL-1120?

Corporations doing business in Illinois and earning income are required to file IL DoR IL-1120, including both domestic and foreign corporations that are subject to Illinois income tax.

How to fill out IL DoR IL-1120?

To fill out IL DoR IL-1120, a corporation must gather its financial data, complete the required sections of the form including income, deductions, and credits, and calculate the total tax due. It is advisable to consult the instructions provided by the Illinois Department of Revenue for specific guidance.

What is the purpose of IL DoR IL-1120?

The purpose of IL DoR IL-1120 is to provide the Illinois Department of Revenue with a comprehensive report of a corporation's income and tax liability to ensure compliance with state tax laws.

What information must be reported on IL DoR IL-1120?

IL DoR IL-1120 requires information such as the corporation's name, address, federal employer identification number (FEIN), total income, deductions, and credits, as well as any applicable taxes owed for the reporting period.

Fill out your il 1120 - www2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Il 1120 - www2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.