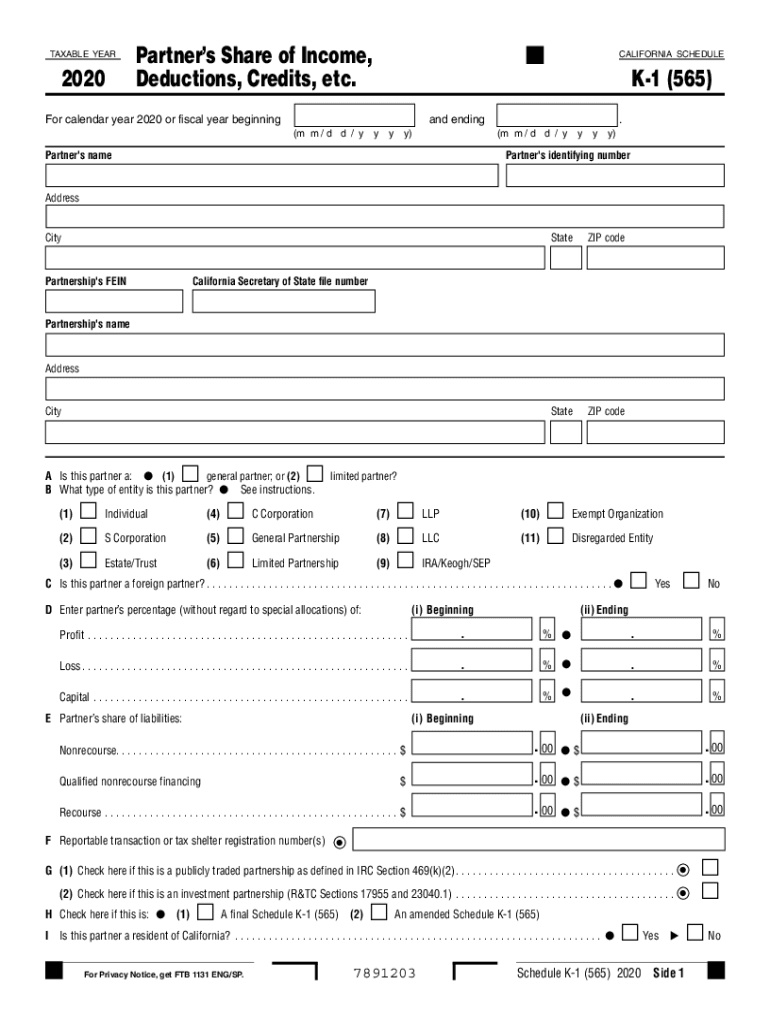

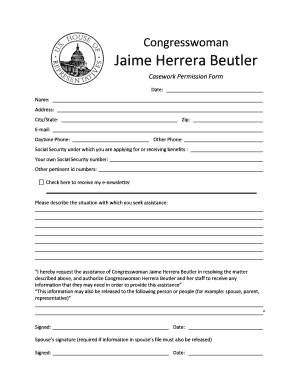

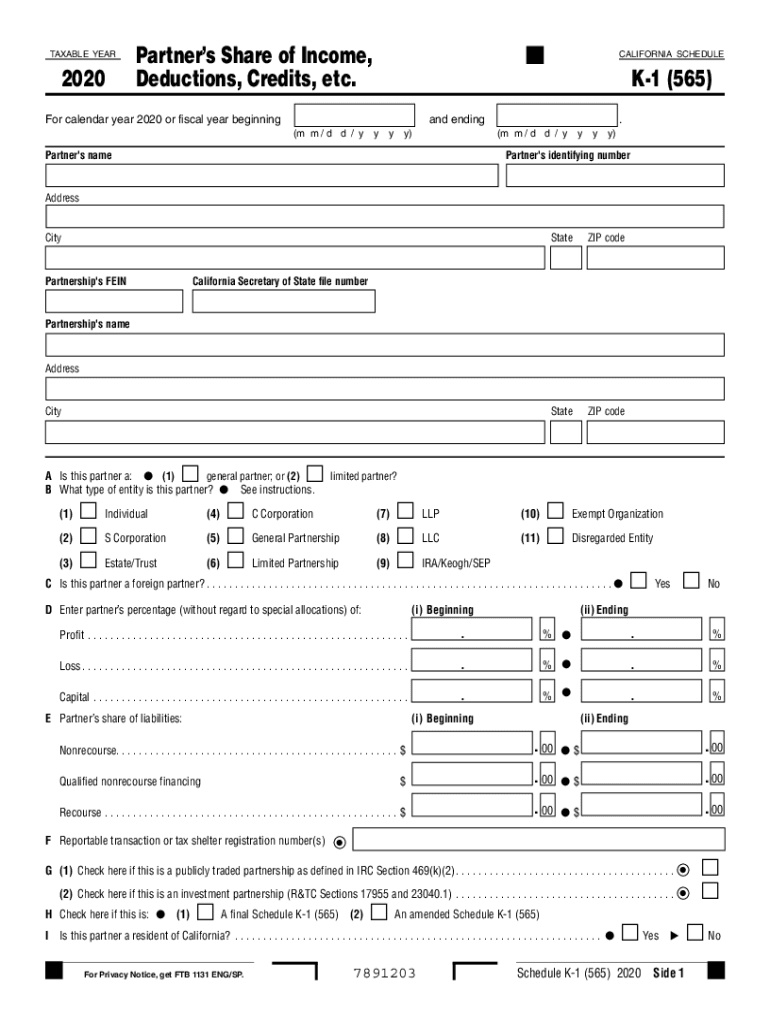

CA Schedule K-1 (565) 2020 free printable template

Get, Create, Make and Sign california k 1

Editing california k 1 online

Uncompromising security for your PDF editing and eSignature needs

CA Schedule K-1 (565) Form Versions

How to fill out california k 1

How to fill out CA Schedule K-1 (565)

Who needs CA Schedule K-1 (565)?

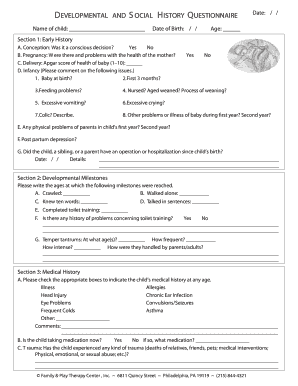

Instructions and Help about california k 1

Laws calm legal forms guide form K — one is United States Internal Revenue Service tax form used for reporting a tax return for income obtained through a business partnership this form would be used by each partner in a business to report income or losses over a taxable year typically this form is used by less involved investors and partnerships rather than involved partners who must report income on a form 1065 the form K — 1 can be obtained through the IRS a--'s website or by obtaining the documents through a local tax office begin by filling out section 1 of the form indicating the partnership name contact information IRS office where partnership return was made and whether the partnership is publicly traded in part 2 you must include your personal information as an investment partner in the named partnership provide your identifying number name address and contact information indicate your partnership status and whether you are an individual partner or a corporate entity on lines J and K indicate your total profit loss and capital for both the beginning term and ending term provide a capital account analysis on line L and indicate the capitalization information over the course of the tax year for part 3 you must next list your share of income as a named partner you must also state all deductions credits or other modifications in this section provide the ordinary income or loss incurred as a partner in line 1 next go line by line indicating all forms of income and losses incurred in your role as a partner if a line does not apply to you, you may enter 0 or leave it blank if you are claiming any deductions enter them on the appropriate lines on lines 12 and 13 once you have disclosed all taxable information your form K — 1 is completed you must attach it to your personal or corporate income tax return and claim the amounts as taxable income retain a copy for your personal records to watch more videos please make sure to visit laws comm

People Also Ask about

How do I get copies of k1?

How do I get a copy of my K-1?

Can I do my own K-1 tax form?

Where do I find my k1?

Are K-1 distributions considered income?

Do I need to file K-1 for inheritance?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

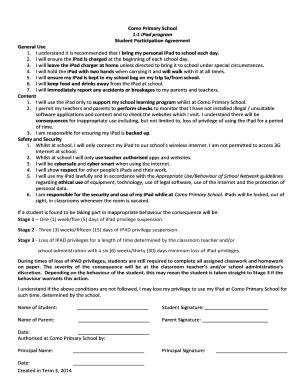

How can I modify california k 1 without leaving Google Drive?

How do I make edits in california k 1 without leaving Chrome?

How do I complete california k 1 on an Android device?

What is CA Schedule K-1 (565)?

Who is required to file CA Schedule K-1 (565)?

How to fill out CA Schedule K-1 (565)?

What is the purpose of CA Schedule K-1 (565)?

What information must be reported on CA Schedule K-1 (565)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.