OR Form OR-18-WC 2021 free printable template

Show details

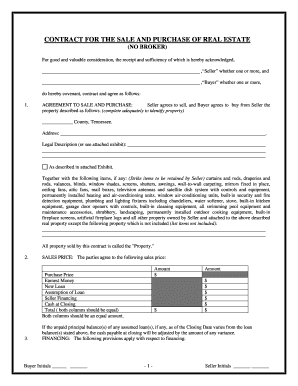

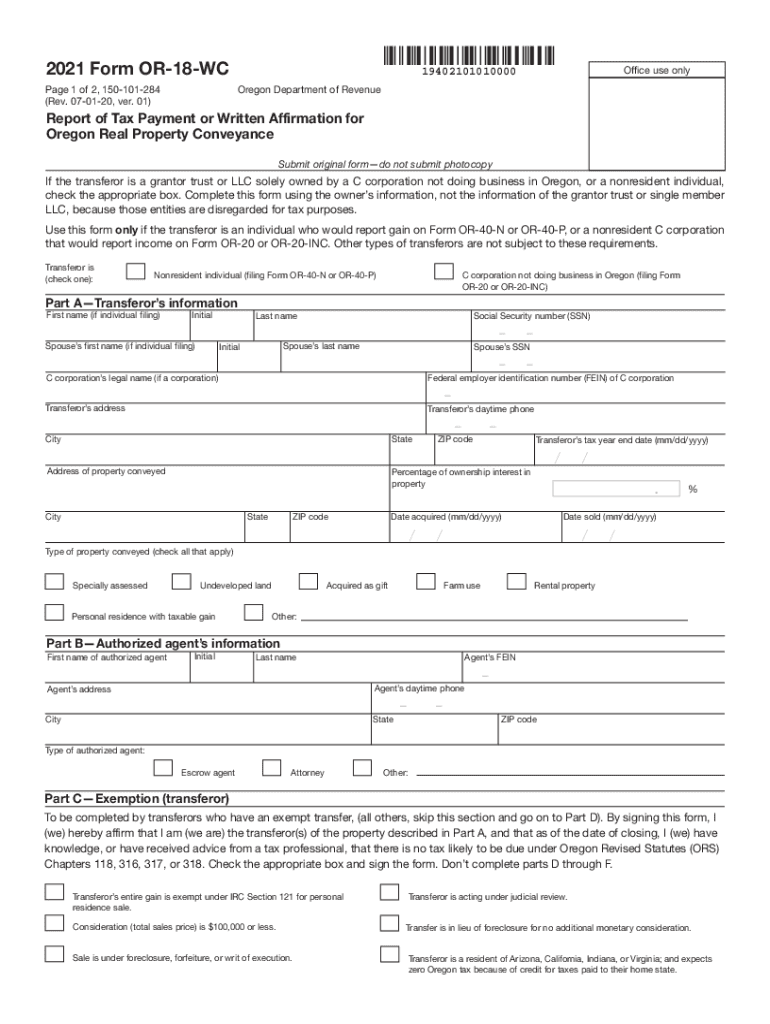

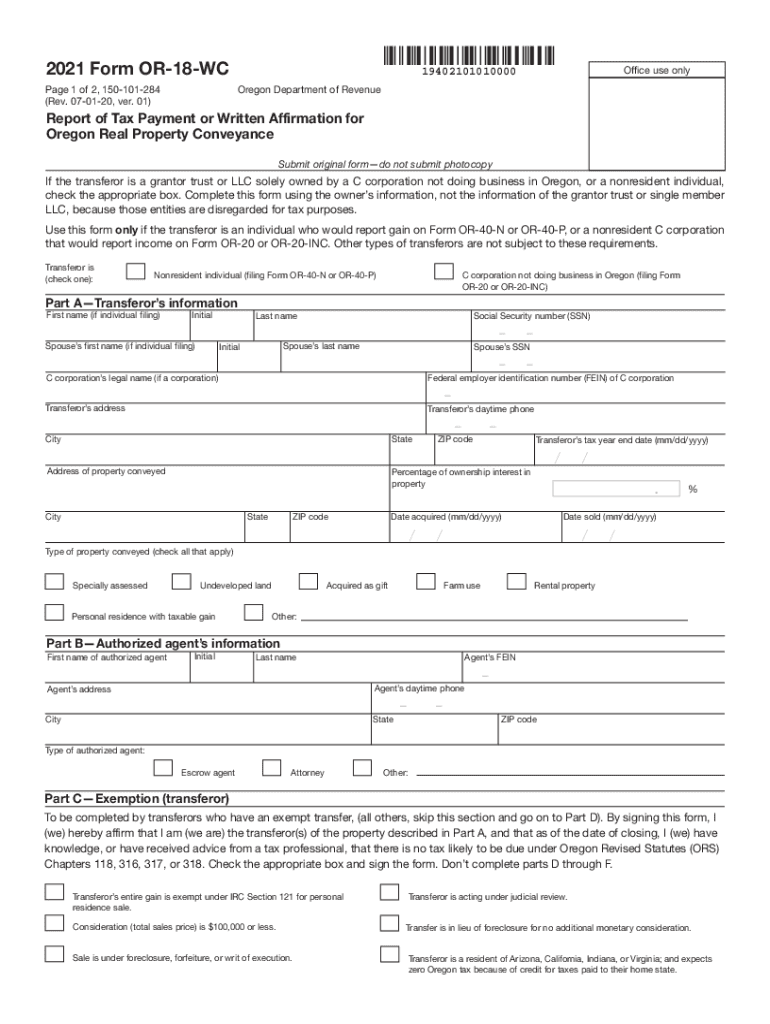

Clear this page2021 Form OR18WCOffice use only19402101010000

Oregon Department of Revenue Page 1 of 2, 150101284

(Rev. 070120, very. 01)Report of Tax Payment or Written Affirmation for

Oregon Real

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR Form OR-18-WC

Edit your OR Form OR-18-WC form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR Form OR-18-WC form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OR Form OR-18-WC online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OR Form OR-18-WC. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR Form OR-18-WC Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OR Form OR-18-WC

How to fill out OR Form OR-18-WC

01

Start by downloading the OR Form OR-18-WC from the appropriate website or agency.

02

Enter your personal information, including your name, address, and contact details at the top of the form.

03

Fill in the details of the accident, including the date, time, and location of the incident.

04

Provide a description of the injuries sustained and any medical treatment received.

05

Include any necessary witness information if applicable.

06

Review all the information entered to ensure accuracy.

07

Sign and date the form at the bottom.

08

Submit the completed form according to the instructions provided, either by mail or electronically.

Who needs OR Form OR-18-WC?

01

The OR Form OR-18-WC is typically needed by individuals who have been involved in a workplace accident and are seeking workers' compensation benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the Oregon WCT tax?

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Oregon employers must withhold 0.10% (0.001) from each employee's gross pay.

What is WC 18?

WC18 applies to wheelchair tiedown and occupant restraint systems (WTORS), consisting of a system or device for securing wheelchairs, and a system of belts for restraining occupants seated in wheelchairs. This includes both strap-type and docking-type securement systems.

What is the Oregon withholding tax rate?

Withholding Formula (Effective Pay Period 03, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $7,500$219.00 plus 4.75%Over $7,500 but not over $18,900$575.00 plus 6.75% of excess over $7,500Over $18,900$1,345.00 plus 8.75% of excess over $18,900 8 Mar 2022

What is the Oregon Form or 18 WC?

Form OR-18-WC is required for all nonexempt transferors who have not provided written assurance that the entire gain is excludable from federal tax under IRC Section 121. Trans- ferors (and their authorized agents) may use this form to show that this sale is exempt by completing Parts A through C and signing the form.

How do I avoid capital gains tax in Oregon?

One option for avoiding capital gains tax on appreciated property is a like-kind exchange or 1031 exchange. With this method, investors pay no taxes on equity growth if they exchange (instead of sell) properties.

How do I avoid capital gains tax on real estate in Oregon?

Home Sale. If you owned and lived in your home for two of the last five years before the sale, then up to $250,000 of profit may be exempt from federal income taxes. If you are married and file a joint return, then it doubles to $500,000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my OR Form OR-18-WC in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your OR Form OR-18-WC and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for the OR Form OR-18-WC in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your OR Form OR-18-WC.

How do I complete OR Form OR-18-WC on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your OR Form OR-18-WC. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is OR Form OR-18-WC?

OR Form OR-18-WC is a specific form used in Oregon for reporting workplace injuries or illnesses, specifically for workers' compensation claims.

Who is required to file OR Form OR-18-WC?

Employers in Oregon are required to file OR Form OR-18-WC when they have employees who have sustained work-related injuries or illnesses that require workers' compensation benefits.

How to fill out OR Form OR-18-WC?

To fill out OR Form OR-18-WC, employers must provide detailed information about the employee's injury or illness, including the date of the incident, nature of the injury, and any medical treatments received.

What is the purpose of OR Form OR-18-WC?

The purpose of OR Form OR-18-WC is to formally document workplace injuries and illnesses for the purpose of facilitating workers' compensation claims and ensuring that employees receive appropriate benefits.

What information must be reported on OR Form OR-18-WC?

The information that must be reported on OR Form OR-18-WC includes the employee's name, date of birth, date of injury or illness, description of the incident, medical treatment details, and employer information.

Fill out your OR Form OR-18-WC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR Form OR-18-WC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.