CA DWC Form 10214 2008-2025 free printable template

Get, Create, Make and Sign compromise and release form

How to edit form 10214 online

Uncompromising security for your PDF editing and eSignature needs

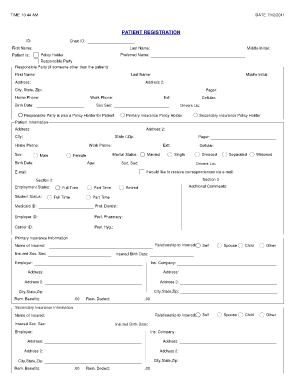

How to fill out ca form 10214

How to fill out CA DWC Form 10214

Who needs CA DWC Form 10214?

Video instructions and help with filling out and completing compromise release fillable

Instructions and Help about CA DWC Form 10214

As you have learned from previous videos there are two types of settlements of workers compensation claims first the stipulations keeping your future medical care open and the second is a compromise and release a buyout of your future medical and essentially all other costs related to your workers compensation claim this is a clean split between you the insurance carrier and usually your employer as well we won't go into the ins and outs of each type as we already done so in previous videos negotiating may sound intimidating at first but once you know your key negotiating points and are looking for a reasonable settlement this can be a relatively painless process that will leave you with a lot more money than originally offered I advise that you watch the negotiation settlements via stipulations video prior to watching this video in order to learn how to negotiate the permanent disability percentage aspect of the settlement in this video we'll go over key bargaining points for a compromise and release settlement in which the insurance company will be paying you a lump sum award in order to buy out the permanent disability future medical care you're entitled to and essentially any and all costs associated with the claim including possibly your employment status the last part is a key factor to remember when thinking about your settlement value let's start off by using an example say you had a knee injury at work you treated and eventually had a knee arthroscopy and you are now deemed permanent and stationary by your primary treating physician your recovery went okay and your doctor dictated a report stating you have a 12% permanent disability rating which is equivalent to about seven thousand eight hundred and seventy seven dollars and fifty cents and he also stated that you're entitled the future medical in the event that you have an aggravation or flare-up of your injury a doctor states specifically you are entitled to orthopedic visits pain medications a new MRI a knee brace every year and possibly even a future knee arthroscopy now an important point here is to ensure that you understand this is essentially for your entire lifetime of course you may not actually treat for every year in your whole life but keeping in mind that you're entitled to it based on the report you can use this as a bargaining tool when trying to negotiate ACN are in ACN are the baseline value is the permanent disability percentage you're given this is essentially the lowest amount of money you would receive and you can learn how to negotiate this value in the prior video negotiation settlements via stipulations in any case say you were successful and we're able to negotiate a pd value up to 18 percent which is approximately fifteen thousand dollars we'll use this as our baseline next up comes the future medical value and here there's a lot of gray area unfortunately that leads to more negotiation power to you so to understand this process we'll first go into how the...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA DWC Form 10214 in Chrome?

Can I create an eSignature for the CA DWC Form 10214 in Gmail?

How do I edit CA DWC Form 10214 on an iOS device?

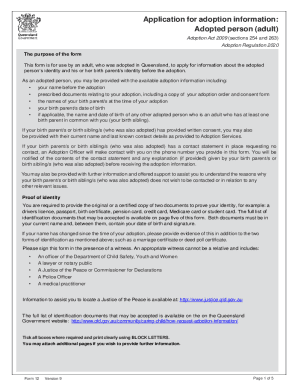

What is CA DWC Form 10214?

Who is required to file CA DWC Form 10214?

How to fill out CA DWC Form 10214?

What is the purpose of CA DWC Form 10214?

What information must be reported on CA DWC Form 10214?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.