SSA-1724 2006-2025 free printable template

Get, Create, Make and Sign ss retirement form

Editing omb no 0960 0101 online

Uncompromising security for your PDF editing and eSignature needs

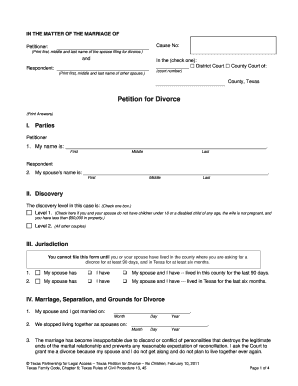

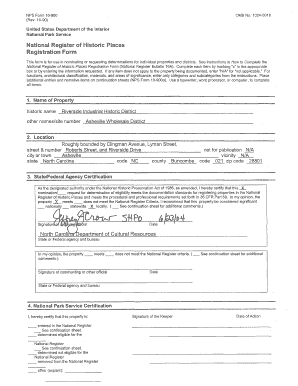

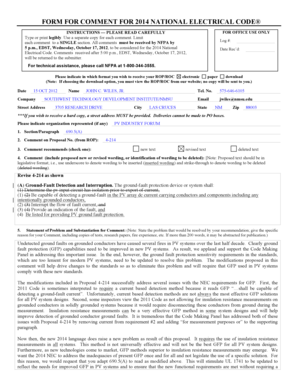

How to fill out benefits retirement form

How to fill out SSA-1724

Who needs SSA-1724?

Video instructions and help with filling out and completing security death

Instructions and Help about security administration

Hey everyone so in this video we're going to talk about another form that gets filled out in every social security case this is the most important form that my clients have to fill out during their case so if there's one you know one packet that Social Security sends you that you really sit down take your time with if you have questions you can call the office or reach us through our app this is the form to do it with because we really do see the responses on this form making the difference between your you know winning case in a losing case this form is where the color is kind of added to the case so in a lot of the other forms its just asking what are the names of your doctors what hospitals have you visited you know what medications are you taking if the answers you really can't get wrong because it's just objective facts, but this form is where social security tries to mix some color in and if you color it right you can help your case a lot but if you color it wrong you can ruin a case that would otherwise potentially be approved this case the form here is really about it wants to know what you do on a typical day how your impairments are impacting you in your daily routine to kind of state the importance of it this form not only turns the heads of adjudicators a lot at the beginning of the case but where I really see, and I don't see it helping too many people at the hearing level, but I see it hurting people when they get before a judge because even though this form is usually sent to my clients within a month or two of them applying even sometimes sooner when I when they go before a judge and I get a decision an unfavorable decision back from a judge two years later most of the time they're quoting answers on this form that was filled out years earlier just because people can be sloppy with it, so please take your time with this watch this video think about what I'm saying remember what this form is about this form is to show that your disability would not only impact you in a work setting but it you in the household in the community as well the first thing that I want you to do so that there's no mistaking by Social Security as I want you to write on the side of the paper here with write a big asterisk and then write responses to this form or how I am on a bad day I don't want you to be filling this form out telling Social Security how you function when everything's great and hunky-dory I want you to be telling Social Security how you're functioning when things are bad or if every day is bad you know even how an average day is for you okay, but I don't want them to get the wrong impression if you put a positive spin on your answers here okay so to just kind of go through the questions that I think come up the most you know section six right here this is the first question on the second page it asks describe what you do from the time you wake up until the time you go to bed you know don't talk about the day that you're feeling good talk...

People Also Ask about social security form 1724

What age is full retirement for Social Security?

Is Social Security based on last 30 years?

Can I work full time at 66 and collect Social Security?

What is the maximum Social Security benefit?

What is the highest Social Security monthly payment?

What is maximum Social Security benefit in 2022?

How much do you have to earn to get maximum Social Security?

What is the maximum Social Security benefit at age 66 in 2022?

Is it better to take Social Security at 62 or 67?

What is the maximum you can make on Social Security benefits?

Is Social Security based on the last 35 years?

What is the average monthly Social Security check at age 65?

At what age do you get 100 of your Social Security benefits?

Will Social Security still be around in 40 years?

How many years of Social Security will I get?

Where do I go to check my Social Security benefits?

How much Social Security will I get if I make 100000 a year?

What is full retirement age?

How do you find out how much Social Security you will receive?

Is the full age of retirement still at 65 or what?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

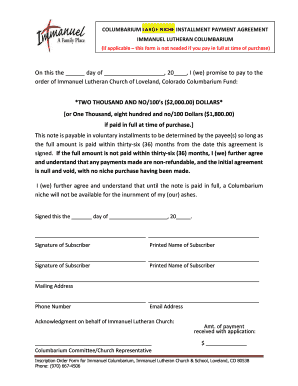

How can I send tax claim for eSignature?

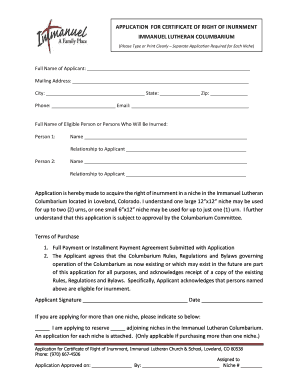

How do I edit ssa form ssa 1724 online?

How can I edit how to complete form 0960 0101 on a smartphone?

What is SSA-1724?

Who is required to file SSA-1724?

How to fill out SSA-1724?

What is the purpose of SSA-1724?

What information must be reported on SSA-1724?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.