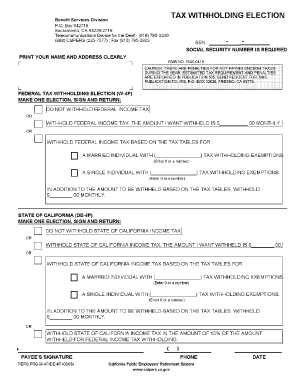

CA CalPERS Tax Withholding Election 2018-2025 free printable template

Show details

P.O. Box 942715 Sacramento, CA 942292715 888 Callers (or 8882257377) Fax: (800) 9596545 TTY: (877) 2497442 www.calpers.ca.gov California Public Employees' Retirement System Withholding Election Section

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign how much will my calpers the 20 federal tax withholding form

Edit your calpers form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your calpers tax withholding calculator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing calpers pay dates 2025 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit california state tax withholding form 2025. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CalPERS Tax Withholding Election Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax election form

How to fill out CA CalPERS Tax Withholding Election

01

Obtain the CA CalPERS Tax Withholding Election form from the CalPERS website or your local CalPERS office.

02

Read the instructions carefully to understand the options available for tax withholding.

03

Fill out your personal information, including your name, address, and Social Security Number.

04

Select your desired withholding status (e.g., single, married) and specify the number of allowances you are claiming.

05

If you wish, you can enter an additional amount to withhold from your pension.

06

Review the filled form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to CalPERS either online or by mailing it to the appropriate address.

Who needs CA CalPERS Tax Withholding Election?

01

Individuals who receive retirement benefits from CalPERS.

02

Pensioners who want to adjust the amount of taxes withheld from their monthly retirement payments.

03

Employees who are nearing retirement and wish to plan their tax withholding strategy.

Fill

no tax pension states

: Try Risk Free

People Also Ask about withholding elections

Do I have to pay federal taxes on my pension?

Taxes on Pension Income You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money.

How do I change my withholding election on workday?

You can easily edit your W-4 withholding elections in Workday by following the steps below: Click the Pay application on your Home page. Click Withholding Elections. City of Baltimore and Effective Date auto-populate. Click OK to continue. Select the I Agree checkbox. Click OK to complete the update.

Do I put 0 or 1 on w4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

How do I change my tax withholding in CalPERS?

There are a few ways to change your tax withholding: By mail or fax - Complete a Tax Withholding Election (PDF) form and mail or fax it to CalPERS.

Do I have to pay taxes on my pension in California?

Are other forms of retirement income taxable in California? Retirement account income, including withdrawals from a 401(k) or IRA, is considered taxable income in California. So is all pension income, whether from a government pension or a private employer pension.

What is a wd4 form?

Key Takeaways. Employees fill out a W-4 form to inform employers how much tax to withhold from their paycheck based on filing status, dependents, anticipated tax credits, and deductions. If the form is filled out incorrectly, you may end up owing taxes when you file your return. The IRS simplified the form in 2020.

How do I change my California state withholding?

If you want to change your tax withholding elections, you may submit a completed Income Tax Withholding Form to the Retirement Services Section. This form allows you to update your tax withholding elections for the federal government and the state of California only.

How do I know if my pension is taxable?

Taxes on Pension Income You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money.

Do you get taxed on CalPERS retirement?

Taxes on Your Retirement Income As a CalPERS retiree, you may still have to pay both federal and state income taxes depending on where you live and your income sources. Check with your new state's tax or revenue agency for more information.

How do I change my withholding?

Change Your Withholding Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Do I have to pay taxes on my CalPERS pension?

Taxes on Your Retirement Income As a CalPERS retiree, you may still have to pay both federal and state income taxes depending on where you live and your income sources. Check with your new state's tax or revenue agency for more information.

What states do not tax CalPERS pensions?

Non-Residents Alabama, Alaska, Florida, Mississippi, New Hampshire, Nevada, Pennsylvania, South Dakota, Tennessee, Texas, Washington and Wyoming either do not have a state income tax or do not tax pension income, so your California pension won't be taxed if you live in one of these states.

How much will my CalPERS pension be taxed?

A mandatory 20% federal tax withholding rate is applied to certain lump-sum paid benefits, such as the Basic Death Benefit, Retired Death Benefit, Option 1 balance, and Temporary Annuity balance. Certain lump-sum benefits are eligible to be rolled over to an IRA to avoid the 20% federal tax withholding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit california tax withholding form 2025 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like calpers retirement application form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit calpers payment schedule 2025 online?

With pdfFiller, it's easy to make changes. Open your california tax withholding form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I make edits in tax withholding election form without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your calpers tax forms, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is CA CalPERS Tax Withholding Election?

The CA CalPERS Tax Withholding Election allows members of the California Public Employees' Retirement System to choose how much federal and state income tax should be withheld from their retirement benefits.

Who is required to file CA CalPERS Tax Withholding Election?

Members who receive retirement benefits from CalPERS and wish to modify their tax withholding amounts are required to file the CA CalPERS Tax Withholding Election.

How to fill out CA CalPERS Tax Withholding Election?

To fill out the CA CalPERS Tax Withholding Election, members must provide their personal information, select the desired withholding amounts for federal and state taxes, and sign the form before submitting it to CalPERS.

What is the purpose of CA CalPERS Tax Withholding Election?

The purpose of the CA CalPERS Tax Withholding Election is to enable retirees to control how much tax is withheld from their monthly retirement payments, helping them meet their tax liability on a timely basis.

What information must be reported on CA CalPERS Tax Withholding Election?

The information that must be reported on the CA CalPERS Tax Withholding Election includes the member's name, Social Security number, address, the selected withholding amounts for federal and state taxes, and the member's signature.

Fill out your CA CalPERS Tax Withholding Election online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California State Tax Form 2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.